GBP/USD: general review

09 August 2018, 11:13

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 1.2854 |

| Take Profit | 1.2800 |

| Stop Loss | 1.2910 |

| Key Levels | 1.2800, 1.2820, 1.2850, 1.2880, 1.2910, 1.2930, 1.2950, 1.2970, 1.3000 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2930 |

| Take Profit | 1.3000 |

| Stop Loss | 1.2880 |

| Key Levels | 1.2800, 1.2820, 1.2850, 1.2880, 1.2910, 1.2930, 1.2950, 1.2970, 1.3000 |

Current trend

USD strengthened against GBP on Wednesday due to the absence of significant macroeconomic releases. The focus of investors' attention was on the trade war between the US and China.

GBP remains under pressure of uncertainty in the outcome of Brexit. This week, Liam Fox, the Secretary of State for International Trade, estimated the probability of the UK's withdrawal from the EU without a deal as 60%. According to the media, 75% of British companies are pessimistic about Brexit.

Investors are waiting for Friday when there will be data on GDP and industrial production of the UK. GDP probably will not change much but industrial production is expected to grow, which can support the pound.

The main event of today will be the release of data on Initial Jobless Claims in the US (14:30 GMT+2), moderate volatility is expected in the market.

Support and resistance

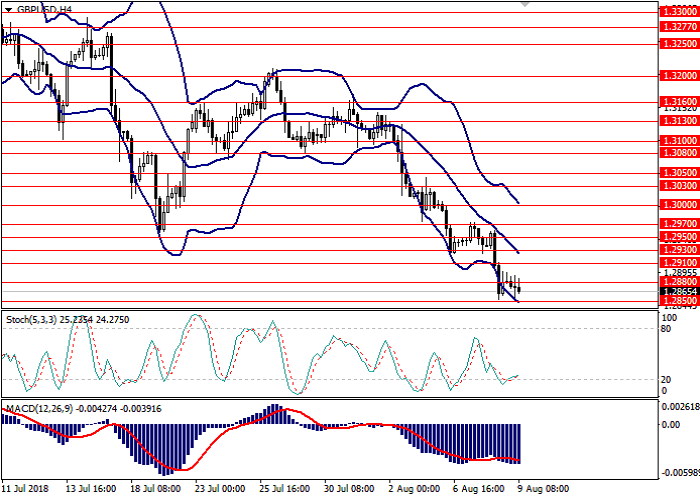

On the H4 chart the pair is decreasing along the lower line of Bollinger Bands. MACD histogram is in the negative zone keeping a signal for opening short positions.

Resistance levels: 1.2880, 1.2910, 1.2930, 1.2950, 1.2970, 1.3000.

Support levels: 1.2850, 1.2820, 1.2800.

Trading tips

Short positions may be opened from the current level with target at 1.2800 and stop loss at 1.2910.

Buy orders may be opened from the level of 1.2930 with target at 1.3000 and stop loss at 1.2880.

Implementation period: 1-3 days.

USD strengthened against GBP on Wednesday due to the absence of significant macroeconomic releases. The focus of investors' attention was on the trade war between the US and China.

GBP remains under pressure of uncertainty in the outcome of Brexit. This week, Liam Fox, the Secretary of State for International Trade, estimated the probability of the UK's withdrawal from the EU without a deal as 60%. According to the media, 75% of British companies are pessimistic about Brexit.

Investors are waiting for Friday when there will be data on GDP and industrial production of the UK. GDP probably will not change much but industrial production is expected to grow, which can support the pound.

The main event of today will be the release of data on Initial Jobless Claims in the US (14:30 GMT+2), moderate volatility is expected in the market.

Support and resistance

On the H4 chart the pair is decreasing along the lower line of Bollinger Bands. MACD histogram is in the negative zone keeping a signal for opening short positions.

Resistance levels: 1.2880, 1.2910, 1.2930, 1.2950, 1.2970, 1.3000.

Support levels: 1.2850, 1.2820, 1.2800.

Trading tips

Short positions may be opened from the current level with target at 1.2800 and stop loss at 1.2910.

Buy orders may be opened from the level of 1.2930 with target at 1.3000 and stop loss at 1.2880.

Implementation period: 1-3 days.

No comments:

Write comments