United Technologies Corp. (UTX/NYSE): general review

29 May 2018, 11:43

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 129.10 |

| Take Profit | 131.00, 133.00, 134.00 |

| Stop Loss | 127.00 |

| Key Levels | 120.00, 122.50, 125.50, 129.00, 134.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 125.40 |

| Take Profit | 122.00, 120.00 |

| Stop Loss | 127.50 |

| Key Levels | 120.00, 122.50, 125.50, 129.00, 134.00 |

Current trend

United Technologies Corp. announced plans to invest more than USD 15 billion in the next 5 years in research and development, as well as in expanding the capacity in the US. The company also plans to hire 35K people in this period and spend about USD 75 billion on purchases from suppliers in the United States. The announcement was made in the period of pressure from a number of shareholders who believe that the division of the company into three enterprises will increase the cost of business by USD 20 billion.

In the previous week the stock of United Technologies Corp. grew by 1.47%. S&P 500 index went down by 0.20% during the same period.

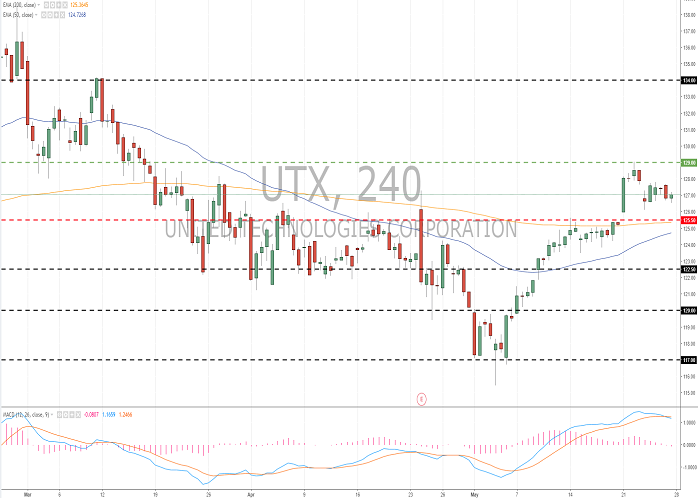

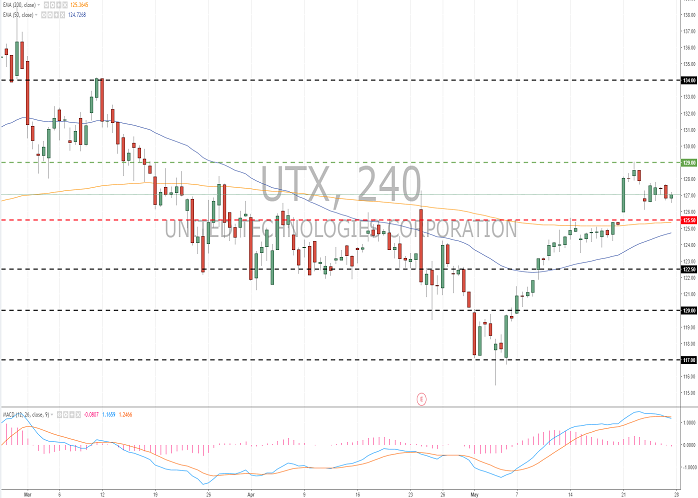

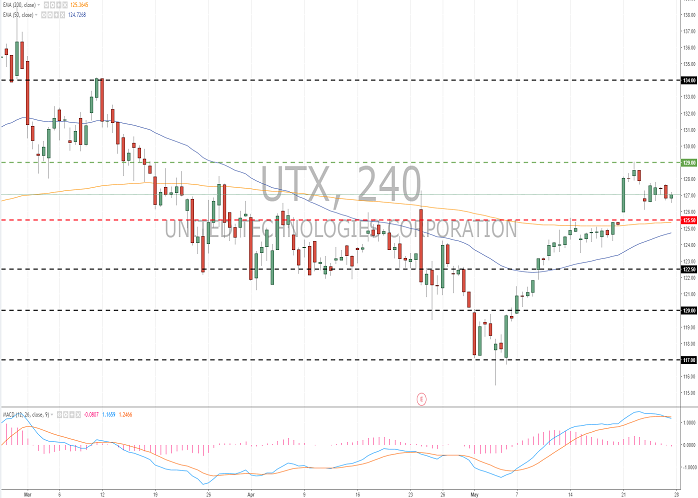

Support and resistance

#UTX has been dominated by aggressive sales since the beginning of the month. At the moment, the company's shares are consolidating. The instrument has the potential to further growth. Indicators don't give a clear signal: the price consolidated above 50(MA) and 200(MA), and MACD histogram is close to zero zone. Positions are to be opened from key levels.

Comparing company's multiplier with its competitors, we can say that #UTX shares are undervalued.

Support levels: 125.50, 122.50, 120.00.

Resistance levels: 129.00, 134.00.

Trading tips

If the price consolidates above the resistance level of 129.00, one should expect the company's shares to grow. Potential profits should be locked in by orders at 131.00, 133.00 and 134.00. Stop-loss will be placed at 127.00.

If the price consolidates below the "mirror" support level of 125.50, one should consider selling #UTX. The moving potential is aimed at 122.00–120.00. Stop-loss should be placed at 127.50.

Implementation period: 3 days.

United Technologies Corp. announced plans to invest more than USD 15 billion in the next 5 years in research and development, as well as in expanding the capacity in the US. The company also plans to hire 35K people in this period and spend about USD 75 billion on purchases from suppliers in the United States. The announcement was made in the period of pressure from a number of shareholders who believe that the division of the company into three enterprises will increase the cost of business by USD 20 billion.

In the previous week the stock of United Technologies Corp. grew by 1.47%. S&P 500 index went down by 0.20% during the same period.

Support and resistance

#UTX has been dominated by aggressive sales since the beginning of the month. At the moment, the company's shares are consolidating. The instrument has the potential to further growth. Indicators don't give a clear signal: the price consolidated above 50(MA) and 200(MA), and MACD histogram is close to zero zone. Positions are to be opened from key levels.

Comparing company's multiplier with its competitors, we can say that #UTX shares are undervalued.

Support levels: 125.50, 122.50, 120.00.

Resistance levels: 129.00, 134.00.

Trading tips

If the price consolidates above the resistance level of 129.00, one should expect the company's shares to grow. Potential profits should be locked in by orders at 131.00, 133.00 and 134.00. Stop-loss will be placed at 127.00.

If the price consolidates below the "mirror" support level of 125.50, one should consider selling #UTX. The moving potential is aimed at 122.00–120.00. Stop-loss should be placed at 127.50.

Implementation period: 3 days.

No comments:

Write comments