USD/JPY: the dollar is trying to correct

22 August 2018, 09:40

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 110.60, 110.80 |

| Take Profit | 111.52, 111.85 |

| Stop Loss | 110.40, 110.25 |

| Key Levels | 109.75, 110.00, 110.25, 110.54, 110.73, 111.16, 111.52 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 109.90 |

| Take Profit | 109.33, 109.00 |

| Stop Loss | 110.30, 110.40 |

| Key Levels | 109.75, 110.00, 110.25, 110.54, 110.73, 111.16, 111.52 |

Current trend

The US dollar showed growth against the Japanese yen on Tuesday, moving away from local lows since June 27.

On Tuesday, investors are focused on the comments of US President Donald Trump, who again expressed dissatisfaction with the monetary policy of the Fed. In an interview with Reuters, he criticized Jerome Powell for raising interest rates and said he needed more serious help from the regulator to restore the American economy. Now investors are waiting for a response from Fed head, which can be given during a speech at the symposium in Jackson Hole.

Trump also once again accused China of manipulating the national currency, which is not the best start for the beginning of the US-China trade talks. Great results are not expected, but the market keeps hope for the best.

Support and resistance

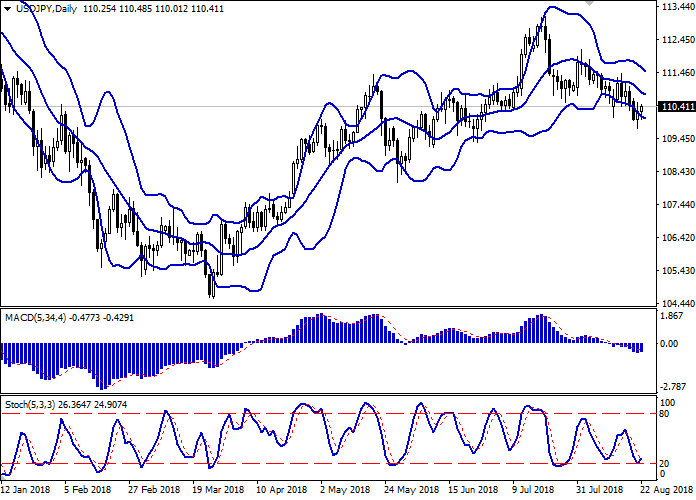

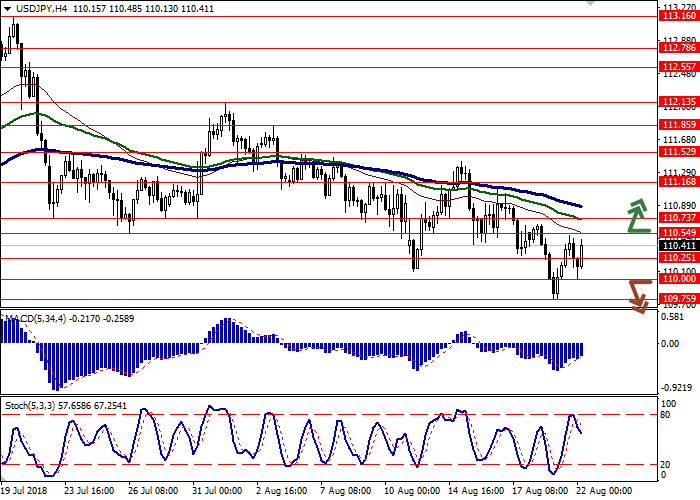

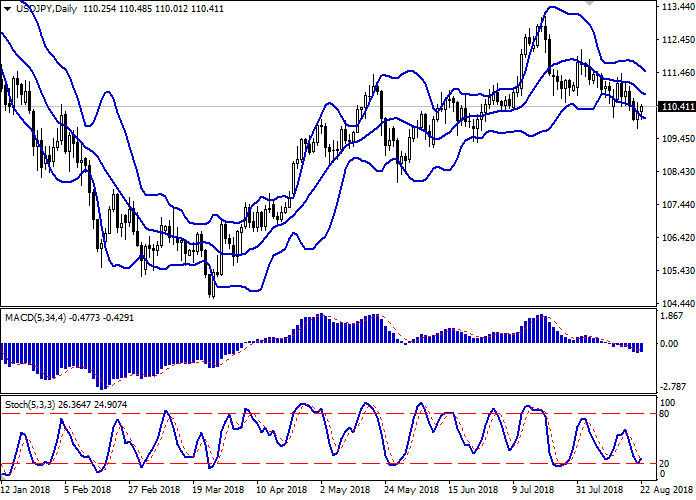

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is narrowing, reflecting the correctional growth in the short term. MACD is reversing upwards preserving a sell signal (histogram being located under the signal line). Stochastic shows a rebound from the "20" mark, which is the formal border of the oversold status of the oversold dollar.

Current showings of the indicators do not contradict the development of corrective growth in favor of the US currency.

Resistance levels: 110.54, 110.73, 111.16, 111.52.

Support levels: 110.25, 110.00, 109.75.

Trading tips

To open long positions, one can rely on the breakout of 110.54-110.73 while the "bullish" signals are preserved. Take profit — 111.52-111.85. Stop loss – 110.40-110.25. Implementation time: 2-3 days.

An alternative may be the return of "bearish" dynamics with the breakdown of the level of 110.00. In this case, 109.33-109.00 will be the target. Stop loss – 110.30-110.40. Implementation time: 2-3 days.

The US dollar showed growth against the Japanese yen on Tuesday, moving away from local lows since June 27.

On Tuesday, investors are focused on the comments of US President Donald Trump, who again expressed dissatisfaction with the monetary policy of the Fed. In an interview with Reuters, he criticized Jerome Powell for raising interest rates and said he needed more serious help from the regulator to restore the American economy. Now investors are waiting for a response from Fed head, which can be given during a speech at the symposium in Jackson Hole.

Trump also once again accused China of manipulating the national currency, which is not the best start for the beginning of the US-China trade talks. Great results are not expected, but the market keeps hope for the best.

Support and resistance

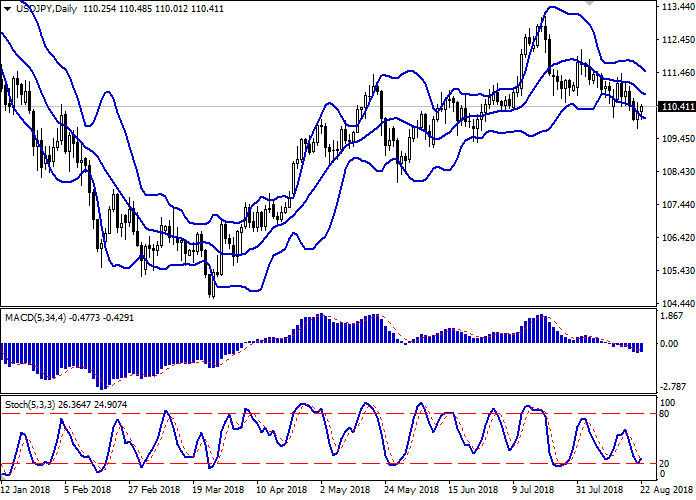

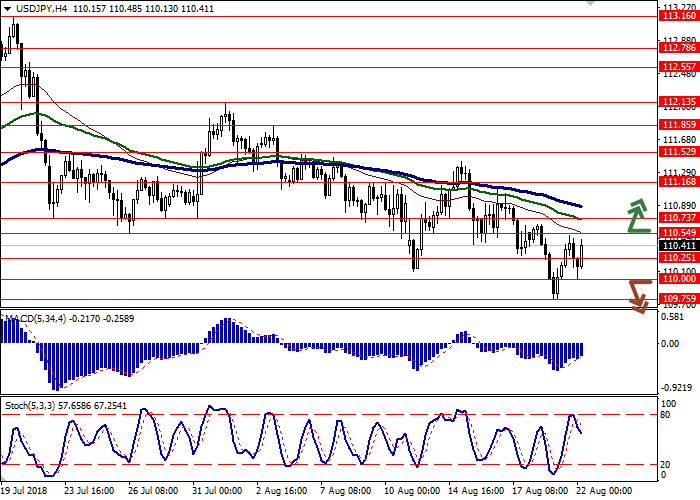

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is narrowing, reflecting the correctional growth in the short term. MACD is reversing upwards preserving a sell signal (histogram being located under the signal line). Stochastic shows a rebound from the "20" mark, which is the formal border of the oversold status of the oversold dollar.

Current showings of the indicators do not contradict the development of corrective growth in favor of the US currency.

Resistance levels: 110.54, 110.73, 111.16, 111.52.

Support levels: 110.25, 110.00, 109.75.

Trading tips

To open long positions, one can rely on the breakout of 110.54-110.73 while the "bullish" signals are preserved. Take profit — 111.52-111.85. Stop loss – 110.40-110.25. Implementation time: 2-3 days.

An alternative may be the return of "bearish" dynamics with the breakdown of the level of 110.00. In this case, 109.33-109.00 will be the target. Stop loss – 110.30-110.40. Implementation time: 2-3 days.

No comments:

Write comments