WTI Crude Oil: into wide sideways consolidation

17 August 2018, 11:45

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 65.12 |

| Take Profit | 70.70, 74.00 |

| Stop Loss | 62.40 |

| Key Levels | 57.10, 57.75, 59.50, 60.75, 61.70, 63.35, 66.55, 67.00, 68.00, 68.75, 70.10, 70.70, 71.50, 72.65, 74.00, 75.00 |

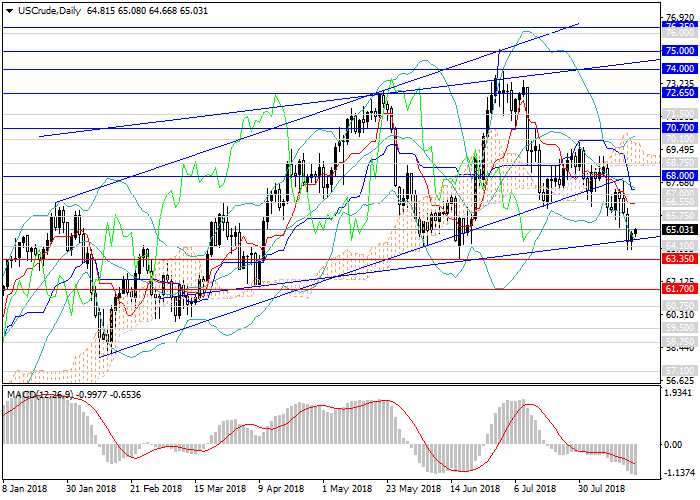

Current trend

For more than one and a half months, the price of oil continues to fall. In addition, it continues to decline due to the US macroeconomic data. Another factor was the increase EIA Oil Rigs Count number and the growth in oil production.

Today, there is no high volatility in the market is expected.

Support and resistance

The price broke through the lower border and left the long-term wide upward channel, but the probability of a transition to a wider consolidation is high. Probably, the price will not immediately be able to break the key support level of 63.35 and continue to decline. From this level, the upward wave with the targets at 70.70, 72.65, 74.00 can form.

The main scenario is the formation of a sideways trend within the framework of 63.35–74.00, the channel may be narrowed.

Technical indicators reflect the growth of the pair, MACD keeps high volumes of long positions, Bollinger bands are directed horizontally, which also indicates the formation of sideways consolidation.

Resistance levels: 66.55, 67.00, 68.00, 68.75, 70.10, 70.70, 71.50, 72.65, 74.00, 75.00.

Support levels: 63.35, 61.70, 60.75, 59.50, 57.75, 57.10.

Trading tips

It is relevant to increase the volumes of long positions from the current level with the targets of 70.70, 74.00 and stop loss 62.40.

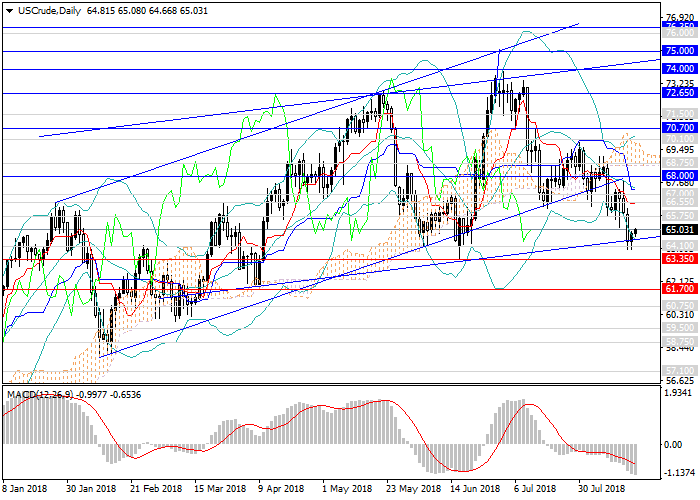

For more than one and a half months, the price of oil continues to fall. In addition, it continues to decline due to the US macroeconomic data. Another factor was the increase EIA Oil Rigs Count number and the growth in oil production.

Today, there is no high volatility in the market is expected.

Support and resistance

The price broke through the lower border and left the long-term wide upward channel, but the probability of a transition to a wider consolidation is high. Probably, the price will not immediately be able to break the key support level of 63.35 and continue to decline. From this level, the upward wave with the targets at 70.70, 72.65, 74.00 can form.

The main scenario is the formation of a sideways trend within the framework of 63.35–74.00, the channel may be narrowed.

Technical indicators reflect the growth of the pair, MACD keeps high volumes of long positions, Bollinger bands are directed horizontally, which also indicates the formation of sideways consolidation.

Resistance levels: 66.55, 67.00, 68.00, 68.75, 70.10, 70.70, 71.50, 72.65, 74.00, 75.00.

Support levels: 63.35, 61.70, 60.75, 59.50, 57.75, 57.10.

Trading tips

It is relevant to increase the volumes of long positions from the current level with the targets of 70.70, 74.00 and stop loss 62.40.

No comments:

Write comments