USD/JPY: uptrend is getting stronger

18 May 2018, 13:50

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 111.00 |

| Take Profit | 112.00, 112.40, 114.50, 115.50 |

| Stop Loss | 108.40 |

| Key Levels | 107.30, 107.75, 108.15, 108.45, 109.00, 109.55, 109.85, 110.50, 111.00, 111.50, 111.75, 112.00, 112.40, 112.85, 113.25, 113.70 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 110.50, 109.85 |

| Take Profit | 112.00, 112.40, 114.50, 115.50 |

| Stop Loss | 108.40 |

| Key Levels | 107.30, 107.75, 108.15, 108.45, 109.00, 109.55, 109.85, 110.50, 111.00, 111.50, 111.75, 112.00, 112.40, 112.85, 113.25, 113.70 |

Current trend

The US dollar against the Japanese yen continues to grow due to the favorable fundamental statistics in the key sectors of the US economy. Additional support for the US currency was provided by comments from representatives of the US Federal Reserve on the continuation of the tightening of monetary policy and raising the key interest rate.

Strong data on major indices, the construction sector and industrial production of the United States came out this week. Since the beginning of the trading week the pair has gained more than 130 points and reached the level of 111.00.

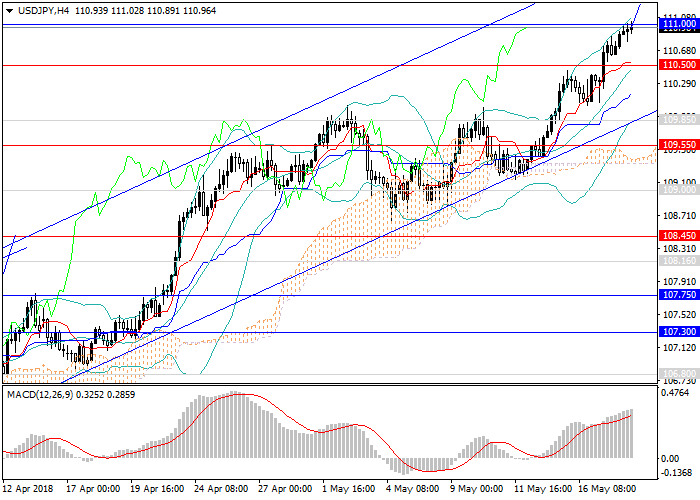

Support and resistance

Over the past few trading weeks, the pair broke through a number of strong resistance levels and will continue to strengthen in the medium term to local highs, reached in July and October last year (114.50 and 115.50). Technical indicators confirm the growth forecast: MACD indicates a high volume of long positions, the Bollinger bands are directed upwards.

Support levels: 110.50, 109.85, 109.55, 109.00, 108.45, 108.15, 107.75, 107.30.

Resistance levels: 111.00, 111.50, 111.75, 112.00, 112.40, 112.85, 113.25, 113.70, 114.50, 115.50.

Trading tips

In this situation, long positions can be opened at current level and pending buy orders can be placed at the levels of 110.50, 109.85 with targets of 112.00, 112.40, 114.50, 115.50 and stop loss at 108.40.

The US dollar against the Japanese yen continues to grow due to the favorable fundamental statistics in the key sectors of the US economy. Additional support for the US currency was provided by comments from representatives of the US Federal Reserve on the continuation of the tightening of monetary policy and raising the key interest rate.

Strong data on major indices, the construction sector and industrial production of the United States came out this week. Since the beginning of the trading week the pair has gained more than 130 points and reached the level of 111.00.

Support and resistance

Over the past few trading weeks, the pair broke through a number of strong resistance levels and will continue to strengthen in the medium term to local highs, reached in July and October last year (114.50 and 115.50). Technical indicators confirm the growth forecast: MACD indicates a high volume of long positions, the Bollinger bands are directed upwards.

Support levels: 110.50, 109.85, 109.55, 109.00, 108.45, 108.15, 107.75, 107.30.

Resistance levels: 111.00, 111.50, 111.75, 112.00, 112.40, 112.85, 113.25, 113.70, 114.50, 115.50.

Trading tips

In this situation, long positions can be opened at current level and pending buy orders can be placed at the levels of 110.50, 109.85 with targets of 112.00, 112.40, 114.50, 115.50 and stop loss at 108.40.

No comments:

Write comments