EUR/USD: general review

07 September 2018, 14:00

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.1660 |

| Take Profit | 1.1718, 1.1790 |

| Stop Loss | 1.1610 |

| Key Levels | 1.1352, 1.1474, 1.1550, 1.1718, 1.1790 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1545 |

| Take Profit | 1.1474, 1.1352 |

| Stop Loss | 1.1600 |

| Key Levels | 1.1352, 1.1474, 1.1550, 1.1718, 1.1790 |

Current trend

Today, the instrument grew to the level of 1.1630.

The market ignored the decline in Eurozone GDP in the Q2 from 2.2% to 2.1%, as it is more concerned about the world trade wars. According to The Wall Street Journal, President Trump's next goal may be Japan. in April, leaders of the countries met and agreed to reduce the US trade deficit, which last year was USD 68.8 billion. However, the reduction is expected to be insignificant and Trump hinted that he could "force Japan to pay".

During the day, the data from the US labor market will be published. The unemployment rate is expected to decrease from 3.9% to 3.8%, and the number of Nonfarm Payrolls may grow from 157K to 191K. Published on Thursday, ADP data on employment (a leading indicator to federal statistics) showed a reduction from 219K to 163K. Thus, official statistics may not reach forecasts, too.

Support and resistance

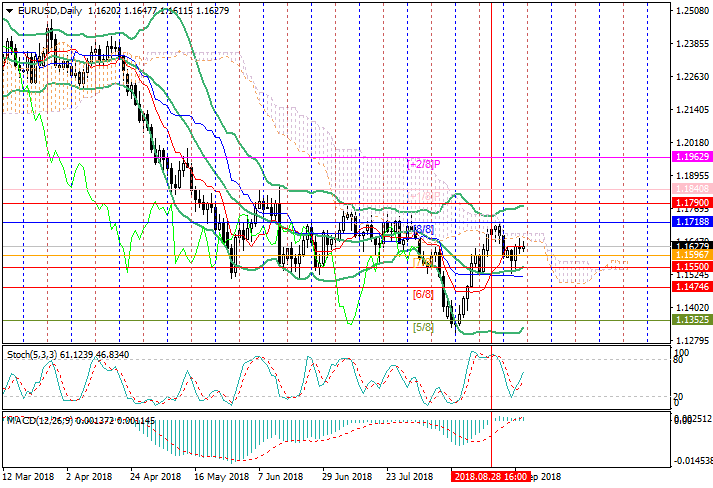

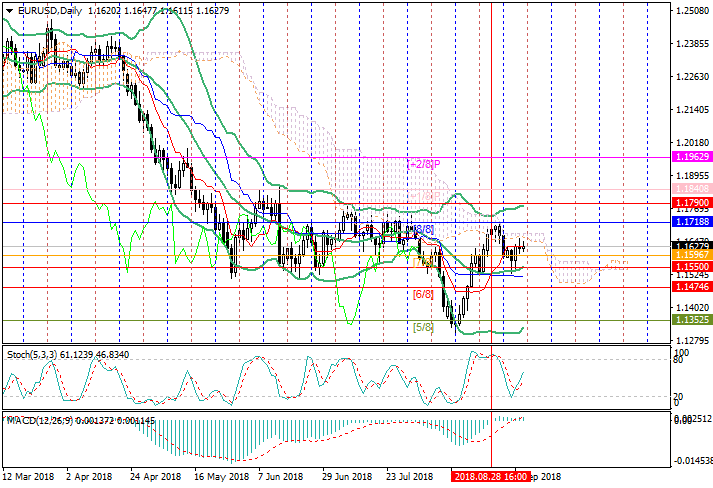

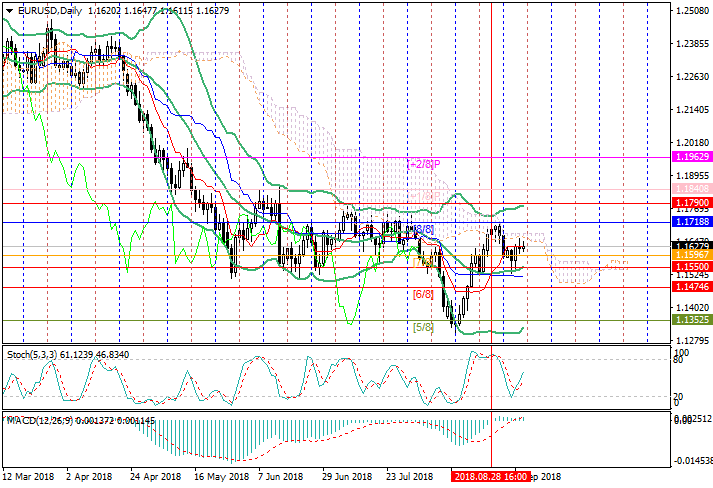

Now, the price has risen above 1.1596 (Murrey [7/8]) and can continue rising to 1.1718 (Murrey [8/8]) and 1.1840 (the upper line of Bollinger Bands). The level of 1.1550 (the center line of Bollinger Bands) is seen as key for the "bears". Its breakdown will give the prospect of a decline to 1.1457 (Murrey [6/8]) and 1.1352 (Murrey [5/8]).

Technical indicators do not give a clear signal: Bollinger Bands are in horizontal motion; MACD histogram is located at the zero line, its volume is insignificant; Stochastic is directed upwards.

Support levels: 1.1550, 1.1474, 1.1352.

Resistance levels: 1.1718, 1.1790.

Trading tips

Buy positions may be opened from 1.1660 with targets at 1.1718, 1.1790 and stop loss at 1.1610.

Sell positions may be opened below 1.1550 with targets at 1.1474, 1.1352 and stop loss at 1.1600.

Implementation time: 3-5 days.

Today, the instrument grew to the level of 1.1630.

The market ignored the decline in Eurozone GDP in the Q2 from 2.2% to 2.1%, as it is more concerned about the world trade wars. According to The Wall Street Journal, President Trump's next goal may be Japan. in April, leaders of the countries met and agreed to reduce the US trade deficit, which last year was USD 68.8 billion. However, the reduction is expected to be insignificant and Trump hinted that he could "force Japan to pay".

During the day, the data from the US labor market will be published. The unemployment rate is expected to decrease from 3.9% to 3.8%, and the number of Nonfarm Payrolls may grow from 157K to 191K. Published on Thursday, ADP data on employment (a leading indicator to federal statistics) showed a reduction from 219K to 163K. Thus, official statistics may not reach forecasts, too.

Support and resistance

Now, the price has risen above 1.1596 (Murrey [7/8]) and can continue rising to 1.1718 (Murrey [8/8]) and 1.1840 (the upper line of Bollinger Bands). The level of 1.1550 (the center line of Bollinger Bands) is seen as key for the "bears". Its breakdown will give the prospect of a decline to 1.1457 (Murrey [6/8]) and 1.1352 (Murrey [5/8]).

Technical indicators do not give a clear signal: Bollinger Bands are in horizontal motion; MACD histogram is located at the zero line, its volume is insignificant; Stochastic is directed upwards.

Support levels: 1.1550, 1.1474, 1.1352.

Resistance levels: 1.1718, 1.1790.

Trading tips

Buy positions may be opened from 1.1660 with targets at 1.1718, 1.1790 and stop loss at 1.1610.

Sell positions may be opened below 1.1550 with targets at 1.1474, 1.1352 and stop loss at 1.1600.

Implementation time: 3-5 days.

No comments:

Write comments