EUR/USD: general analysis

22 August 2018, 12:55

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.1600 |

| Take Profit | 1.1718, 1.1840 |

| Stop Loss | 1.1560 |

| Key Levels | 1.1352, 1.1474, 1.1596, 1.1718, 1.1840 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1535 |

| Take Profit | 1.1474, 1.1352 |

| Stop Loss | 1.1590 |

| Key Levels | 1.1352, 1.1474, 1.1596, 1.1718, 1.1840 |

Current trend

Since the middle of last week, the pair has been growing and is now testing the level of 1.1596. USD is under pressure of the commentaries of President Trump, who yesterday in an interview with Reuters expressed dissatisfaction with the increase in US interest rates and said that he needs more help from Fed to restore the American economy.

Today the investors are focused on US-China trade negotiations and FOMC Minutes release. Two-day talks between China's Deputy Trade Minister Wang Shouwen and US Deputy Finance Minister David Malpass will be held in Washington. President Trump said that the Chinese authorities cannot offer the US an acceptable agreement. However, the meeting can become a basis for further discussion, culminating in the meeting between Donald Trump and Xi Jinping in November.

In the evening, FOMC Minutes will be published. The market is confident that the regulator will increase the rate twice this year, but the fate of the interest rate and Fed’s balance ($4.2 trillion) in the next year is not clear.

Support and resistance

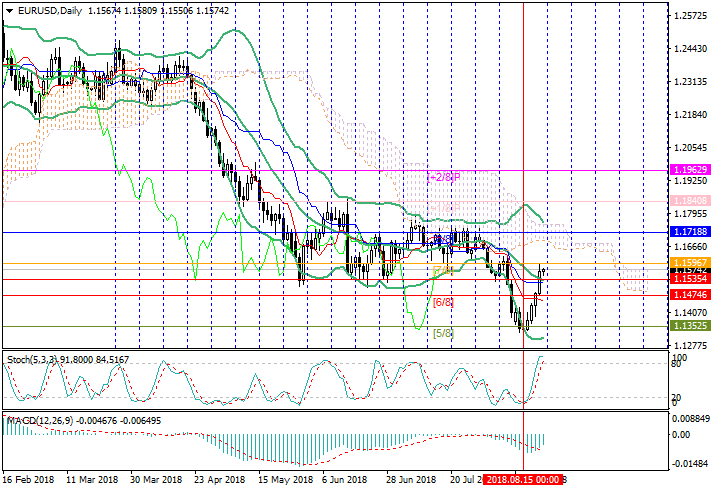

The price is around 1.1596 (Murrey [7/8]), the breakout will let it grow to 1.1718 (Murrey [8/8]) and 1.1840 (Murrey [+1/8]). However, the beginning of the reversal of Stochastic in the overbought zone and the downward movement of Bollinger bands indicate a probability of the beginning of the decline to levels 1.1474 (Murrey [6/8]) and 1.1352 (Murrey [5/8]).

Resistance levels: 1.1596, 1.1718, 1.1840.

Support levels: 1.1474, 1.1352.

Trading tips

Long positions can be opened above the level of 1.1596 with the targets at 1.1718, 1.1840 and stop loss around 1.1560.

Short positions can be opened be from 1.1535 with the targets at 1.1474, 1.1352 and stop loss around 1.1590.

Implementation period: 3–5 days.

Since the middle of last week, the pair has been growing and is now testing the level of 1.1596. USD is under pressure of the commentaries of President Trump, who yesterday in an interview with Reuters expressed dissatisfaction with the increase in US interest rates and said that he needs more help from Fed to restore the American economy.

Today the investors are focused on US-China trade negotiations and FOMC Minutes release. Two-day talks between China's Deputy Trade Minister Wang Shouwen and US Deputy Finance Minister David Malpass will be held in Washington. President Trump said that the Chinese authorities cannot offer the US an acceptable agreement. However, the meeting can become a basis for further discussion, culminating in the meeting between Donald Trump and Xi Jinping in November.

In the evening, FOMC Minutes will be published. The market is confident that the regulator will increase the rate twice this year, but the fate of the interest rate and Fed’s balance ($4.2 trillion) in the next year is not clear.

Support and resistance

The price is around 1.1596 (Murrey [7/8]), the breakout will let it grow to 1.1718 (Murrey [8/8]) and 1.1840 (Murrey [+1/8]). However, the beginning of the reversal of Stochastic in the overbought zone and the downward movement of Bollinger bands indicate a probability of the beginning of the decline to levels 1.1474 (Murrey [6/8]) and 1.1352 (Murrey [5/8]).

Resistance levels: 1.1596, 1.1718, 1.1840.

Support levels: 1.1474, 1.1352.

Trading tips

Long positions can be opened above the level of 1.1596 with the targets at 1.1718, 1.1840 and stop loss around 1.1560.

Short positions can be opened be from 1.1535 with the targets at 1.1474, 1.1352 and stop loss around 1.1590.

Implementation period: 3–5 days.

No comments:

Write comments