AUD/USD: Australian dollar is going down

10 August 2018, 10:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7380, 0.7385 |

| Take Profit | 0.7420, 0.7430 |

| Stop Loss | 0.7360, 0.7350 |

| Key Levels | 0.7309, 0.7322, 0.7346, 0.7362, 0.7390, 0.7413, 0.7441, 0.7463 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7355 |

| Take Profit | 0.7322, 0.7300 |

| Stop Loss | 0.7390 |

| Key Levels | 0.7309, 0.7322, 0.7346, 0.7362, 0.7390, 0.7413, 0.7441, 0.7463 |

Current trend

AUD showed a significant decline against USD on Thursday, departing from the updated local highs of July 26.

The investors are focused on the world trade problems. The Chinese authorities announced a reciprocal increase of import duties on American goods totaling USD 16B to 25%. Today in Washington, negotiations between the representatives of the US administration and the Japanese government should begin with the aim to equalize the balance in trade between the two countries.

Today, the pair is slightly decreasing, and investors are discussing the RBA's quarterly report on monetary policy, published yesterday. The regulator reiterated its commitment to a soft policy, noting that there are no reasons for raising rates in the short term yet.

Support and resistance

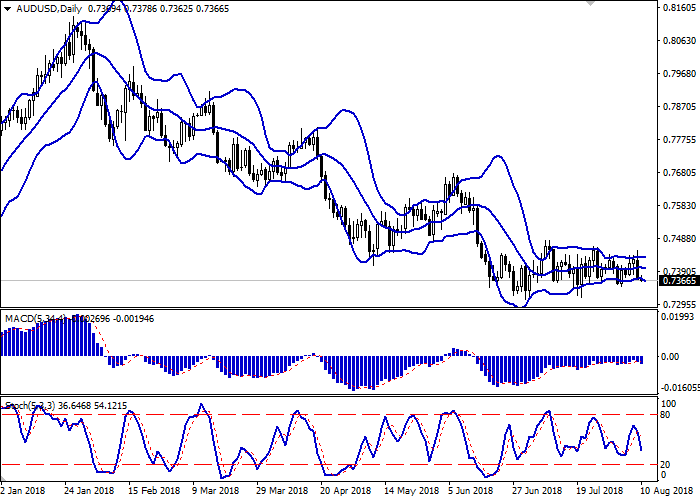

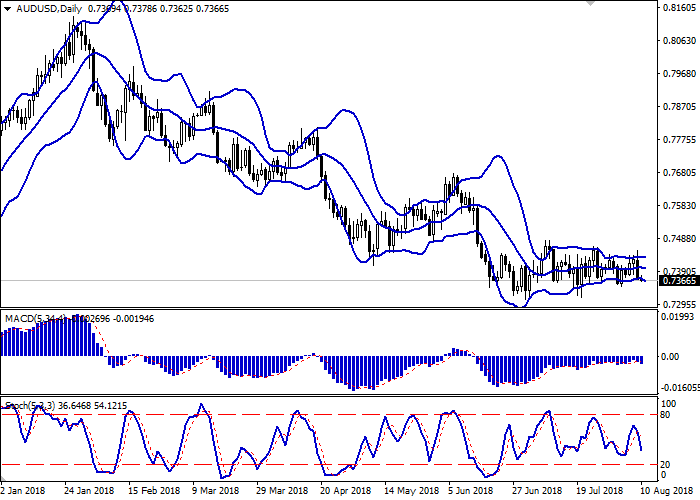

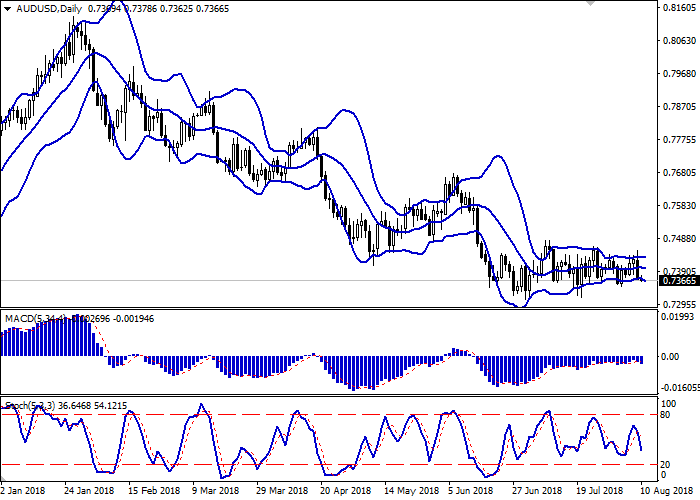

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is widening from below but does not conform to the development of the "bearish" trend in the ultra-short term yet. MACD reversed downwards having formed a new sell signal (located below the signal line). Stochastic is declining more steadily, but is rapidly approaching its minimum levels, which signals the risks associated with the oversold AUD.

The current showings of the indicators do not contradict the further development of the downtrend. However, at the end of the week, there is a possibility of corrective growth.

Resistance levels: 0.7390, 0.7413, 0.7441, 0.7463.

Support levels: 0.7362, 0.7346, 0.7322, 0.7309.

Trading tips

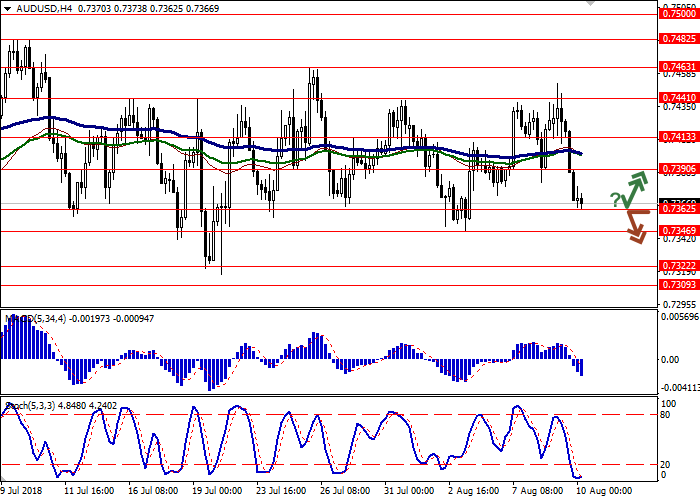

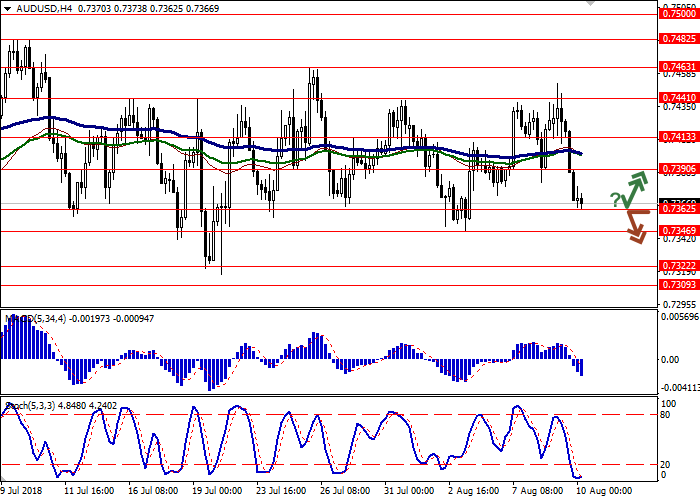

To open long positions, one can rely on the rebound from the support level of 0.7362 with the subsequent breakout of 0.7375 or 0.7380. Take profit — 0.7420 or 0.7430. Stop loss — 0.7360 or 0.7350.

A breakdown of 0.7362 may be a signal to further sales with target at 0.7322 or 0.7300. Stop loss — 0.7390.

Implementation period: 2-3 days.

AUD showed a significant decline against USD on Thursday, departing from the updated local highs of July 26.

The investors are focused on the world trade problems. The Chinese authorities announced a reciprocal increase of import duties on American goods totaling USD 16B to 25%. Today in Washington, negotiations between the representatives of the US administration and the Japanese government should begin with the aim to equalize the balance in trade between the two countries.

Today, the pair is slightly decreasing, and investors are discussing the RBA's quarterly report on monetary policy, published yesterday. The regulator reiterated its commitment to a soft policy, noting that there are no reasons for raising rates in the short term yet.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is widening from below but does not conform to the development of the "bearish" trend in the ultra-short term yet. MACD reversed downwards having formed a new sell signal (located below the signal line). Stochastic is declining more steadily, but is rapidly approaching its minimum levels, which signals the risks associated with the oversold AUD.

The current showings of the indicators do not contradict the further development of the downtrend. However, at the end of the week, there is a possibility of corrective growth.

Resistance levels: 0.7390, 0.7413, 0.7441, 0.7463.

Support levels: 0.7362, 0.7346, 0.7322, 0.7309.

Trading tips

To open long positions, one can rely on the rebound from the support level of 0.7362 with the subsequent breakout of 0.7375 or 0.7380. Take profit — 0.7420 or 0.7430. Stop loss — 0.7360 or 0.7350.

A breakdown of 0.7362 may be a signal to further sales with target at 0.7322 or 0.7300. Stop loss — 0.7390.

Implementation period: 2-3 days.

No comments:

Write comments