GBP/USD: the pound is declining

22 May 2018, 09:46

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3455 |

| Take Profit | 1.3600, 1.3650 |

| Stop Loss | 1.3390 |

| Key Levels | 1.3300, 1.3350, 1.3400, 1.3448, 1.3535, 1.3600, 1.3650 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3390 |

| Take Profit | 1.3300 |

| Stop Loss | 1.3450 |

| Key Levels | 1.3300, 1.3350, 1.3400, 1.3448, 1.3535, 1.3600, 1.3650 |

Current trend

GBP dropped against USD on Monday, updating the local lows of last year. Yesterday, the instrument managed to rise, but today GBP is declining again.

As there is lack of significant releases, GBP is moving due to speculative reasons. Investors are waiting for important statistics that will determine the state of the British economy. On Wednesday, April Inflation data will be published. CPI is expected to decline and reach 2.3%, corresponding with BoE forecasts, which expects stabilization around 2.0% in the next two years. The implementation of the forecast may delay the regulator's decision to raise the interest rate but will increase the purchasing power of British households. Other indicators are also expected to be positive. Retail sales in February promise to increase from 1.1% to 1.4% and GDP – from 1.2% to 1.3%. However, economic statistics can be balanced by the progress of Brexit negotiations.

Support and resistance

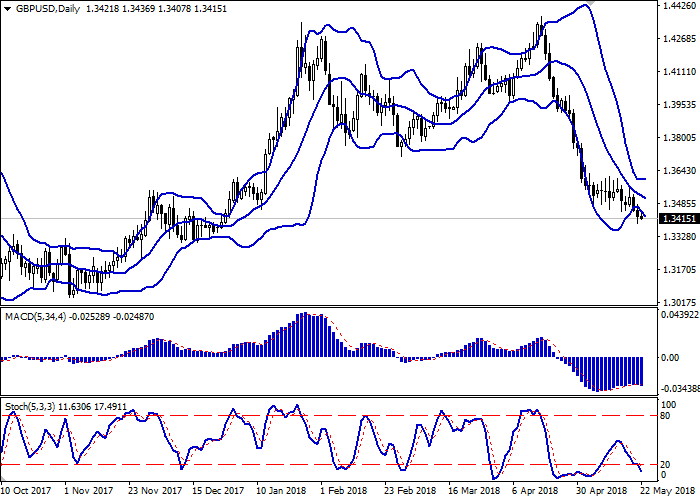

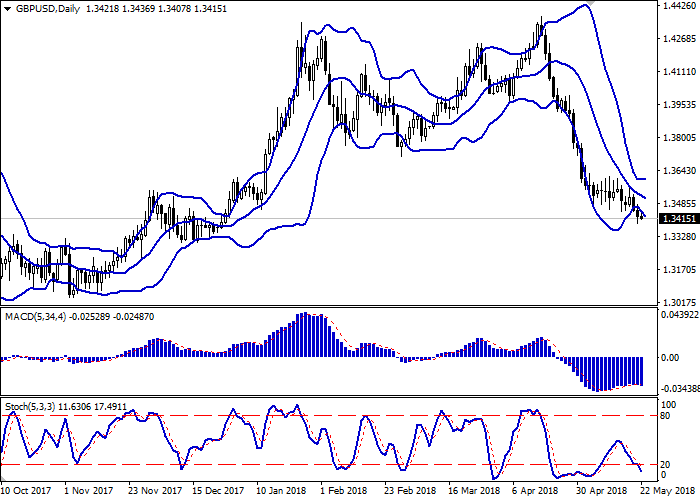

Bollinger Bands in D1 chart decrease. The price range is widening but does not conform to the development of the "bearish" trend. MACD indicator tries to reverse downwards and to form a sell signal (it has to consolidate below the signal line). Stochastic points downwards but is approaching its minimum marks, which indicates the oversold pound in the short term.

Short positions should be left open in the short term until the situation is clear.

Resistance levels: 1.3448, 1.3535, 1.3600, 1.3650.

Support levels: 1.3400, 1.3350, 1.3300.

Trading tips

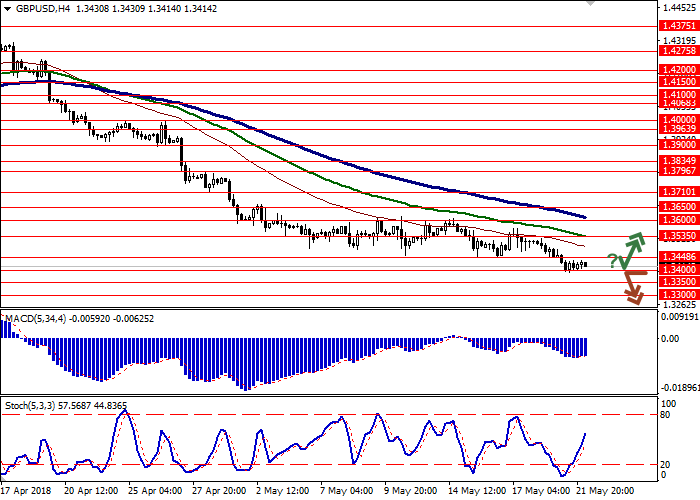

To open long positions, one can rely on the rebound from the support level of 1.3400, with the subsequent breakout of the 1.3448 mark. Take-profit – 1.3600–1.3650. Stop-loss — 1.3390. Implementation period: 2-3 days.

The breakdown of the level of 1.3400 may serve as a signal for new sales with the target at 1.3300. Stop-loss — 1.3450. Implementation period: 1-2 days.

GBP dropped against USD on Monday, updating the local lows of last year. Yesterday, the instrument managed to rise, but today GBP is declining again.

As there is lack of significant releases, GBP is moving due to speculative reasons. Investors are waiting for important statistics that will determine the state of the British economy. On Wednesday, April Inflation data will be published. CPI is expected to decline and reach 2.3%, corresponding with BoE forecasts, which expects stabilization around 2.0% in the next two years. The implementation of the forecast may delay the regulator's decision to raise the interest rate but will increase the purchasing power of British households. Other indicators are also expected to be positive. Retail sales in February promise to increase from 1.1% to 1.4% and GDP – from 1.2% to 1.3%. However, economic statistics can be balanced by the progress of Brexit negotiations.

Support and resistance

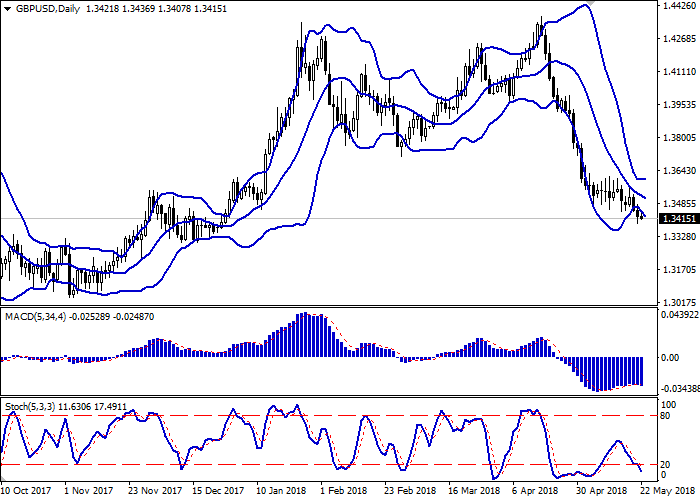

Bollinger Bands in D1 chart decrease. The price range is widening but does not conform to the development of the "bearish" trend. MACD indicator tries to reverse downwards and to form a sell signal (it has to consolidate below the signal line). Stochastic points downwards but is approaching its minimum marks, which indicates the oversold pound in the short term.

Short positions should be left open in the short term until the situation is clear.

Resistance levels: 1.3448, 1.3535, 1.3600, 1.3650.

Support levels: 1.3400, 1.3350, 1.3300.

Trading tips

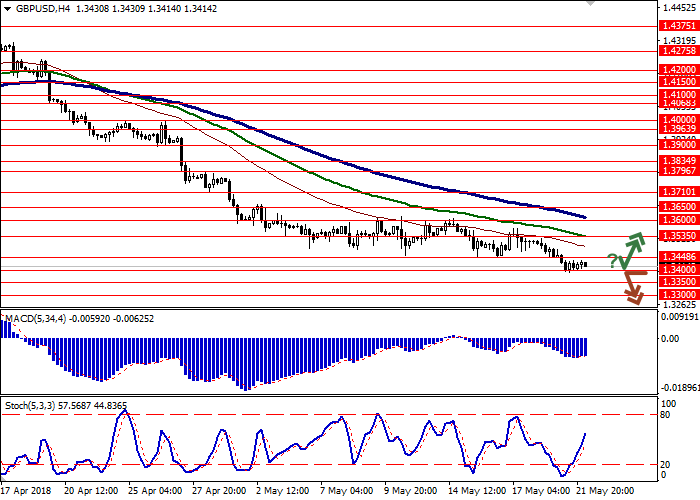

To open long positions, one can rely on the rebound from the support level of 1.3400, with the subsequent breakout of the 1.3448 mark. Take-profit – 1.3600–1.3650. Stop-loss — 1.3390. Implementation period: 2-3 days.

The breakdown of the level of 1.3400 may serve as a signal for new sales with the target at 1.3300. Stop-loss — 1.3450. Implementation period: 1-2 days.

No comments:

Write comments