YM: general analysis

20 August 2018, 14:27

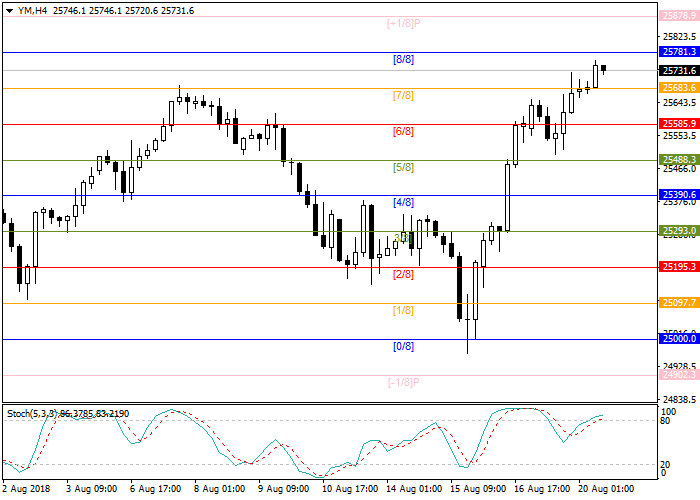

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 25683.0 |

| Take Profit | 25585.9 |

| Stop Loss | 25781.3 |

| Key Levels | 25585.9, 25683.6, 25781.3, 25878.9 |

Current trend

Dow Jones continues to trade within the upward trend: the price reached a strong resistance level of 8/8 Murrey or 25781.3. Even the worsening of US-Turkey relations did not affect the stock market significantly. US Secretary of State Mnuchin recently announced his readiness to introduce a new package of sanctions against Turkey, if the country's authorities do not release the American pastor. The Lira also accelerated its decline in these conditions.

If the trade wars grow stronger, the Fed may postpone the tightening of monetary policy to support the economy. According to preliminary forecasts, the interest rate can be changed not earlier than September. Some experts believe that the US stock market is overheated, and in the near future a global correction is possible. It is confirmed by the decline in the assets of emerging markets by more than 15% and the global decline in the shares of companies that deal with banking operations. Since the beginning of this year, they have lost about 23%.

Support and resistance

Stochastic is at around 98 points and reflects a possibility of a correction.

Resistance levels: 25781.3, 25878.9.

Support levels: 25683.6, 25585.9.

Trading tips

Short positions can be opened after the breakdown of the level 25683.6 with the target at 25585.9 and stop loss 25781.3.

Dow Jones continues to trade within the upward trend: the price reached a strong resistance level of 8/8 Murrey or 25781.3. Even the worsening of US-Turkey relations did not affect the stock market significantly. US Secretary of State Mnuchin recently announced his readiness to introduce a new package of sanctions against Turkey, if the country's authorities do not release the American pastor. The Lira also accelerated its decline in these conditions.

If the trade wars grow stronger, the Fed may postpone the tightening of monetary policy to support the economy. According to preliminary forecasts, the interest rate can be changed not earlier than September. Some experts believe that the US stock market is overheated, and in the near future a global correction is possible. It is confirmed by the decline in the assets of emerging markets by more than 15% and the global decline in the shares of companies that deal with banking operations. Since the beginning of this year, they have lost about 23%.

Support and resistance

Stochastic is at around 98 points and reflects a possibility of a correction.

Resistance levels: 25781.3, 25878.9.

Support levels: 25683.6, 25585.9.

Trading tips

Short positions can be opened after the breakdown of the level 25683.6 with the target at 25585.9 and stop loss 25781.3.

No comments:

Write comments