AUD/USD: towards new lows

13 August 2018, 15:00

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 0.7300, 0.7330, 0.7370 |

| Take Profit | 0.7150 |

| Stop Loss | 0.7420 |

| Key Levels | 0.7070, 0.7130, 0.7150, 0.7180, 0.7200, 0.7250, 0.7275, 0.7300, 0.7330, 0.7370, 0.7410, 0.7505, 0.7560, 0.7600 |

Current trend

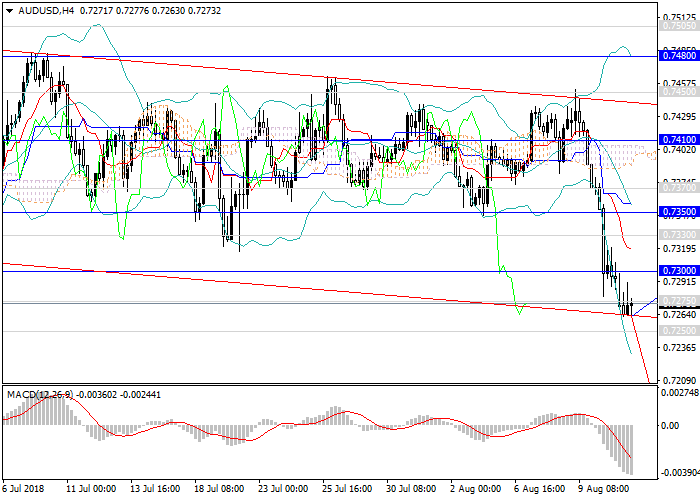

After the formation of narrowing consolidation, the pair dropped down significantly at the end of last trading week. The fundamental factor of the fall was the comments of RBA representatives on the positive effect on inflation from the weak Australian dollar. In addition, on Friday the US dollar received support after the release of data on US inflation.

Today the pair AUD/USD has reached the level of 0.7260. This week, we are waiting for statistics on retail sales, industrial production, the labor market and leading US indices. Australia will respond with data on the level of unemployment.

Support and resistance

After a strong fall, one should wait for a correction wave in the medium term, however, at higher timeframes, technical indicators confirm a downtrend: MACD indicates an increase in the volume of short positions; the Bollinger bands are directed downwards.

Support levels: 0.7275, 0.7250, 0.7200, 0.7180, 0.7150, 0.7130, 0.7070.

Resistance levels: 0.7300, 0.7330, 0.7370, 0.7410, 0.7505, 0.7560, 0.7600.

Trading tips

In this situation, short positions can be opened from key resistance levels of 0.7300, 0.7330, 0.7370 with the target of 0.7150 and a stop loss of 0.7420.

After the formation of narrowing consolidation, the pair dropped down significantly at the end of last trading week. The fundamental factor of the fall was the comments of RBA representatives on the positive effect on inflation from the weak Australian dollar. In addition, on Friday the US dollar received support after the release of data on US inflation.

Today the pair AUD/USD has reached the level of 0.7260. This week, we are waiting for statistics on retail sales, industrial production, the labor market and leading US indices. Australia will respond with data on the level of unemployment.

Support and resistance

After a strong fall, one should wait for a correction wave in the medium term, however, at higher timeframes, technical indicators confirm a downtrend: MACD indicates an increase in the volume of short positions; the Bollinger bands are directed downwards.

Support levels: 0.7275, 0.7250, 0.7200, 0.7180, 0.7150, 0.7130, 0.7070.

Resistance levels: 0.7300, 0.7330, 0.7370, 0.7410, 0.7505, 0.7560, 0.7600.

Trading tips

In this situation, short positions can be opened from key resistance levels of 0.7300, 0.7330, 0.7370 with the target of 0.7150 and a stop loss of 0.7420.

No comments:

Write comments