XAG/USD: prices show ambiguous dynamics

23 August 2018, 09:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 14.65 |

| Take Profit | 14.89, 15.00 |

| Stop Loss | 14.45, 14.40 |

| Key Levels | 14.00, 14.24, 14.40, 14.48, 14.60, 14.79, 14.89, 15.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 14.45 |

| Take Profit | 14.24, 14.00 |

| Stop Loss | 14.65, 14.70 |

| Key Levels | 14.00, 14.24, 14.40, 14.48, 14.60, 14.79, 14.89, 15.00 |

Current trend

Prices for silver remained virtually unchanged on Wednesday, but show an active decline during the Asian session today.

Investors are focused on two-day trade talks between the US and China in Washington, which will be the first ones after a series of unsuccessful May consultations. President Donald Trump has already noted that the Chinese authorities cannot offer the US an acceptable agreement. Beijing, on the contrary, is hoping for a positive result, as stated on Tuesday by the representative of the Ministry of Foreign Affairs of the People's Republic of China, Lu Kang.

If the negotiations are completed without results, then today the US will introduce new import tariffs, which will lead to similar measures on the part of China.

Support and resistance

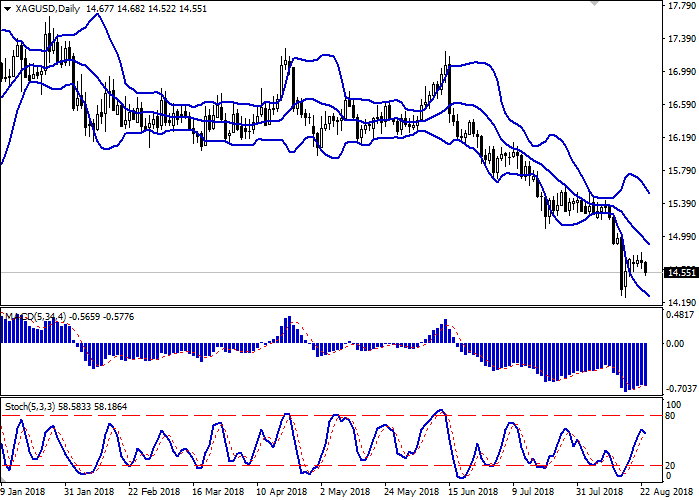

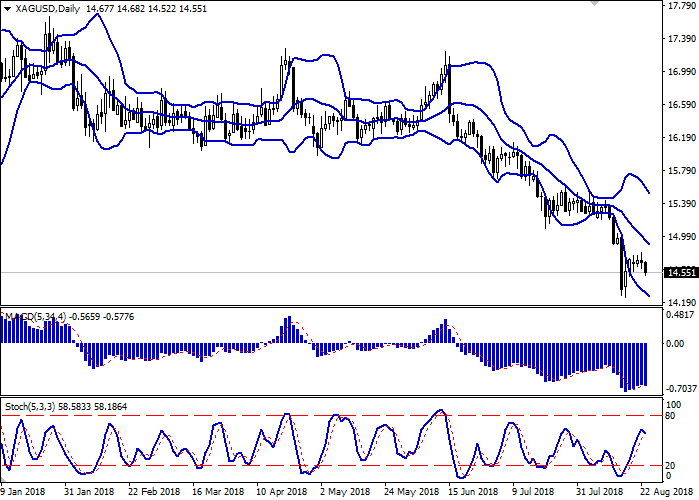

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is slightly narrowed from above, being spacious enough for the current activity level in the market. MACD is growing keeping a weak buy signal (located above the signal line). Stochastic reversed downwards sharply, reacting to the "bearish" nature of trading, formed during the Asian session on August 23.

It is necessary to wait for the emergence of stronger trade signals from technical indicators.

Resistance levels: 14.60, 14.79, 14.89, 15.00.

Support levels: 14.48, 14.40, 14.24, 14.00.

Trading tips

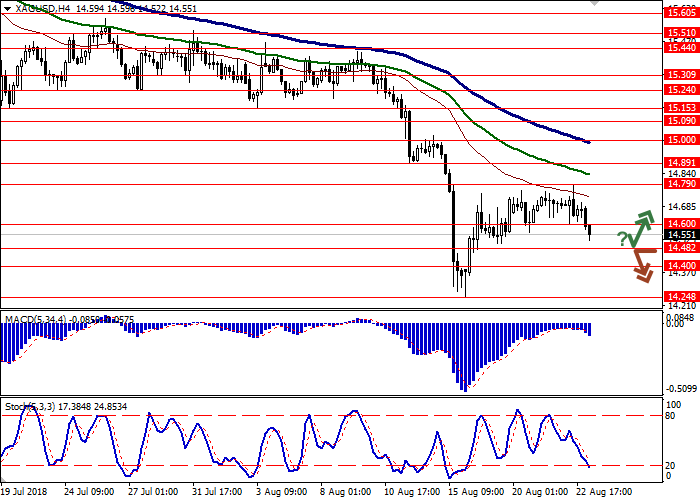

To open long positions, one can rely on the rebound from 14.48 as from support with the subsequent breakout of 14.60. Take profit — 14.89 or 15.00. Stop loss — 14.45 or 14.40.

A breakdown of 14.48 may be a signal to further sales with target at 14.24 or 14.00. Stop loss — 14.65 or 14.70.

Implementation period: 2-3 days.

Prices for silver remained virtually unchanged on Wednesday, but show an active decline during the Asian session today.

Investors are focused on two-day trade talks between the US and China in Washington, which will be the first ones after a series of unsuccessful May consultations. President Donald Trump has already noted that the Chinese authorities cannot offer the US an acceptable agreement. Beijing, on the contrary, is hoping for a positive result, as stated on Tuesday by the representative of the Ministry of Foreign Affairs of the People's Republic of China, Lu Kang.

If the negotiations are completed without results, then today the US will introduce new import tariffs, which will lead to similar measures on the part of China.

Support and resistance

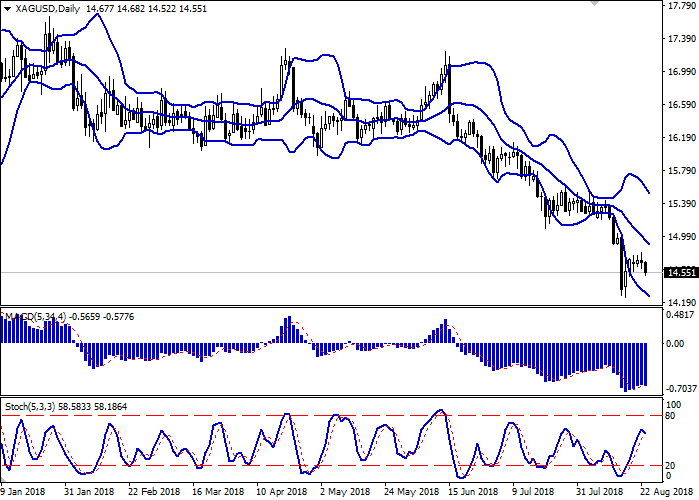

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is slightly narrowed from above, being spacious enough for the current activity level in the market. MACD is growing keeping a weak buy signal (located above the signal line). Stochastic reversed downwards sharply, reacting to the "bearish" nature of trading, formed during the Asian session on August 23.

It is necessary to wait for the emergence of stronger trade signals from technical indicators.

Resistance levels: 14.60, 14.79, 14.89, 15.00.

Support levels: 14.48, 14.40, 14.24, 14.00.

Trading tips

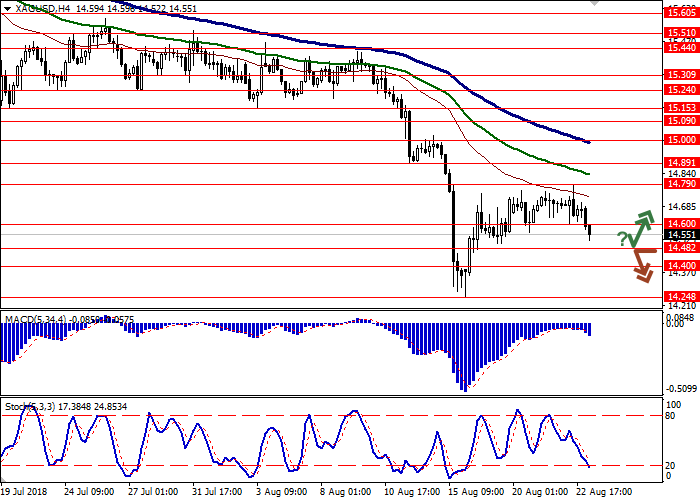

To open long positions, one can rely on the rebound from 14.48 as from support with the subsequent breakout of 14.60. Take profit — 14.89 or 15.00. Stop loss — 14.45 or 14.40.

A breakdown of 14.48 may be a signal to further sales with target at 14.24 or 14.00. Stop loss — 14.65 or 14.70.

Implementation period: 2-3 days.

No comments:

Write comments