SPX: general review

29 May 2018, 13:46

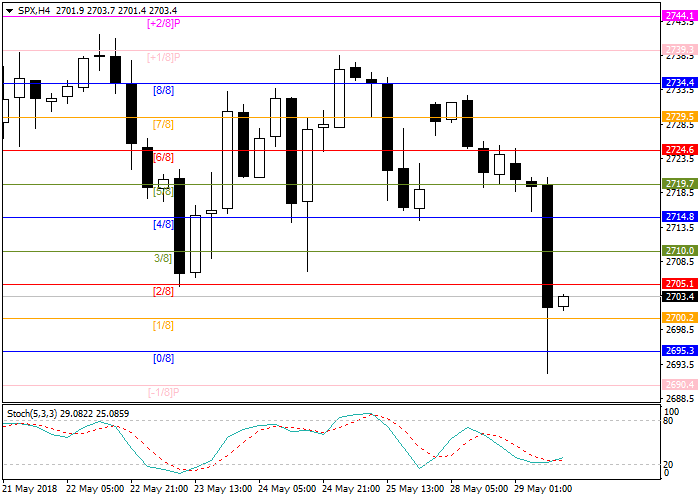

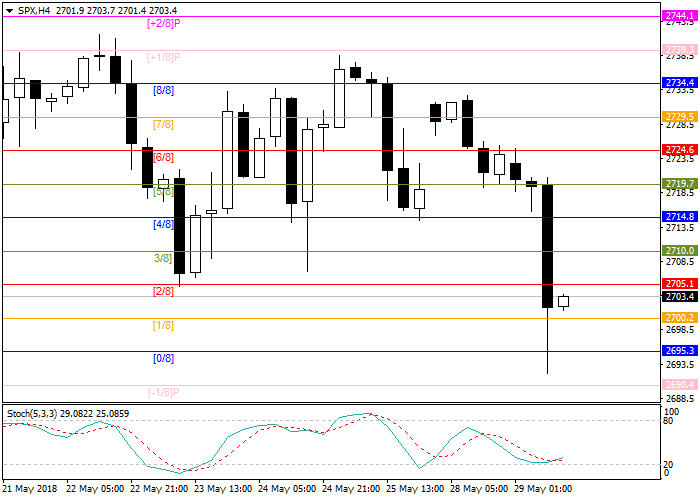

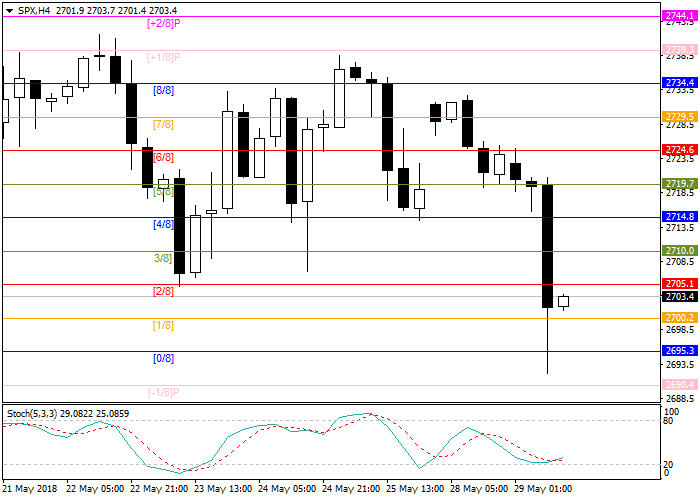

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 2695.3 |

| Take Profit | 2724.6 |

| Stop Loss | 2690.4 |

| Key Levels | 2690.4, 2695.3, 2700.2, 2710.0 |

Current trend

S&P500 broad spectrum index is declining with the opening of the European session. At the moment, the rate is 2701.2, the nearest important support level, from which a turn is possible, is located at 2695.3 or 0/8 Murray.

10-year bonds yield is 2.86%, which is below the important psychological level of 3%, so a rebound and correction of the stock index are possible. According to world news reports, the US president's team arrived in North Korea to prepare a summit between the leaders of the two countries, although last week Donald Trump wrote that he did not plan to hold the meeting. One of the main goals of the American president is to achieve the destruction of the site for the testing of nuclear weapons and to stop all developments related to this project.

Today, special attention should be paid to the housing price index and consumer confidence indicator.

Support and resistance

Stochastic is at the level of 20 points and indicates a possible correction.

Resistance levels: 2700.2, 2710.0.

Support levels: 2695.3, 2690.4.

Trading tips

Long positions may be opened from the support level of 2695.3 with take-profit at 2724.6 and stop-loss at 2690.4.

S&P500 broad spectrum index is declining with the opening of the European session. At the moment, the rate is 2701.2, the nearest important support level, from which a turn is possible, is located at 2695.3 or 0/8 Murray.

10-year bonds yield is 2.86%, which is below the important psychological level of 3%, so a rebound and correction of the stock index are possible. According to world news reports, the US president's team arrived in North Korea to prepare a summit between the leaders of the two countries, although last week Donald Trump wrote that he did not plan to hold the meeting. One of the main goals of the American president is to achieve the destruction of the site for the testing of nuclear weapons and to stop all developments related to this project.

Today, special attention should be paid to the housing price index and consumer confidence indicator.

Support and resistance

Stochastic is at the level of 20 points and indicates a possible correction.

Resistance levels: 2700.2, 2710.0.

Support levels: 2695.3, 2690.4.

Trading tips

Long positions may be opened from the support level of 2695.3 with take-profit at 2724.6 and stop-loss at 2690.4.

No comments:

Write comments