GBP/USD: pound is growing

22 August 2018, 09:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2925 |

| Take Profit | 1.3000, 1.3048 |

| Stop Loss | 1.2850 |

| Key Levels | 1.2634, 1.2659, 1.2732, 1.2800, 1.2850, 1.2923, 1.3000, 1.3048, 1.3100 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2870, 1.2845 |

| Take Profit | 1.2732, 1.2700 |

| Stop Loss | 1.2920 |

| Key Levels | 1.2634, 1.2659, 1.2732, 1.2800, 1.2850, 1.2923, 1.3000, 1.3048, 1.3100 |

Current trend

Yesterday, GBP significantly grew against USD, renewing a local maximum since August 8.

Strong budget data support GBP. In July, Public Net Borrowings fell by 2.9 billion, and its overall surplus reached 1.1 billion pounds, the highest for the past 18 years. Though, the filling of the budget is connected with the seasonal factor of income tax payments. The overall budget deficit for the fiscal year is also declining and now is 12.8 billion (8.5 billion less than last year).

Commerce Minister Liam Fox presented a plan to increase exports of British goods to non-EU countries, which expected increase in the share of exports in the UK's GDP from 30% to 35%. According to the minister, currently there are about 400K enterprises in the UK that could (but for various reasons do not) export goods and services, so they will be stimulated by government support and guarantees worth about 50 billion pounds.

Support and resistance

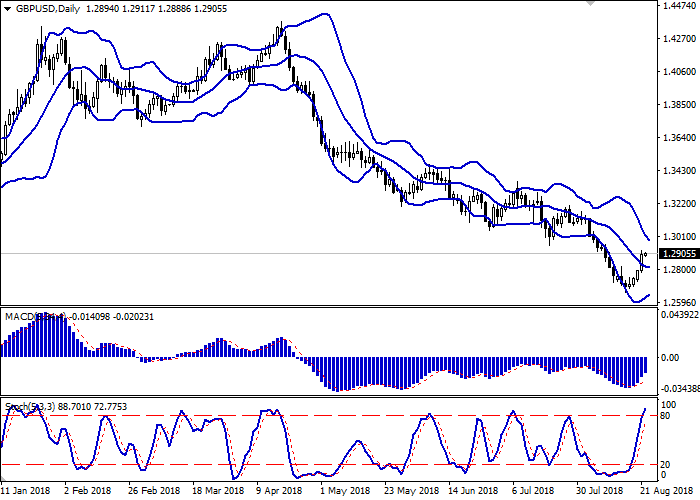

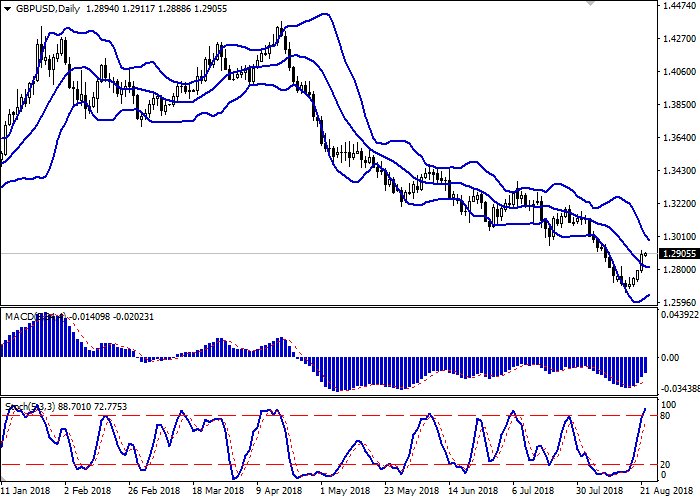

On the daily chart, Bollinger bands unfold horizontally. The price range is narrowing, reflecting a change of direction in the short term. The indicator MACD grows, keeping a buy signal (the histogram consolidated above a signal line). Stochastic is directed upwards, but is closed to its highs, which reflects that GBP is overbought.

It is better to keep current purchases before the situation is clear.

Resistance levels: 1.2923, 1.3000, 1.3048, 1.3100.

Support levels: 1.2850, 1.2800, 1.2732, 1.2659, 1.2634.

Trading tips

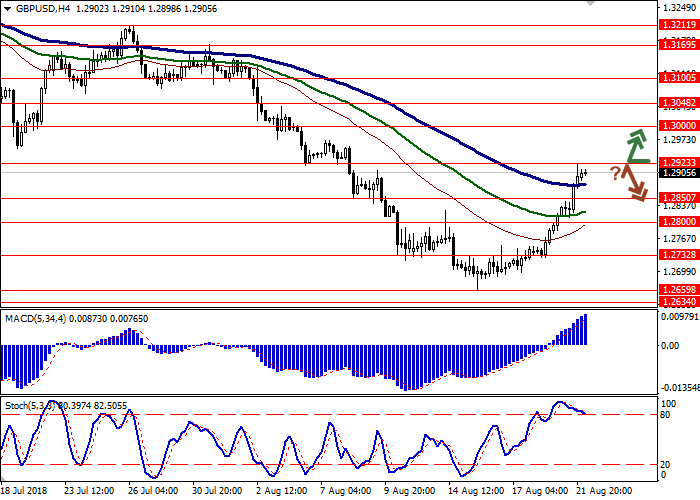

Long positions can be opened after the breakout of 1.2923 with the targets at 1.3000–1.3048 and the stop loss 1.2850. Implementation period: 1–2 days.

Short positions can be opened after the rebound from 1.2923 and breakdown of 1.2875–1.2850 with the targets at 1.2732–1.2700 and stop loss 1.2900–1.2920. Implementation period: 2–3 days.

Yesterday, GBP significantly grew against USD, renewing a local maximum since August 8.

Strong budget data support GBP. In July, Public Net Borrowings fell by 2.9 billion, and its overall surplus reached 1.1 billion pounds, the highest for the past 18 years. Though, the filling of the budget is connected with the seasonal factor of income tax payments. The overall budget deficit for the fiscal year is also declining and now is 12.8 billion (8.5 billion less than last year).

Commerce Minister Liam Fox presented a plan to increase exports of British goods to non-EU countries, which expected increase in the share of exports in the UK's GDP from 30% to 35%. According to the minister, currently there are about 400K enterprises in the UK that could (but for various reasons do not) export goods and services, so they will be stimulated by government support and guarantees worth about 50 billion pounds.

Support and resistance

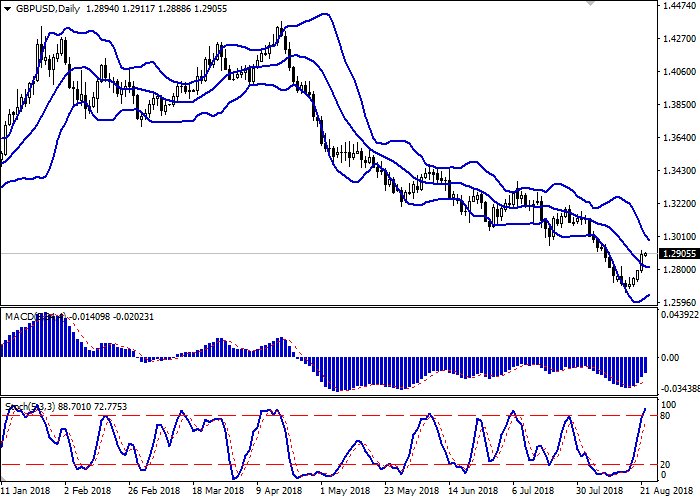

On the daily chart, Bollinger bands unfold horizontally. The price range is narrowing, reflecting a change of direction in the short term. The indicator MACD grows, keeping a buy signal (the histogram consolidated above a signal line). Stochastic is directed upwards, but is closed to its highs, which reflects that GBP is overbought.

It is better to keep current purchases before the situation is clear.

Resistance levels: 1.2923, 1.3000, 1.3048, 1.3100.

Support levels: 1.2850, 1.2800, 1.2732, 1.2659, 1.2634.

Trading tips

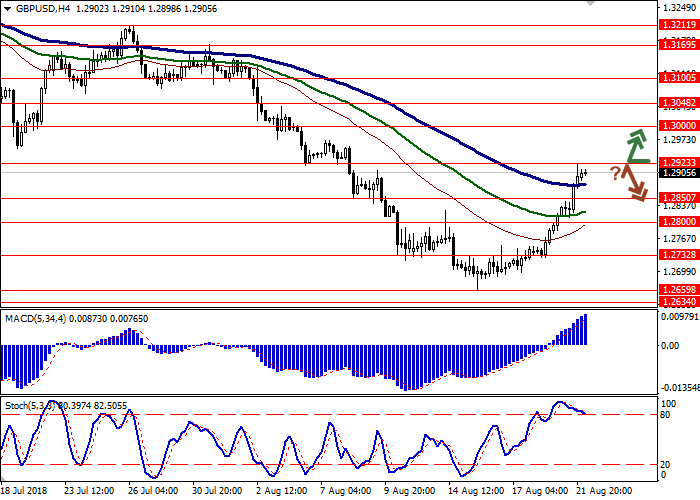

Long positions can be opened after the breakout of 1.2923 with the targets at 1.3000–1.3048 and the stop loss 1.2850. Implementation period: 1–2 days.

Short positions can be opened after the rebound from 1.2923 and breakdown of 1.2875–1.2850 with the targets at 1.2732–1.2700 and stop loss 1.2900–1.2920. Implementation period: 2–3 days.

No comments:

Write comments