SPX: general review

24 May 2018, 13:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 2734.4 |

| Take Profit | 2724.6 |

| Stop Loss | 2793.3 |

| Key Levels | 2724.6, 2729.5, 2734.4, 2793.3 |

Current trend

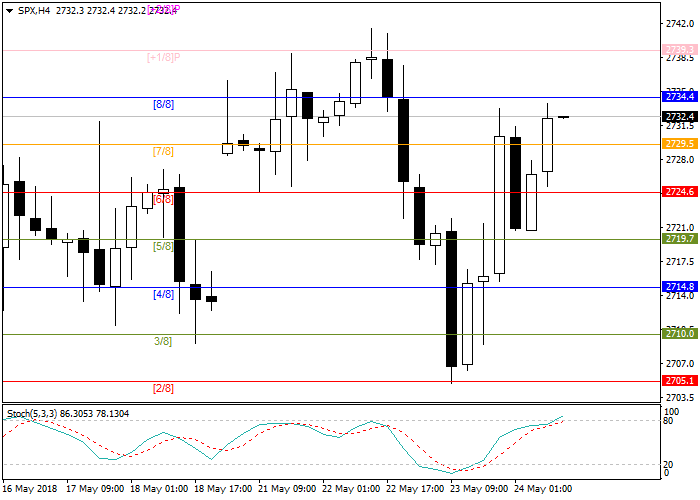

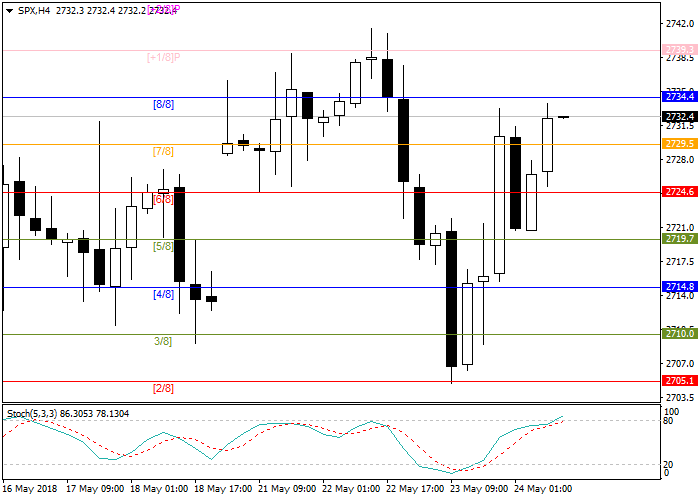

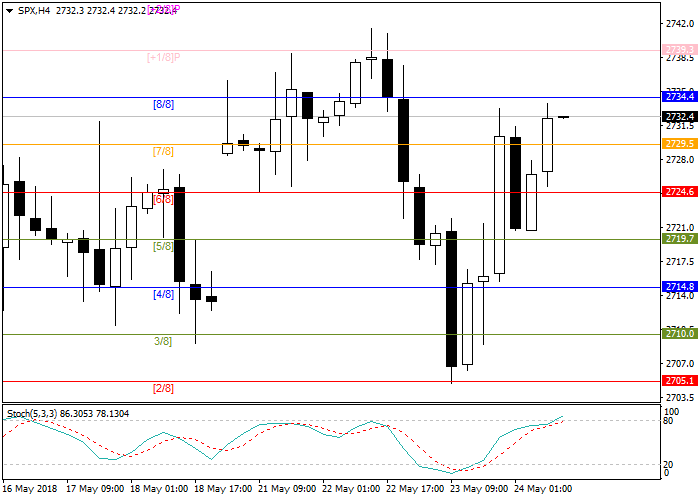

S&P500 broad spectrum index continues to show positive dynamics since the opening of yesterday's trading session in the US. Currently, the instrument is trading around the resistance level of 8/8 Murrey or 2734.4. If it is broken out in the near future, the next target will be 2742.5.

Published yesterday, the minutes of the Fed meeting did not surprise investors; as expected, the regulator will continue to raise the interest rate, as the economy grows and the inflationary pressure intensifies. The next meeting will be held on 12-13 June, and the probability of a rate increase at it is more than 70%. The yield on 10-year US bonds remains above 3%, which has a negative pressure on the stock market, forcing speculators to look for new points to open short positions.

Today, data on secondary jobless claims and the housing price index will be published.

Support and resistance

Stochastic is at 71 points and does not provide a signal for the opening of positions.

Resistance levels: 2734.4, 2793.3.

Support levels: 2729.5, 2724.6.

Trading tips

Short positions may be opened from the resistance level of 2734.4 with take-profit at 2724.6 and stop-loss at 2793.3.

S&P500 broad spectrum index continues to show positive dynamics since the opening of yesterday's trading session in the US. Currently, the instrument is trading around the resistance level of 8/8 Murrey or 2734.4. If it is broken out in the near future, the next target will be 2742.5.

Published yesterday, the minutes of the Fed meeting did not surprise investors; as expected, the regulator will continue to raise the interest rate, as the economy grows and the inflationary pressure intensifies. The next meeting will be held on 12-13 June, and the probability of a rate increase at it is more than 70%. The yield on 10-year US bonds remains above 3%, which has a negative pressure on the stock market, forcing speculators to look for new points to open short positions.

Today, data on secondary jobless claims and the housing price index will be published.

Support and resistance

Stochastic is at 71 points and does not provide a signal for the opening of positions.

Resistance levels: 2734.4, 2793.3.

Support levels: 2729.5, 2724.6.

Trading tips

Short positions may be opened from the resistance level of 2734.4 with take-profit at 2724.6 and stop-loss at 2793.3.

No comments:

Write comments