AUD/USD: Australian dollar is going down

10 September 2018, 09:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7135 |

| Take Profit | 0.7200, 0.7236, 0.7260 |

| Stop Loss | 0.7080 |

| Key Levels | 0.7045, 0.7068, 0.7096, 0.7130, 0.7155, 0.7175, 0.7200 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7090 |

| Take Profit | 0.7045, 0.7020 |

| Stop Loss | 0.7120, 0.7130 |

| Key Levels | 0.7045, 0.7068, 0.7096, 0.7130, 0.7155, 0.7175, 0.7200 |

Current trend

AUD showed a steady decline against USD on Friday, having updated its record lows of February 2016. August’s US labor market data supported USD significantly.

Nonfarm Payrolls grew from 147K to 201K, which exceeded the market’s expectations. Hourly Earnings also grew better than investors expected: by 0.4% MoM and by 2.9% YoY. However, Unemployment Rate remained at the same level of 3.9% instead of the expected decline.

AUD is under pressure due to the concerns of trade war expanding. In the near future, Washington can increase pressure on Japan, forcing it to reduce the trade surplus with the US. In addition, if the US administration still intends to impose duties on Chinese goods worth USD 200 billion, the Australian economy will take significant damage. According to the experts, the country's GDP may decrease by 0.3% by 2022, which corresponds to a loss of USD 36 billion.

Support and resistance

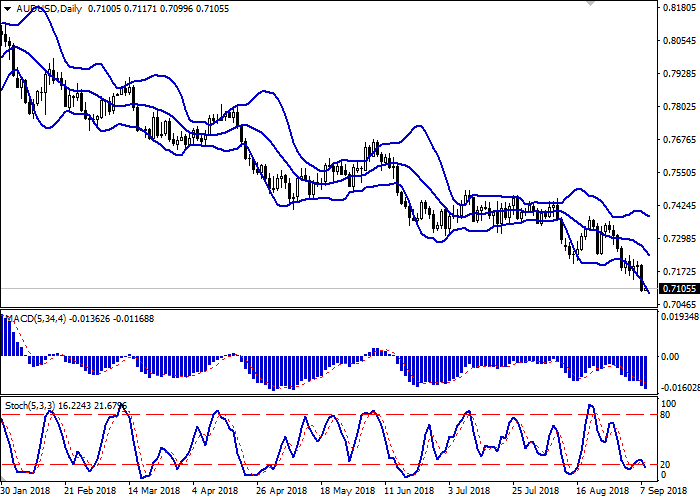

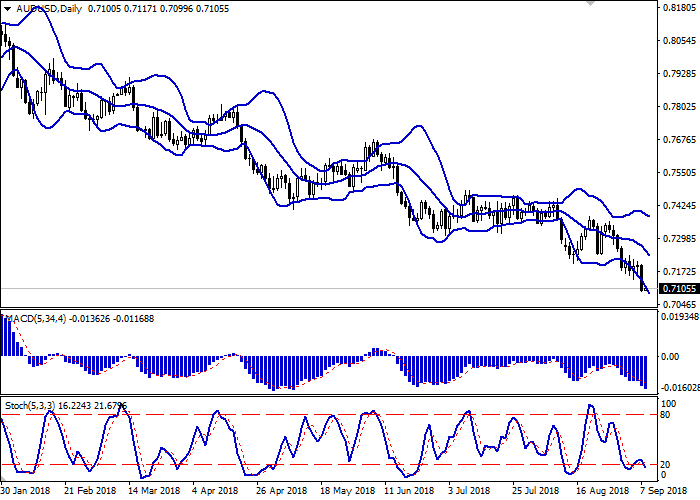

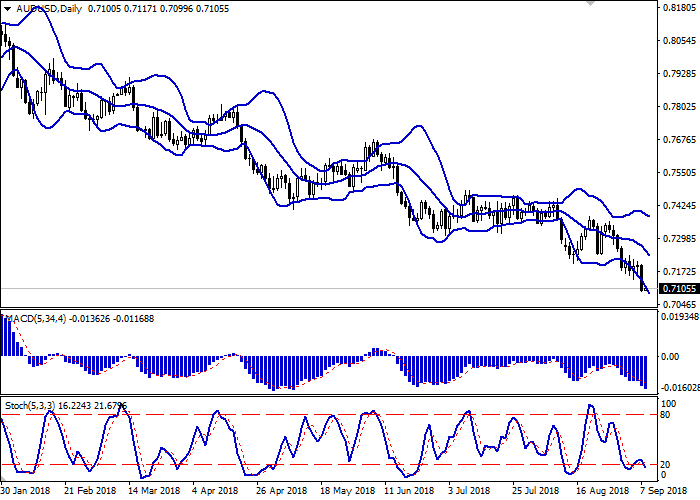

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range expands, making way for new local lows for the "bears". MACD is declining keeping a stable sell signal (located below the signal line). Stochastic reversed downwards after a short upward correction. As before, the indicator signals about the oversold AUD.

One should keep existing short positions in the short and/or ultra-short term.

Resistance levels: 0.7130, 0.7155, 0.7175, 0.7200.

Support levels: 0.7096, 0.7068, 0.7045.

Trading tips

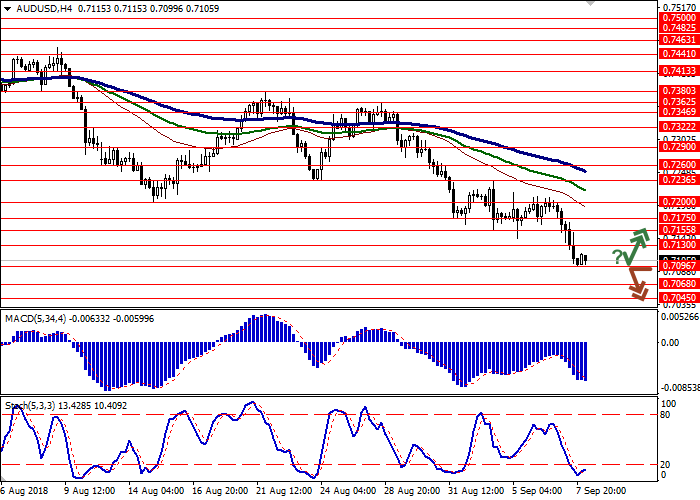

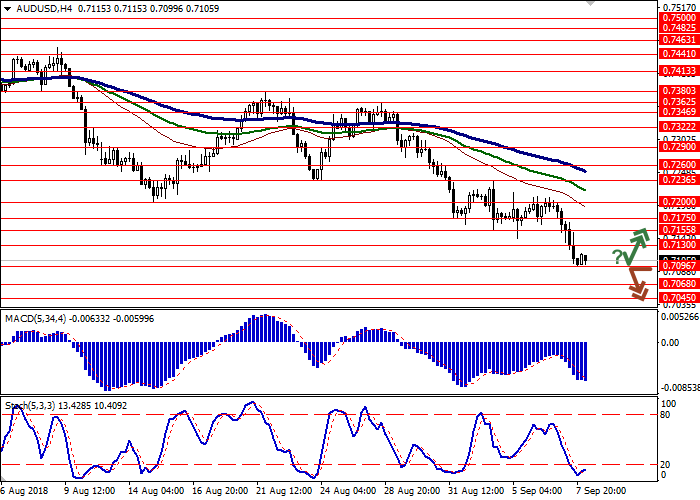

To open long positions, one can rely on the rebound from 0.7096 as from support with the subsequent breakout of 0.7130. Take profit — 0.7200 or 0.7236, 0.7260. Stop loss – 0.7080. Implementation period: 2-3 days.

A breakdown of 0.7096 may be a signal to further sales with target at 0.7045 or 0.7020. Stop loss — 0.7120 or 0.7130. Implementation period: 1-2 days.

AUD showed a steady decline against USD on Friday, having updated its record lows of February 2016. August’s US labor market data supported USD significantly.

Nonfarm Payrolls grew from 147K to 201K, which exceeded the market’s expectations. Hourly Earnings also grew better than investors expected: by 0.4% MoM and by 2.9% YoY. However, Unemployment Rate remained at the same level of 3.9% instead of the expected decline.

AUD is under pressure due to the concerns of trade war expanding. In the near future, Washington can increase pressure on Japan, forcing it to reduce the trade surplus with the US. In addition, if the US administration still intends to impose duties on Chinese goods worth USD 200 billion, the Australian economy will take significant damage. According to the experts, the country's GDP may decrease by 0.3% by 2022, which corresponds to a loss of USD 36 billion.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range expands, making way for new local lows for the "bears". MACD is declining keeping a stable sell signal (located below the signal line). Stochastic reversed downwards after a short upward correction. As before, the indicator signals about the oversold AUD.

One should keep existing short positions in the short and/or ultra-short term.

Resistance levels: 0.7130, 0.7155, 0.7175, 0.7200.

Support levels: 0.7096, 0.7068, 0.7045.

Trading tips

To open long positions, one can rely on the rebound from 0.7096 as from support with the subsequent breakout of 0.7130. Take profit — 0.7200 or 0.7236, 0.7260. Stop loss – 0.7080. Implementation period: 2-3 days.

A breakdown of 0.7096 may be a signal to further sales with target at 0.7045 or 0.7020. Stop loss — 0.7120 or 0.7130. Implementation period: 1-2 days.

No comments:

Write comments