Bitcoin: technical analysis

15 August 2018, 12:36

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 6500.00 |

| Take Profit | 6718.75, 6875.00 |

| Stop Loss | 6400.00 |

| Key Levels | 5937.50, 6093.75, 6250.00, 6471.25, 6718.75, 6875.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 6230.00 |

| Take Profit | 6093.75, 5937.50 |

| Stop Loss | 6300.00 |

| Key Levels | 5937.50, 6093.75, 6250.00, 6471.25, 6718.75, 6875.00 |

Current trend

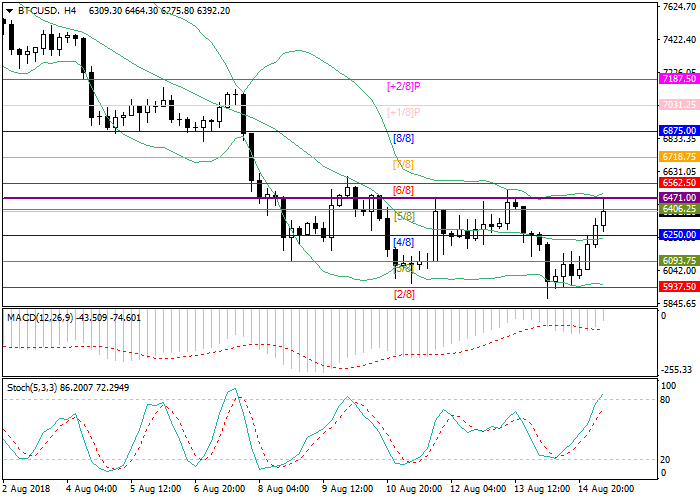

Quotes of Bitcoin are recovering after a decrease to the support level of 5937.50 (Murray [2/8]). The first serious resistance may be at the zone of 6471.00-6562.50, which was impassable for Bitcoin during almost a week.

In case of breakout of the level of 6562.50, the main goal for buyers in the short term will be the level of 6875.00 (Murray [8/8]). On the 4-hour chart, technical indicators show a moderate continuation of the current upward trend. MACD is shrinking in the negative zone and is going to move to the positive zone. The Bollinger bands show a small divergence, confirming the current trend. Stochastics lines are directed upwards.

Support and resistance

Support levels: 6250.00, 6093.75, 5937.50.

Resistance levels: 6471.25, 6718.75, 6875.00.

Trading tips

Long positions will become relevant above the level of 6471.00 with targets in the area of 6718.75 - 6875.00 and stop loss at 6400.00.

Short positions can be set below level 6250.00 with targets in the area of 6093.75 - 5937.50 and stop loss at the level of 6300.00.

Quotes of Bitcoin are recovering after a decrease to the support level of 5937.50 (Murray [2/8]). The first serious resistance may be at the zone of 6471.00-6562.50, which was impassable for Bitcoin during almost a week.

In case of breakout of the level of 6562.50, the main goal for buyers in the short term will be the level of 6875.00 (Murray [8/8]). On the 4-hour chart, technical indicators show a moderate continuation of the current upward trend. MACD is shrinking in the negative zone and is going to move to the positive zone. The Bollinger bands show a small divergence, confirming the current trend. Stochastics lines are directed upwards.

Support and resistance

Support levels: 6250.00, 6093.75, 5937.50.

Resistance levels: 6471.25, 6718.75, 6875.00.

Trading tips

Long positions will become relevant above the level of 6471.00 with targets in the area of 6718.75 - 6875.00 and stop loss at 6400.00.

Short positions can be set below level 6250.00 with targets in the area of 6093.75 - 5937.50 and stop loss at the level of 6300.00.

No comments:

Write comments