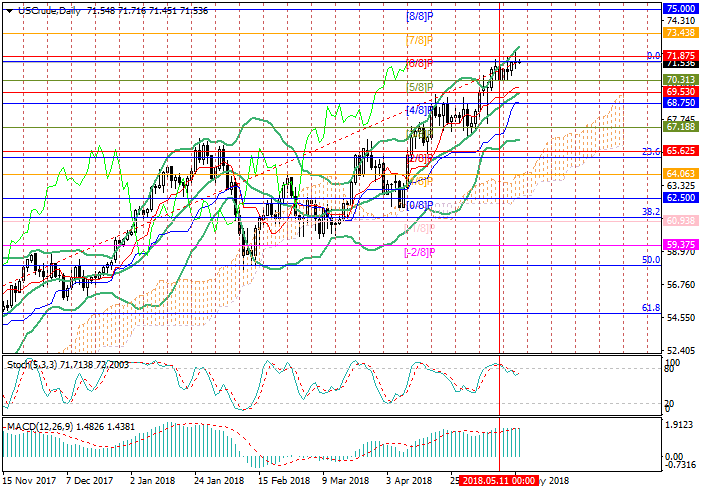

WTI Crude Oil: Murrey analysis

18 May 2018, 15:08

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 71.95 |

| Take Profit | 73.43, 75.00 |

| Stop Loss | 71.20 |

| Key Levels | 68.75, 69.53, 70.31, 71.87, 73.43, 75.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 71.05 |

| Take Profit | 70.31, 69.53 |

| Stop Loss | 71.50 |

| Key Levels | 68.75, 69.53, 70.31, 71.87, 73.43, 75.00 |

This week, the price of WTI Crude oil continued to grow and is now testing

the 71.87 mark ([6/8]). Its breakout will give the prospect of further growth to

the levels of 73.43 ([7/8]) and 75.00 ([8/8]). Technical indicators generally

confirm the development of an uptrend: Bollinger Bands are directed upwards, and

MACD histogram grows in the positive zone; Stochastic is directed downwards, but

it makes a reversal attempt.

In the price fails to consolidate above 71.87, correction to the mid-range of Bollinger Bands (69.53) or to the mid-range of the Murray trade range (68.75 [4/8]) is possible. But so far this scenario seems less probable.

Support and resistance

Support levels: 70.31 ([5/8]), 69.53 ([1/8], H4), 68.75 ([4/8]).

Resistance levels: 71.87 ([6/8]), 73.43 ([7/8]), 75.00 ([8/8]).

Trading tips

Long positions may be opened above the 71.87 mark with targets at 73.43, 75.00 and the stop-loss at 71.20.

Short positions may be opened from the level of 71.00 with targets at 70.31, 69.53 and the stop-loss at 71.50.

Implementation time: 5-7 days.

In the price fails to consolidate above 71.87, correction to the mid-range of Bollinger Bands (69.53) or to the mid-range of the Murray trade range (68.75 [4/8]) is possible. But so far this scenario seems less probable.

Support and resistance

Support levels: 70.31 ([5/8]), 69.53 ([1/8], H4), 68.75 ([4/8]).

Resistance levels: 71.87 ([6/8]), 73.43 ([7/8]), 75.00 ([8/8]).

Trading tips

Long positions may be opened above the 71.87 mark with targets at 73.43, 75.00 and the stop-loss at 71.20.

Short positions may be opened from the level of 71.00 with targets at 70.31, 69.53 and the stop-loss at 71.50.

Implementation time: 5-7 days.

No comments:

Write comments