USD/CHF: USD remains under pressure

23 May 2018, 09:58

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9945, 0.9970 |

| Take Profit | 1.0000, 1.0020, 1.0040 |

| Stop Loss | 0.9922, 0.9900 |

| Key Levels | 0.9800, 0.9825, 0.9850, 0.9894, 0.9940, 0.9967, 1.0000, 1.0020 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9890 |

| Take Profit | 0.9850, 0.9825, 0.9800 |

| Stop Loss | 0.9930, 0.9940 |

| Key Levels | 0.9800, 0.9825, 0.9850, 0.9894, 0.9940, 0.9967, 1.0000, 1.0020 |

Current trend

USD declined against CHF on Tuesday, updating the local minimum of the beginning of the month. The development of the US-China trade relations keeps putting pressure on USD.

Despite certain optimistic data, the overall situation remains tense, and the continuing uncertainty forces investors to look for alternatives. In addition, traders are concerned about the possible breakdown of the meeting between Donald Trump and North Korean leader Kim Jong-un.

On Wednesday, investors will focus on EU and German PMI releases. The indicators are expected to fall slightly or stay at the same levels. German Markit Services PMI is expected to reach 53.0 points; EU Markit Services PMI can fall from 54.7 to 54.6 points.

Support and resistance

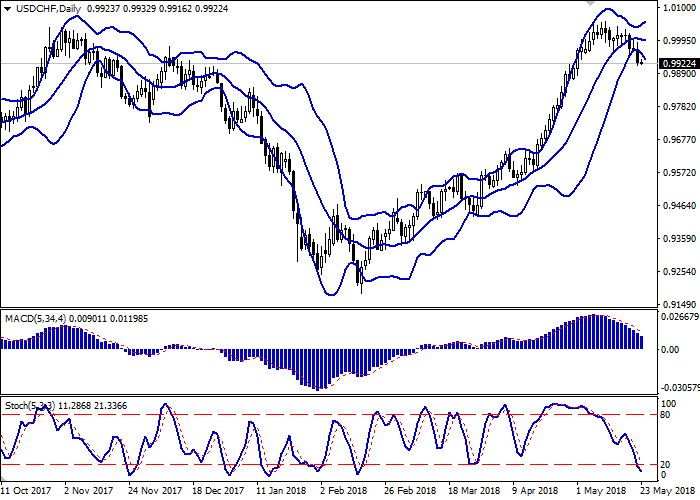

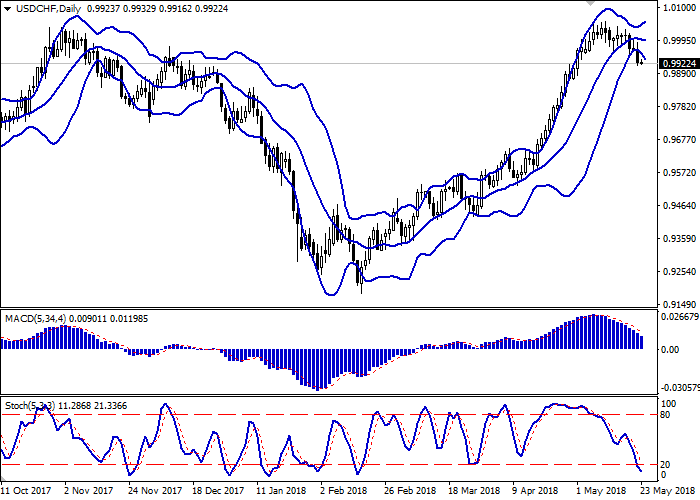

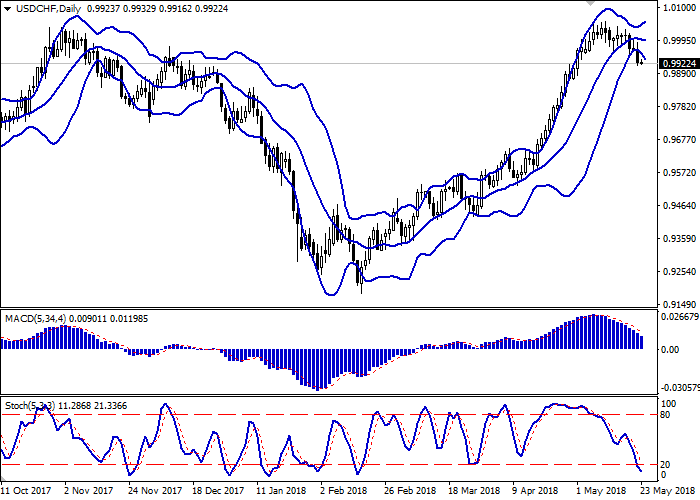

In the D1 chart, the Bollinger Bands are gradually reversing horizontally. The price range is expanding but does not conform to the development of the "bearish" trend yet.

MACD is declining preserving a stable sell signal (being located below the signal line).

Stochastic shows similar dynamics but is approaching its minimum marks, which indicates the oversold dollar in the short or ultra-short term.

Some of the existing short positions should be left open until the situation is clear. One should take into account the risks of a corrective growth in the ultra-short term.

Resistance levels: 0.9940, 0.9967, 1.0000, 1.0020.

Support levels: 0.9894, 0.9850, 0.9825, 0.9800.

Trading tips

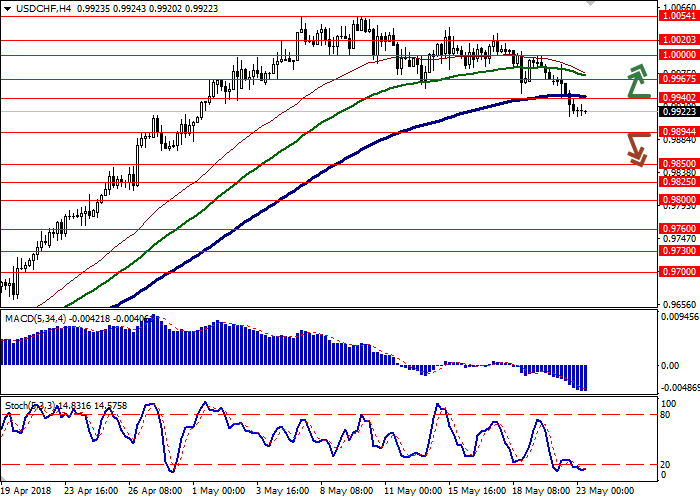

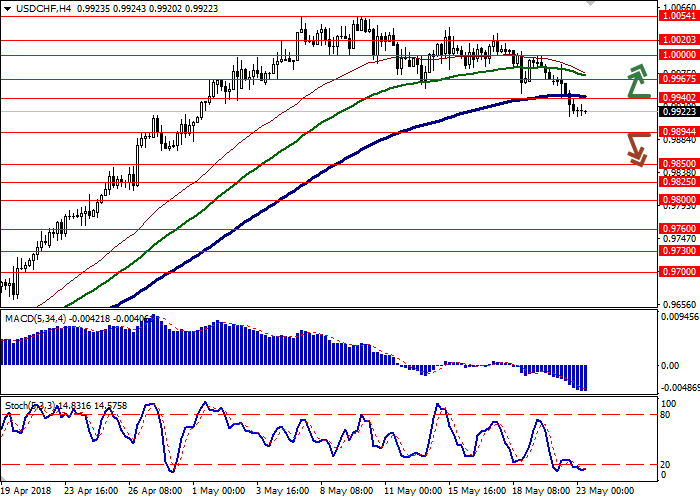

To open long positions one can rely on the breakout of the levels of 0.9940–0.9967, if the "bullish" signals from technical indicators appear. Take-profit — 1.0000 or 1.0020, 1.0040. Stop-loss — 0.9922 or 0.9900.

The development of "bearish" dynamics with the breakdown of the level of 0.9894 may become a signal for further sales with targets at 0.9850 or 0.9825, 0.9800. Stop-loss — 0.9930 or 0.9940.

Implementation period: 2-3 days.

USD declined against CHF on Tuesday, updating the local minimum of the beginning of the month. The development of the US-China trade relations keeps putting pressure on USD.

Despite certain optimistic data, the overall situation remains tense, and the continuing uncertainty forces investors to look for alternatives. In addition, traders are concerned about the possible breakdown of the meeting between Donald Trump and North Korean leader Kim Jong-un.

On Wednesday, investors will focus on EU and German PMI releases. The indicators are expected to fall slightly or stay at the same levels. German Markit Services PMI is expected to reach 53.0 points; EU Markit Services PMI can fall from 54.7 to 54.6 points.

Support and resistance

In the D1 chart, the Bollinger Bands are gradually reversing horizontally. The price range is expanding but does not conform to the development of the "bearish" trend yet.

MACD is declining preserving a stable sell signal (being located below the signal line).

Stochastic shows similar dynamics but is approaching its minimum marks, which indicates the oversold dollar in the short or ultra-short term.

Some of the existing short positions should be left open until the situation is clear. One should take into account the risks of a corrective growth in the ultra-short term.

Resistance levels: 0.9940, 0.9967, 1.0000, 1.0020.

Support levels: 0.9894, 0.9850, 0.9825, 0.9800.

Trading tips

To open long positions one can rely on the breakout of the levels of 0.9940–0.9967, if the "bullish" signals from technical indicators appear. Take-profit — 1.0000 or 1.0020, 1.0040. Stop-loss — 0.9922 or 0.9900.

The development of "bearish" dynamics with the breakdown of the level of 0.9894 may become a signal for further sales with targets at 0.9850 or 0.9825, 0.9800. Stop-loss — 0.9930 or 0.9940.

Implementation period: 2-3 days.

No comments:

Write comments