AUD/USD: Australian dollar is in correction

20 August 2018, 10:23

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7330 |

| Take Profit | 0.7390, 0.7413 |

| Stop Loss | 0.7290 |

| Key Levels | 0.7200, 0.7220, 0.7260, 0.7290, 0.7322, 0.7346, 0.7362, 0.7390, 0.7413 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7285 |

| Take Profit | 0.7220, 0.7200 |

| Stop Loss | 0.7330 |

| Key Levels | 0.7200, 0.7220, 0.7260, 0.7290, 0.7322, 0.7346, 0.7362, 0.7390, 0.7413 |

Current trend

On Friday, AUD grew moderately against USD, continuing the development of correctional dynamics, formed in the middle of last week, after the neutral speech of the head of the RBA.

On Friday, the Head of the Reserve Bank of Australia, Phillip Lowe, addressed the Economic Commission for the House of Representatives of the Australian Parliament, but said nothing new to the market. The official noted that the state of the economy continues to improve, and the labor market is approaching full employment and a target inflation rate. With the continuation of economic growth, an increase in the interest rate is likely, but it is necessary to achieve a stable increase in the incomes of the population. So far, there are no serious reasons for changing the monetary policy.

Support and resistance

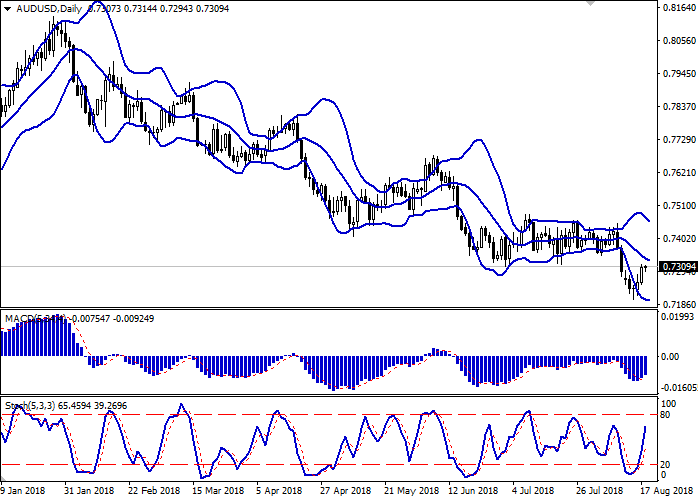

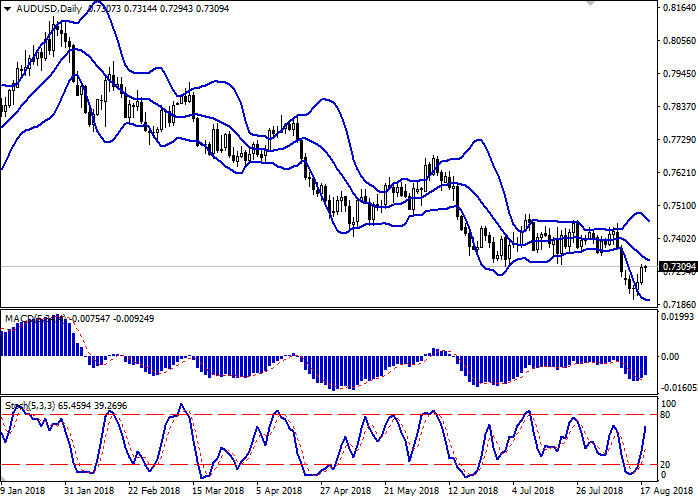

On the daily chart, Bollinger bands are moderately declining. The price range is narrowing, reflecting a change of trend in the short term. MACD indicator reversed upwards, forming a new buy signal (the histogram is above the signal line). Stochastic is growing but is approaching its highs, which indicates that AUD will become overbought in the nearest future.

The current indicators’ readings do not contradict the further growth.

Resistance levels: 0.7322, 0.7346, 0.7362, 0.7390, 0.7413.

Support levels: 0.7290, 0.7260, 0.7220, 0.7200.

Trading tips

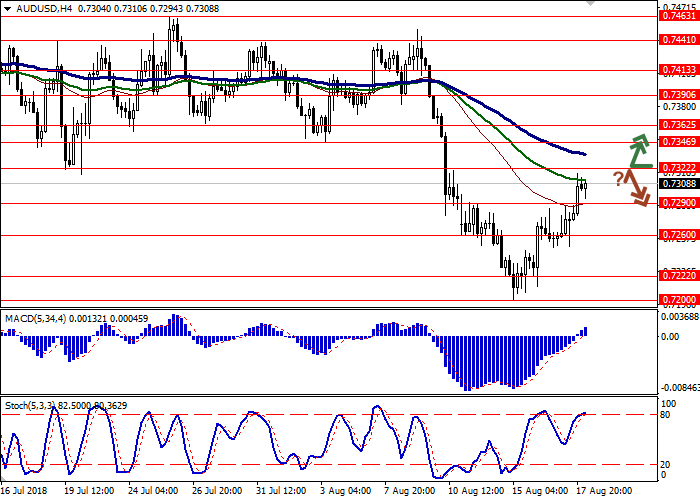

Long positions can be opened after the breakout of the level of 0.7322 with the target at 0.7390 or 0.7413. Stop loss is 0.7290.

Short positions can be opened after a rebound from the level of 0.7322 and breakdown of the level of 0.7290 with the targets at 0.7250 or 0.7220–0.7200. Stop loss is 0.7322–0.7330.

Implementation period: 2–3 days.

On Friday, AUD grew moderately against USD, continuing the development of correctional dynamics, formed in the middle of last week, after the neutral speech of the head of the RBA.

On Friday, the Head of the Reserve Bank of Australia, Phillip Lowe, addressed the Economic Commission for the House of Representatives of the Australian Parliament, but said nothing new to the market. The official noted that the state of the economy continues to improve, and the labor market is approaching full employment and a target inflation rate. With the continuation of economic growth, an increase in the interest rate is likely, but it is necessary to achieve a stable increase in the incomes of the population. So far, there are no serious reasons for changing the monetary policy.

Support and resistance

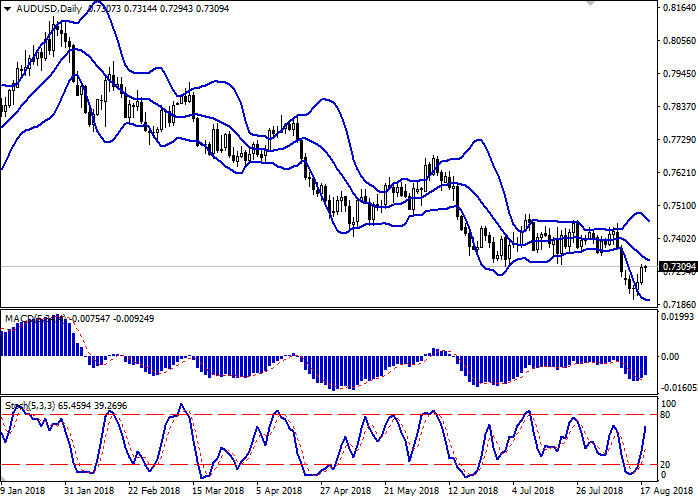

On the daily chart, Bollinger bands are moderately declining. The price range is narrowing, reflecting a change of trend in the short term. MACD indicator reversed upwards, forming a new buy signal (the histogram is above the signal line). Stochastic is growing but is approaching its highs, which indicates that AUD will become overbought in the nearest future.

The current indicators’ readings do not contradict the further growth.

Resistance levels: 0.7322, 0.7346, 0.7362, 0.7390, 0.7413.

Support levels: 0.7290, 0.7260, 0.7220, 0.7200.

Trading tips

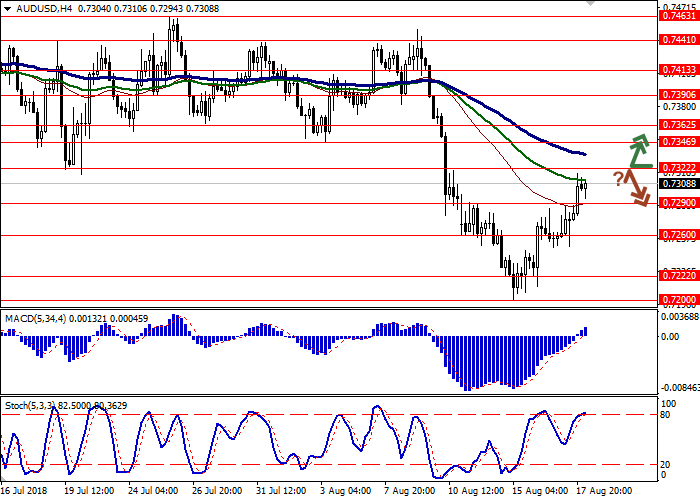

Long positions can be opened after the breakout of the level of 0.7322 with the target at 0.7390 or 0.7413. Stop loss is 0.7290.

Short positions can be opened after a rebound from the level of 0.7322 and breakdown of the level of 0.7290 with the targets at 0.7250 or 0.7220–0.7200. Stop loss is 0.7322–0.7330.

Implementation period: 2–3 days.

No comments:

Write comments