XAU/USD: gold is declining

24 August 2018, 10:31

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1191.40 |

| Take Profit | 1211.14, 1215.79 |

| Stop Loss | 1182.79 |

| Key Levels | 1159.83, 1170.00, 1182.79, 1191.36, 1200.00, 1204.55, 1211.14 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1182.70 |

| Take Profit | 1170.00 |

| Stop Loss | 1191.36 |

| Key Levels | 1159.83, 1170.00, 1182.79, 1191.36, 1200.00, 1204.55, 1211.14 |

Current trend

Yesterday, gold prices declined in response to the resumed growth of USD due to the increase in the US bonds’ yield. In addition, investors reacted positively to FOMC Minutes, which confirmed the readiness of the regulator to raise the interest rate at the September meeting.

The escalation of the trade conflict between the US and China also provides more support for the safe dollar than gold. Yesterday new reciprocal duties were implemented, as there was no noticeable progress in negotiations in Washington.

Today, investors are waiting for the speech of Fed Chairman Jerome Powell within the symposium in Jackson Hole. He will provide a report on monetary policy in a changing economy. Also, the market is waiting for the comments of the regulator's head regarding the latest critical statements of President Trump.

Support and resistance

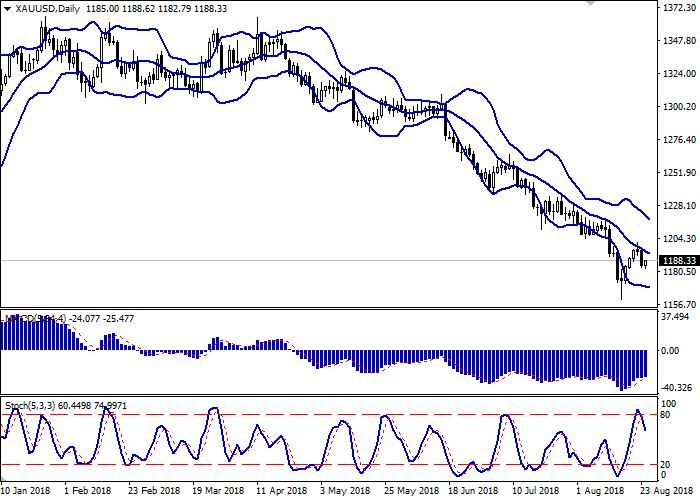

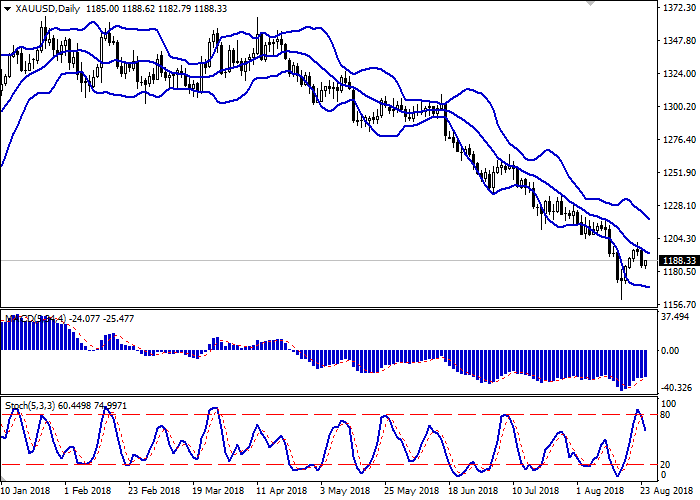

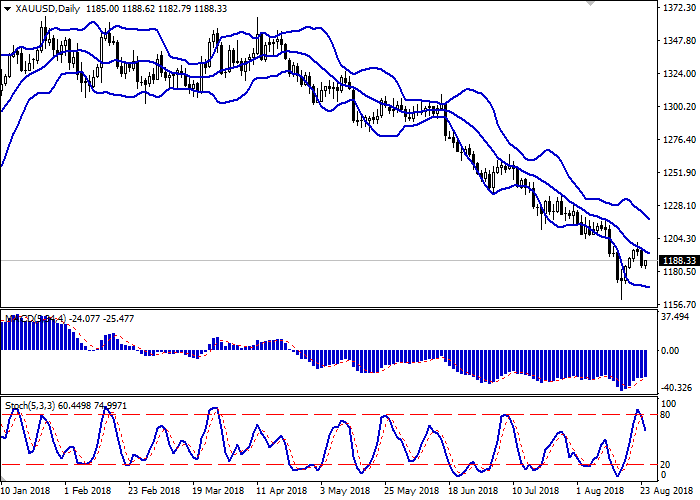

On the daily chart, Bollinger bands are steadily declining. The price range is slightly narrowed from above, reflecting the recent ambiguous trade. MACD indicator grows, maintaining the buy signal (the histogram is above the signal line). Stochastic reversed downwards, reflecting the risks of corrective dynamics of overbought gold development.

It is better to keep current short positions in the short and/or short-term perspective until new trade signals appear.

Resistance levels: 1191.36, 1200.00, 1204.55, 1211.14.

Support levels: 1182.79, 1170.00, 1159.83.

Trading tips

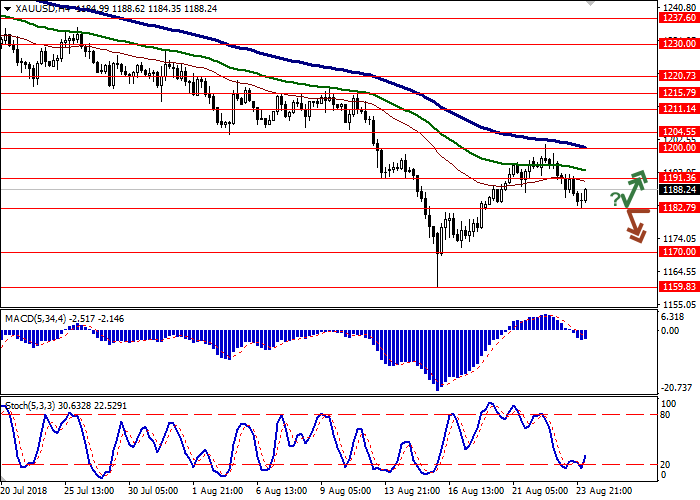

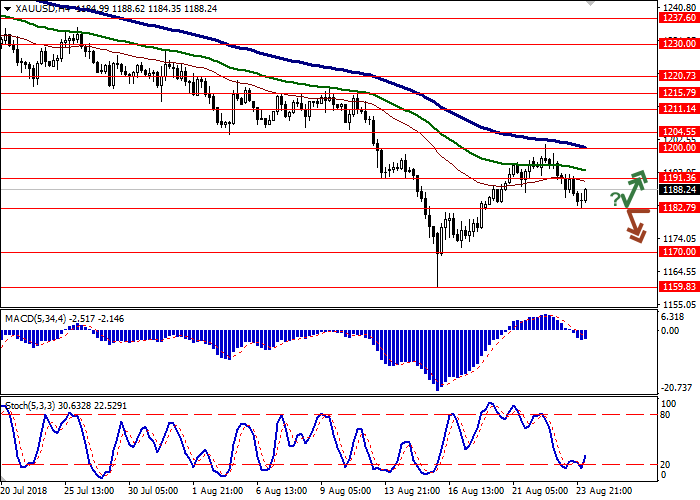

Long positions can be opened after a rebound from the level of 1182.79 and breakout of the level 1191.36 with the target at 1211.14 or 1215.79. Stop loss is 1182.79. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of level 1182.79 with the target at 1170.00. Stop loss is 1191.36. Implementation period: 1–2 days.

Yesterday, gold prices declined in response to the resumed growth of USD due to the increase in the US bonds’ yield. In addition, investors reacted positively to FOMC Minutes, which confirmed the readiness of the regulator to raise the interest rate at the September meeting.

The escalation of the trade conflict between the US and China also provides more support for the safe dollar than gold. Yesterday new reciprocal duties were implemented, as there was no noticeable progress in negotiations in Washington.

Today, investors are waiting for the speech of Fed Chairman Jerome Powell within the symposium in Jackson Hole. He will provide a report on monetary policy in a changing economy. Also, the market is waiting for the comments of the regulator's head regarding the latest critical statements of President Trump.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is slightly narrowed from above, reflecting the recent ambiguous trade. MACD indicator grows, maintaining the buy signal (the histogram is above the signal line). Stochastic reversed downwards, reflecting the risks of corrective dynamics of overbought gold development.

It is better to keep current short positions in the short and/or short-term perspective until new trade signals appear.

Resistance levels: 1191.36, 1200.00, 1204.55, 1211.14.

Support levels: 1182.79, 1170.00, 1159.83.

Trading tips

Long positions can be opened after a rebound from the level of 1182.79 and breakout of the level 1191.36 with the target at 1211.14 or 1215.79. Stop loss is 1182.79. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of level 1182.79 with the target at 1170.00. Stop loss is 1191.36. Implementation period: 1–2 days.

No comments:

Write comments