Ethereum: general review

23 August 2018, 11:50

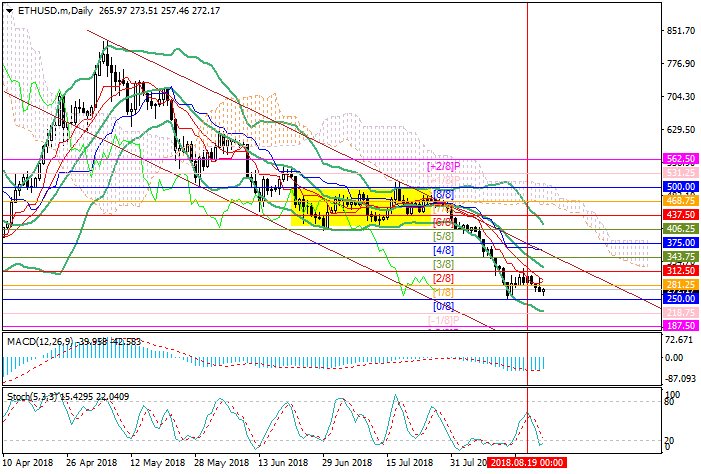

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 273.81 |

| Take Profit | 312.50, 343.75 |

| Stop Loss | 260.00 |

| Key Levels | 187.50, 218.75, 250.00, 312.50, 343.75, 375.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 247.00 |

| Take Profit | 218.75, 187.50 |

| Stop Loss | 280.00 |

| Key Levels | 187.50, 218.75, 250.00, 312.50, 343.75, 375.00 |

Current trend

Quotations of Ether fell to the lower border of the trading range to 250.00 due to the actions of the US Securities and Exchange Commission, which rejected bids for bitcoin-ETF from Direxion and GraniteShares, as well as NYSE Arca. The reason for the refusal was the insecurity of the asset and the high probability of manipulating it in the market. The regulator used the same arguments when banning the launch of ETF to other companies. The market reaction to the SEC decision was negative, but did not lead to a serious reduction in prices. Investors hope that the companies VanEck and SolidX, whose application was not rejected immediately and its consideration was postponed to September, still have the chance to get permission to create bitcoin-ETF.

Support and resistance

The level of 250.00 (Murrey [3/8]) is still seen as the key for the "bears". Its breakdown will give the prospect of growth to the level of 218.75 (Murrey [–1/8]) and 187.50 (Murrey [–2/8]). However, judging by the indicators, this will not happen. Stochastic is reversing in the oversold area, and MACD histogram is reducing in the negative zone. At present, the upward correction to the levels of 312.50 (Murrey [2/8], the center line of Bollinger Bands) and 343.75 (Murrey [3/8], the upper boundary of the descending channel) is more likely.

Resistance levels: 312.50, 343.75, 375.00.

Support levels: 250.00, 218.75, 187.50.

Trading tips

Long positions may be opened from the current level with targets at 312.50, 343.75 and stop loss at 260.00.

Short positions could be opened below 250.00 with targets at 218.75, 187.50 and stop loss at 280.00.

Implementation period: 3-5 days.

Quotations of Ether fell to the lower border of the trading range to 250.00 due to the actions of the US Securities and Exchange Commission, which rejected bids for bitcoin-ETF from Direxion and GraniteShares, as well as NYSE Arca. The reason for the refusal was the insecurity of the asset and the high probability of manipulating it in the market. The regulator used the same arguments when banning the launch of ETF to other companies. The market reaction to the SEC decision was negative, but did not lead to a serious reduction in prices. Investors hope that the companies VanEck and SolidX, whose application was not rejected immediately and its consideration was postponed to September, still have the chance to get permission to create bitcoin-ETF.

Support and resistance

The level of 250.00 (Murrey [3/8]) is still seen as the key for the "bears". Its breakdown will give the prospect of growth to the level of 218.75 (Murrey [–1/8]) and 187.50 (Murrey [–2/8]). However, judging by the indicators, this will not happen. Stochastic is reversing in the oversold area, and MACD histogram is reducing in the negative zone. At present, the upward correction to the levels of 312.50 (Murrey [2/8], the center line of Bollinger Bands) and 343.75 (Murrey [3/8], the upper boundary of the descending channel) is more likely.

Resistance levels: 312.50, 343.75, 375.00.

Support levels: 250.00, 218.75, 187.50.

Trading tips

Long positions may be opened from the current level with targets at 312.50, 343.75 and stop loss at 260.00.

Short positions could be opened below 250.00 with targets at 218.75, 187.50 and stop loss at 280.00.

Implementation period: 3-5 days.

No comments:

Write comments