USD/JPY: The dollar is strengthening

22 May 2018, 09:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 111.45 |

| Take Profit | 112.00, 112.30 |

| Stop Loss | 110.90, 110.70 |

| Key Levels | 109.76, 110.00, 110.43, 110.70, 111.00, 111.38, 111.85, 112.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 110.65 |

| Take Profit | 110.00, 109.70, 109.50 |

| Stop Loss | 111.20 |

| Key Levels | 109.76, 110.00, 110.43, 110.70, 111.00, 111.38, 111.85, 112.30 |

Current trend

Yesterday, the US dollar grew moderately against the Japanese yen, renewing the local maximum since January 23. Monday Japanese statistic did not support the price. 7.8% in April against the forecasted growth of 8.1% (the previous value was 2.1%). The overall trade balance was better than expected and reached 626.0 billion yen in April against the expected level of 405.6 billion yen (the previous value was 797.0 billion yen).

The dollar was slightly supported by the improvement of short-term prospects in the trade dispute between the US and China. However, experts note that long-term prospects are still negative, and the risks of a large-scale trade war are still present.

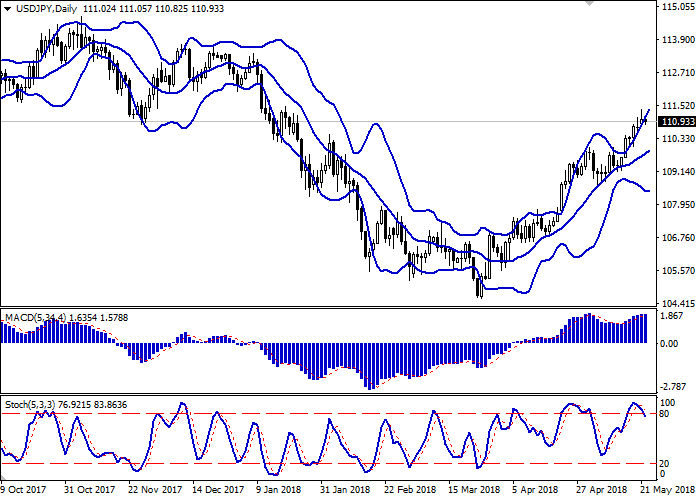

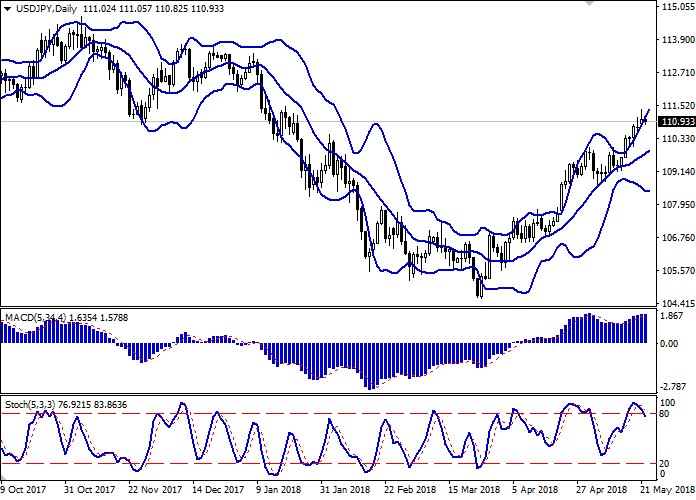

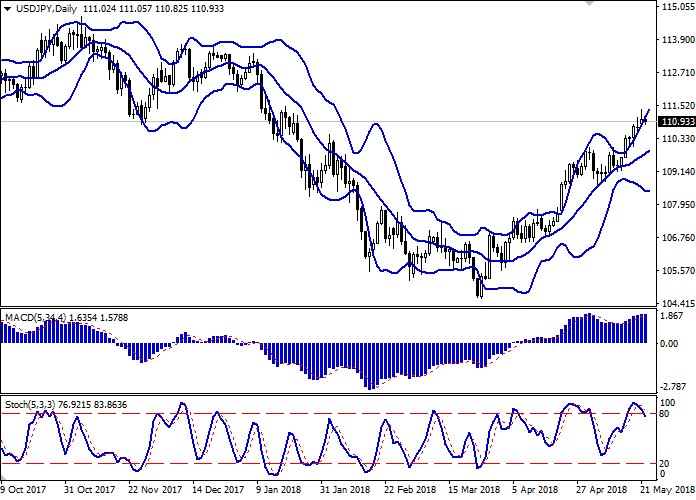

Support and resistance

On the daily chart, Bollinger bands are actively growing. The price range expands from above, letting the "bulls" renew local highs. MACD smoothly turns downwards, keeping the buy signal (the histogram is above the signal line). Stochastic has reversed downwards, rebounded from its highs. The indicator’s readings reflect that USD is overbought in the short term.

To open new short positions, it is better to wait for a sell signal for from MACD.

Resistance levels: 111.00, 111.38, 111.85, 112.30.

Support levels: 110.70, 110.43, 110.00, 109.76.

Trading Tips

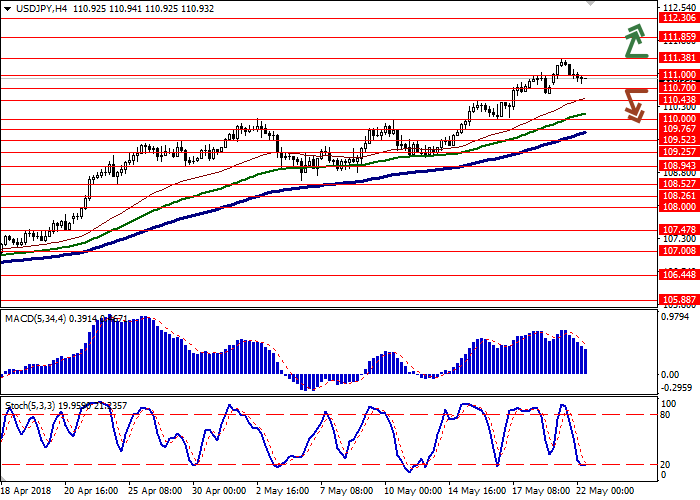

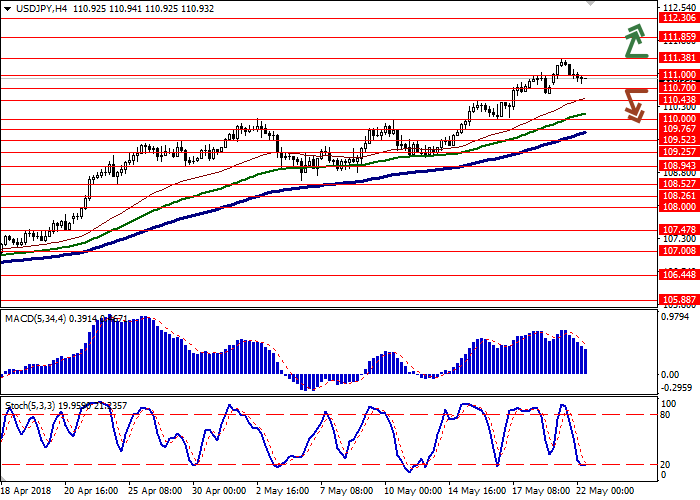

Long positions can be opened after the breakout of the level of 111.38 with the targets at 112.00–112.30 and stop loss 110.90–110.70.

Short positions can be opened after the breakdown of the level of 110.70 with targets of 110.00 or 109.70–109.50 and stop loss 111.20.

Implementation period: 2–3 days.

Yesterday, the US dollar grew moderately against the Japanese yen, renewing the local maximum since January 23. Monday Japanese statistic did not support the price. 7.8% in April against the forecasted growth of 8.1% (the previous value was 2.1%). The overall trade balance was better than expected and reached 626.0 billion yen in April against the expected level of 405.6 billion yen (the previous value was 797.0 billion yen).

The dollar was slightly supported by the improvement of short-term prospects in the trade dispute between the US and China. However, experts note that long-term prospects are still negative, and the risks of a large-scale trade war are still present.

Support and resistance

On the daily chart, Bollinger bands are actively growing. The price range expands from above, letting the "bulls" renew local highs. MACD smoothly turns downwards, keeping the buy signal (the histogram is above the signal line). Stochastic has reversed downwards, rebounded from its highs. The indicator’s readings reflect that USD is overbought in the short term.

To open new short positions, it is better to wait for a sell signal for from MACD.

Resistance levels: 111.00, 111.38, 111.85, 112.30.

Support levels: 110.70, 110.43, 110.00, 109.76.

Trading Tips

Long positions can be opened after the breakout of the level of 111.38 with the targets at 112.00–112.30 and stop loss 110.90–110.70.

Short positions can be opened after the breakdown of the level of 110.70 with targets of 110.00 or 109.70–109.50 and stop loss 111.20.

Implementation period: 2–3 days.

No comments:

Write comments