USD/JPY: the dollar is growing again

09 May 2018, 10:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 109.60 |

| Take Profit | 110.00 |

| Stop Loss | 109.20 |

| Key Levels | 108.26, 108.52, 108.94, 109.25, 109.52, 109.76, 110.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 109.20 |

| Take Profit | 108.94, 108.52 |

| Stop Loss | 109.60 |

| Key Levels | 108.26, 108.52, 108.94, 109.25, 109.52, 109.76, 110.00 |

Current trend

Yesterday USD was trading in different directions against JPY, but today, during the Asian session, is strengthening actively, despite the increase in earnings in Japan in March.

The growth is due to the increase in US bonds’ yield and the great growth in the oil market after US President Donald Trump announced the exit of international nuclear agreement with Iran. Besides, the investors fear the development of the political crisis in Italy, which also supports USD.

Tomorrow, the traders are focused on a large block of news from Japan: BOJ Summary of Opinions release, March foreign trade data, and April Bank Lending publications.

Support and resistance

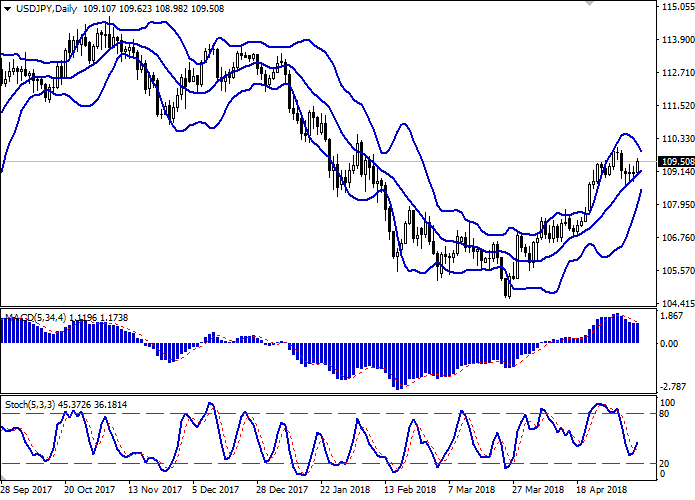

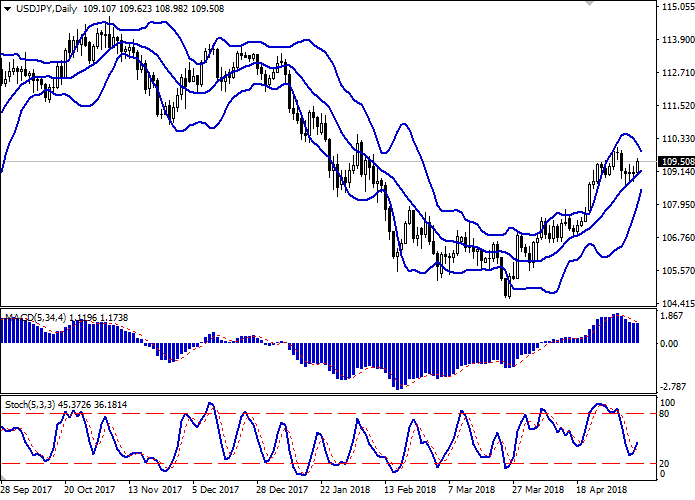

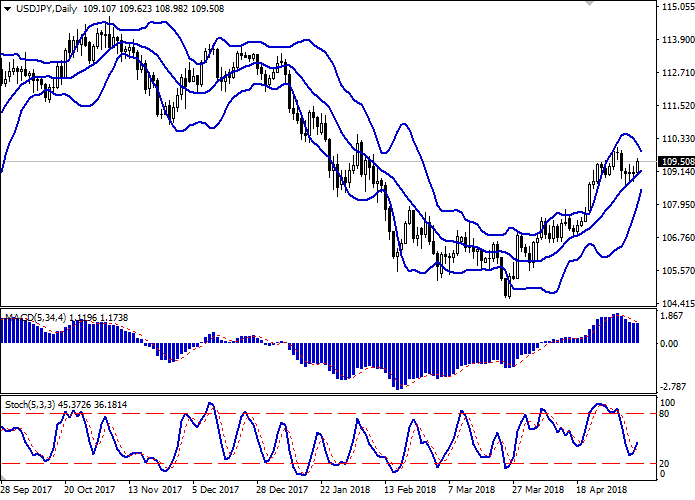

On the daily chart, Bollinger Bands are strongly growing. The price range is actively narrowing, reflecting the appearance of the mixed dynamic in the short term.

MACD is trying to reverse upwards and form a new buy signal (the histogram should be above the signal line).

Stochastic has reversed upwards, have not reached the level of 20, which is the former border of the oversold area.

It is better to wait until the “bullish” signal to open correctional positions in the short or very short term is formed.

Resistance levels: 109.52, 109.76, 110.00.

Support levels: 109.25, 108.94, 108.52, 108.26.

Trading tips

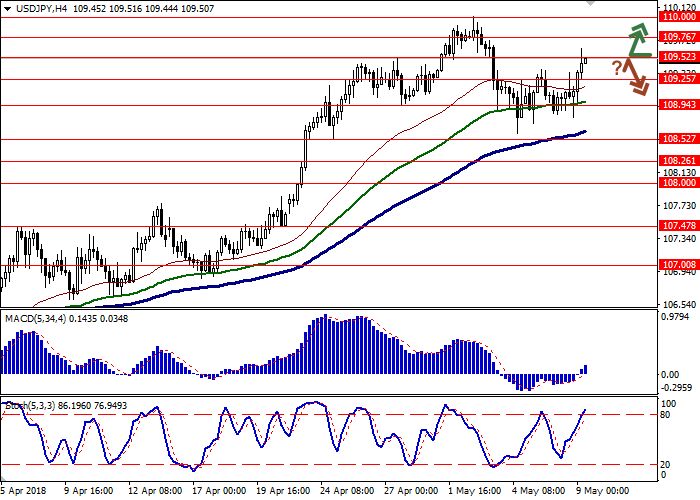

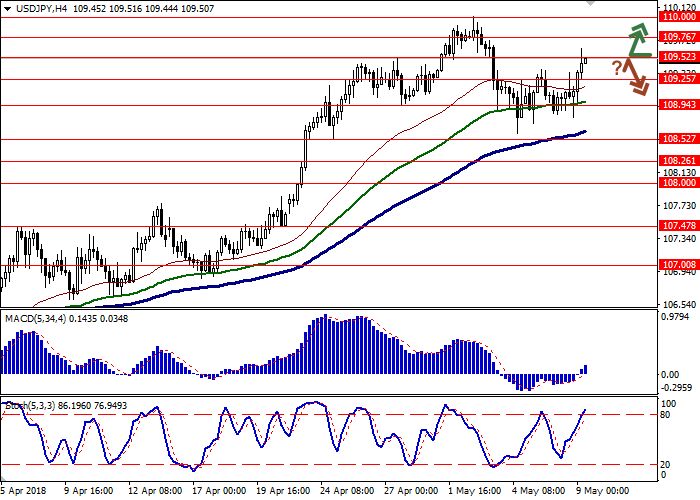

Long positions can be opened after the breakout of the level 109.52 with the target at 110.00 and stop loss 109.20. Implementation period: 1–2 days.

Short positions can be opened after the rebound at the level of 109.52 and the breakout of the level 109.25 with the target at 108.94 or 108.52 and stop loss 109.60. Implementation period: 2–3 days.

Yesterday USD was trading in different directions against JPY, but today, during the Asian session, is strengthening actively, despite the increase in earnings in Japan in March.

The growth is due to the increase in US bonds’ yield and the great growth in the oil market after US President Donald Trump announced the exit of international nuclear agreement with Iran. Besides, the investors fear the development of the political crisis in Italy, which also supports USD.

Tomorrow, the traders are focused on a large block of news from Japan: BOJ Summary of Opinions release, March foreign trade data, and April Bank Lending publications.

Support and resistance

On the daily chart, Bollinger Bands are strongly growing. The price range is actively narrowing, reflecting the appearance of the mixed dynamic in the short term.

MACD is trying to reverse upwards and form a new buy signal (the histogram should be above the signal line).

Stochastic has reversed upwards, have not reached the level of 20, which is the former border of the oversold area.

It is better to wait until the “bullish” signal to open correctional positions in the short or very short term is formed.

Resistance levels: 109.52, 109.76, 110.00.

Support levels: 109.25, 108.94, 108.52, 108.26.

Trading tips

Long positions can be opened after the breakout of the level 109.52 with the target at 110.00 and stop loss 109.20. Implementation period: 1–2 days.

Short positions can be opened after the rebound at the level of 109.52 and the breakout of the level 109.25 with the target at 108.94 or 108.52 and stop loss 109.60. Implementation period: 2–3 days.

No comments:

Write comments