GBP/USD: Pound is correcting

14 August 2018, 10:52

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2810 |

| Take Profit | 1.2900, 1.2956, 1.3000 |

| Stop Loss | 1.2740 |

| Key Levels | 1.2634, 1.2673, 1.2721, 1.2800, 1.2850, 1.2900, 1.2956 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2715 |

| Take Profit | 1.2600 |

| Stop Loss | 1.2770 |

| Key Levels | 1.2634, 1.2673, 1.2721, 1.2800, 1.2850, 1.2900, 1.2956 |

Current trend

The British currency showed some growth against the Dollar on Monday, 13 august, and slightly corrected after the Bearish rally that led to a renewal of its lows since June 2017.

The GBP moves due to the technical reasons. Investors are waiting for a block of key British statistics. On Tuesday, there will be data from the UK labor market. It is projected that the unemployment rate will remain at the same level of 4.2%, and the wage growth index will be around 2.5%. The pace of wage growth in the UK has been gradually declining since the beginning of this year, which could lead to a decrease in retail sales and affect the country's GDP negatively.

Another interesting event to watch will be Q2 GDP release and June industrial production statistics publication in the Eurozone. GDP growth is likely to stay at the same level of 2.1% YoY and 0.3% QoQ. Industrial production data are expected to be ambiguous. The indicator could grow by 2.5% YoY and decrease by 0.4% MoM.

Support and resistance

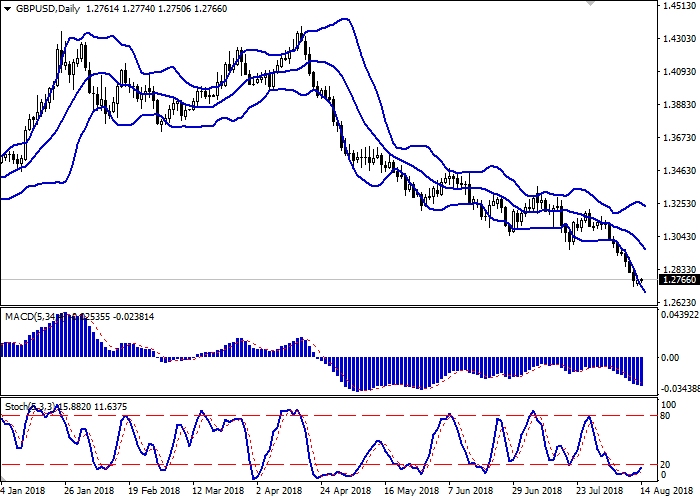

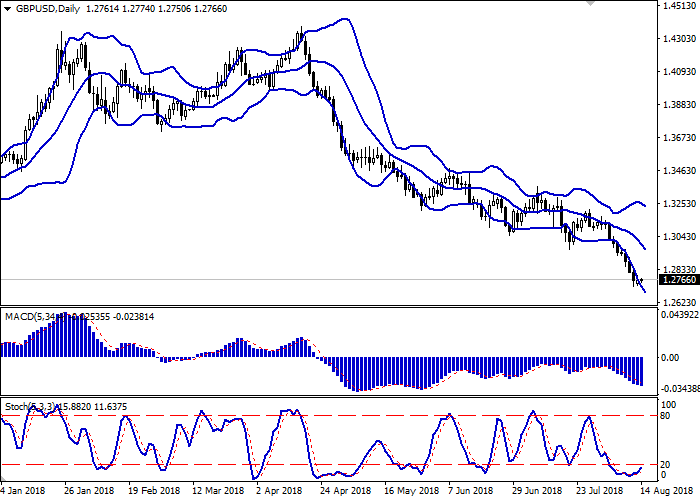

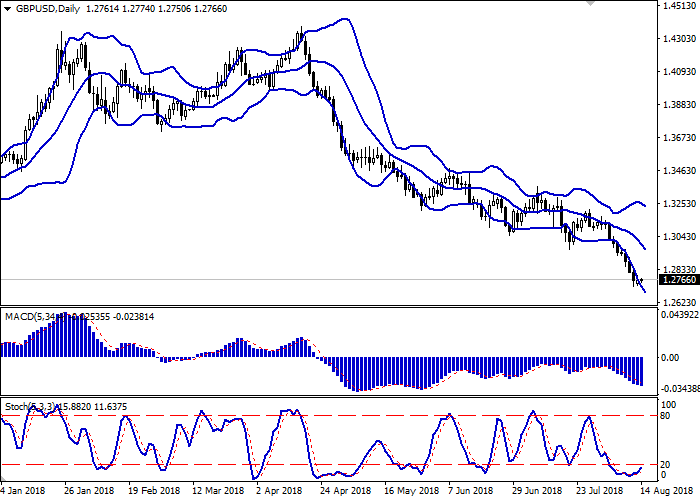

The Bollinger Bands on the daily chart is moving downward. The price range is widening from the bottom, allowing the bears to move to new lows. The MACD is falling and keeping a weak sell signal (the histogram is below the signal line). The Stochastic, having reached its minimum levels has turned upward, representing the risks of the Pound being oversold. A possibility of an upward correction in the short-term should be considered.

Support levels: 1.2721, 1.2673, 1.2634.

Resistance levels: 1.2800, 1.2850, 1.2900, 1.2956.

Trading tips

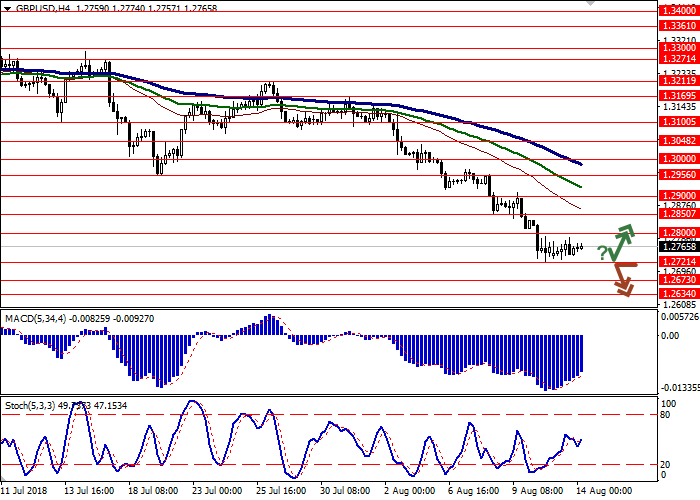

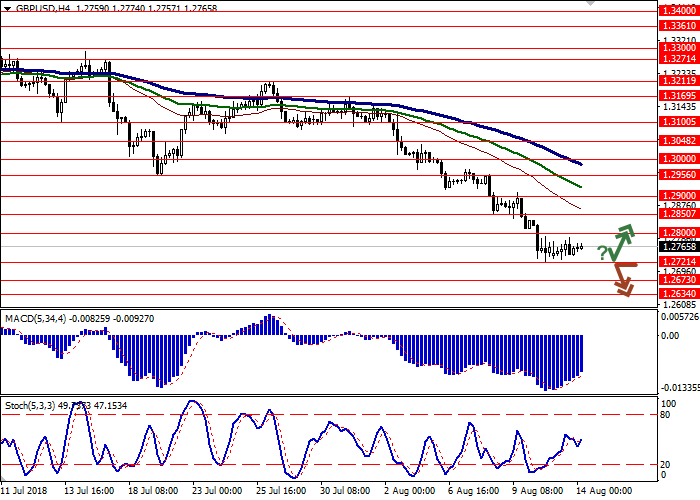

Long positions can be opened after the breakout of the level of 1.2800 with targets at 1.2900, 1.2956, 1.3000 and stop-loss at 1.2740. Validity – 2-3 days.

Short positions can be opened after the breakdown of the level of 1.2721 with the target at 1.2600 and stop-loss at 1.2770. Validity – 2-3 days.

The British currency showed some growth against the Dollar on Monday, 13 august, and slightly corrected after the Bearish rally that led to a renewal of its lows since June 2017.

The GBP moves due to the technical reasons. Investors are waiting for a block of key British statistics. On Tuesday, there will be data from the UK labor market. It is projected that the unemployment rate will remain at the same level of 4.2%, and the wage growth index will be around 2.5%. The pace of wage growth in the UK has been gradually declining since the beginning of this year, which could lead to a decrease in retail sales and affect the country's GDP negatively.

Another interesting event to watch will be Q2 GDP release and June industrial production statistics publication in the Eurozone. GDP growth is likely to stay at the same level of 2.1% YoY and 0.3% QoQ. Industrial production data are expected to be ambiguous. The indicator could grow by 2.5% YoY and decrease by 0.4% MoM.

Support and resistance

The Bollinger Bands on the daily chart is moving downward. The price range is widening from the bottom, allowing the bears to move to new lows. The MACD is falling and keeping a weak sell signal (the histogram is below the signal line). The Stochastic, having reached its minimum levels has turned upward, representing the risks of the Pound being oversold. A possibility of an upward correction in the short-term should be considered.

Support levels: 1.2721, 1.2673, 1.2634.

Resistance levels: 1.2800, 1.2850, 1.2900, 1.2956.

Trading tips

Long positions can be opened after the breakout of the level of 1.2800 with targets at 1.2900, 1.2956, 1.3000 and stop-loss at 1.2740. Validity – 2-3 days.

Short positions can be opened after the breakdown of the level of 1.2721 with the target at 1.2600 and stop-loss at 1.2770. Validity – 2-3 days.

No comments:

Write comments