NZD/USD: NZD is falling

24 August 2018, 10:05

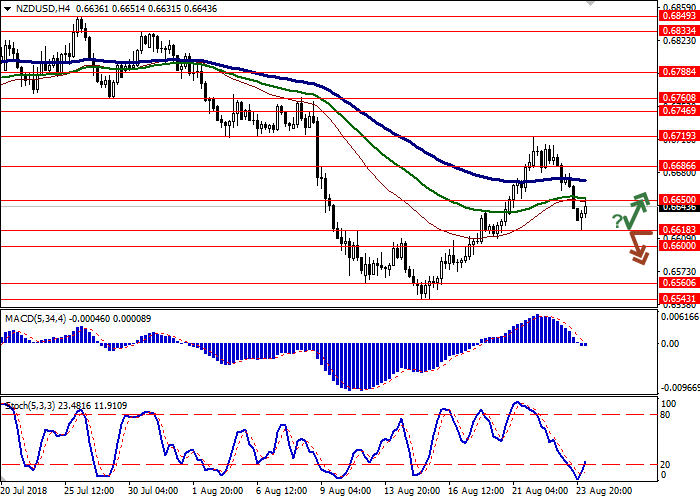

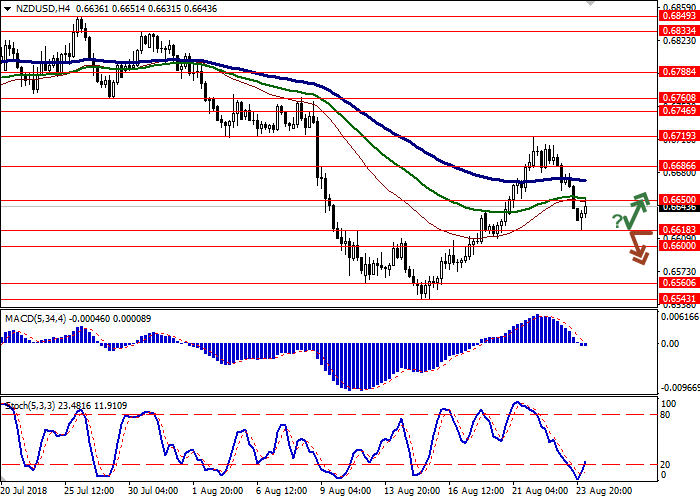

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6660 |

| Take Profit | 0.6719, 0.6746 |

| Stop Loss | 0.6600 |

| Key Levels | 0.6543, 0.6560, 0.6600, 0.6618, 0.6650, 0.6686, 0.6719, 0.6746 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6610 |

| Take Profit | 0.6560, 0.6543 |

| Stop Loss | 0.6650 |

| Key Levels | 0.6543, 0.6560, 0.6600, 0.6618, 0.6650, 0.6686, 0.6719, 0.6746 |

Current trend

Yesterday, NZD significantly decreased against USD, interrupting the "bullish" series, which led the instrument to the highs of August 9.

Investors are focused on the introduction of additional US-Chinese reciprocal duties by USD 16 billion each. The United States raised tariffs, in particular, on motorcycles produced, railway cars, and steam turbines in China. The PRC responded with duties on American cars, buses, coal, and other goods. The new restrictions came into force amid the negotiations between the countries going in Washington. Today, they are scheduled for completion and a joint statement on the results is expected.

Published on Wednesday, FOMC minutes generally did not tell investors anything new. Fed officials confirmed the possibility of further rate hikes if the US economy continues to develop. At the same time, it was noted that in the medium term, the consumer price index will reach the target level of 2.0%, and the risks for GDP, unemployment, and inflation are balanced.

Support and resistance

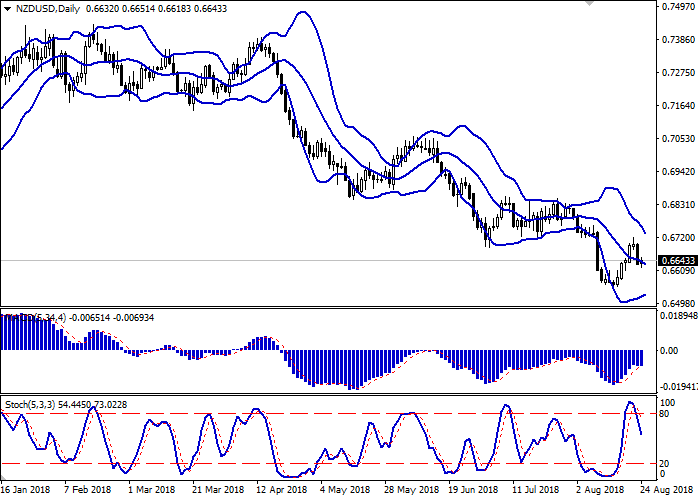

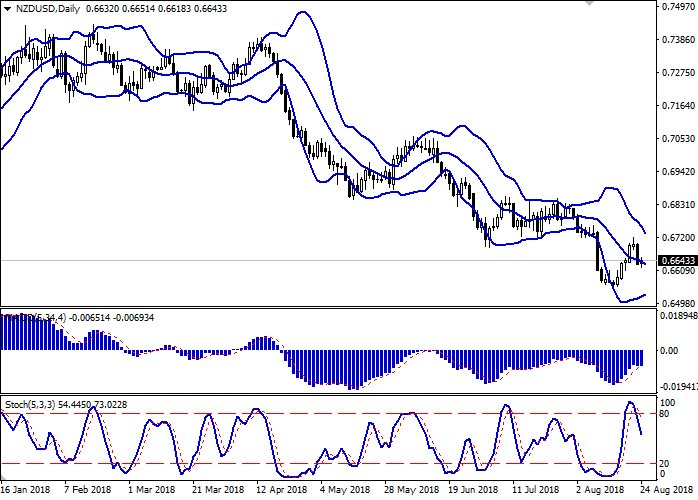

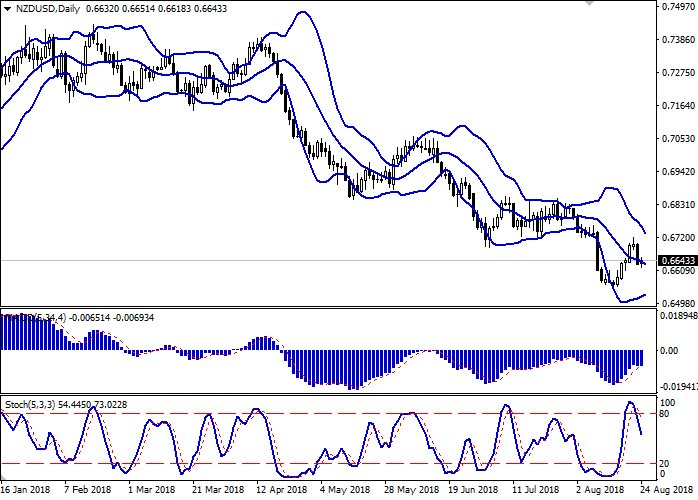

On the daily chart, Bollinger bands are moving flat. The price range is narrowing, reflecting a sharp change in the trade direction in the short term. MACD grows, keeping a weak signal for purchase (the histogram is above the signal line). Stochastic is declining, reflecting the possibility of corrective decline in the short term.

It is better to keep the "bearish" scenario before new signals appear.

Resistance levels: 0.6650, 0.6686, 0.6719, 0.6746.

Support levels: 0.6618, 0.6600, 0.6560, 0.6543.

Trading tips

Long positions can be opened after rebound from 0.6618 and breakout of 0.6650 with the target at 0.6719 or 0.6746. Stop loss is 0.6600.

Short positions can be opened after a breakdown of the level of 0.6618 with the targets at 0.6560–0.6543 and stop loss 0.6650.

Implementation period: 2–3 days.

Yesterday, NZD significantly decreased against USD, interrupting the "bullish" series, which led the instrument to the highs of August 9.

Investors are focused on the introduction of additional US-Chinese reciprocal duties by USD 16 billion each. The United States raised tariffs, in particular, on motorcycles produced, railway cars, and steam turbines in China. The PRC responded with duties on American cars, buses, coal, and other goods. The new restrictions came into force amid the negotiations between the countries going in Washington. Today, they are scheduled for completion and a joint statement on the results is expected.

Published on Wednesday, FOMC minutes generally did not tell investors anything new. Fed officials confirmed the possibility of further rate hikes if the US economy continues to develop. At the same time, it was noted that in the medium term, the consumer price index will reach the target level of 2.0%, and the risks for GDP, unemployment, and inflation are balanced.

Support and resistance

On the daily chart, Bollinger bands are moving flat. The price range is narrowing, reflecting a sharp change in the trade direction in the short term. MACD grows, keeping a weak signal for purchase (the histogram is above the signal line). Stochastic is declining, reflecting the possibility of corrective decline in the short term.

It is better to keep the "bearish" scenario before new signals appear.

Resistance levels: 0.6650, 0.6686, 0.6719, 0.6746.

Support levels: 0.6618, 0.6600, 0.6560, 0.6543.

Trading tips

Long positions can be opened after rebound from 0.6618 and breakout of 0.6650 with the target at 0.6719 or 0.6746. Stop loss is 0.6600.

Short positions can be opened after a breakdown of the level of 0.6618 with the targets at 0.6560–0.6543 and stop loss 0.6650.

Implementation period: 2–3 days.

No comments:

Write comments