NZD/USD: general analysis

17 August 2018, 12:31

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.6540 |

| Take Profit | 0.6450 |

| Stop Loss | 0.6600 |

| Key Levels | 0.6450, 0.6500, 0.6544, 0.6612, 0.6684, 0.6745, 0.6847, 0.6924 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6750 |

| Take Profit | 0.6840 |

| Stop Loss | 0.6710 |

| Key Levels | 0.6450, 0.6500, 0.6544, 0.6612, 0.6684, 0.6745, 0.6847, 0.6924 |

Current trend

Yesterday NZD strengthened against USD due to the release of ambiguous macroeconomic statistics from the United States. Initial Jobless Claims data exceeded the forecast, but the decline in Philadelphia Fed Manufacturing Survey index and in Housing Starts data affected USD negatively.

Today, the pair continued to rise due to the increase in Q2 Producer Price Index in New Zealand. The dynamics can be affected by US statistics: Michigan Consumer Sentiment Index release at 16:00 (GMT+2) and Baker Hughes US Oil Rig Count publication at 19:00 (GMT+2). The market expects moderate volatility.

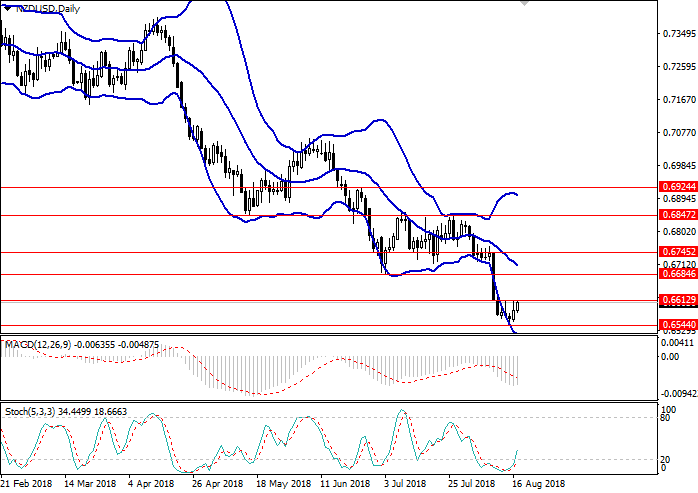

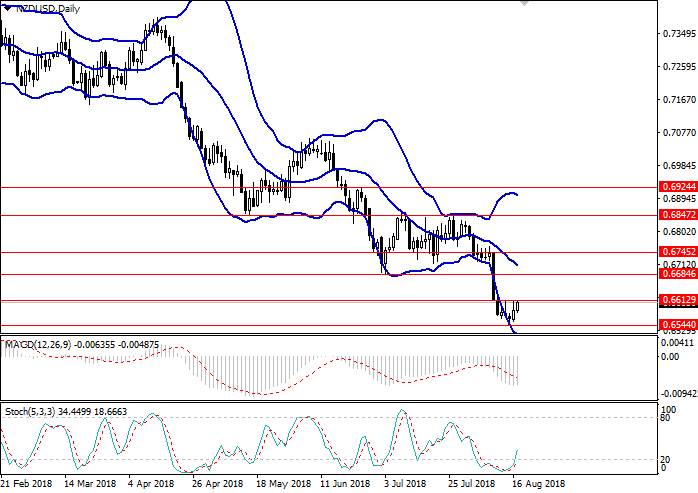

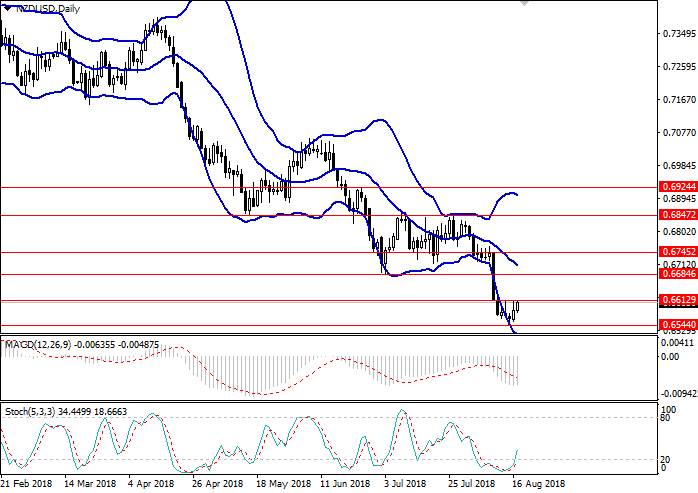

Support and resistance

On the daily chart, the downward movement is in the correction, the pair is traded near the lower border of Bollinger bands, and the price range is extended, which indicates a possible resumption of the downward trend. MACD histogram is in the negative area, keeping the signal to the opening of short positions.

Resistance levels: 0.6612, 0.6684, 0.6745, 0.6847, 0.6924.

Support levels: 0.6544, 0.6500, 0.6450.

Trading tips

Short positions can be opened from the level of 0.6540 with the target at 0.6450 and stop loss 0.6600. Implementation period: 1–3 days.

Long positions can be opened from the level of 0.6750 with the target at 0.6840 and stop loss 0.6710. Implementation period: 3–5 days.

Yesterday NZD strengthened against USD due to the release of ambiguous macroeconomic statistics from the United States. Initial Jobless Claims data exceeded the forecast, but the decline in Philadelphia Fed Manufacturing Survey index and in Housing Starts data affected USD negatively.

Today, the pair continued to rise due to the increase in Q2 Producer Price Index in New Zealand. The dynamics can be affected by US statistics: Michigan Consumer Sentiment Index release at 16:00 (GMT+2) and Baker Hughes US Oil Rig Count publication at 19:00 (GMT+2). The market expects moderate volatility.

Support and resistance

On the daily chart, the downward movement is in the correction, the pair is traded near the lower border of Bollinger bands, and the price range is extended, which indicates a possible resumption of the downward trend. MACD histogram is in the negative area, keeping the signal to the opening of short positions.

Resistance levels: 0.6612, 0.6684, 0.6745, 0.6847, 0.6924.

Support levels: 0.6544, 0.6500, 0.6450.

Trading tips

Short positions can be opened from the level of 0.6540 with the target at 0.6450 and stop loss 0.6600. Implementation period: 1–3 days.

Long positions can be opened from the level of 0.6750 with the target at 0.6840 and stop loss 0.6710. Implementation period: 3–5 days.

No comments:

Write comments