SPX: general review

10 May 2018, 13:47

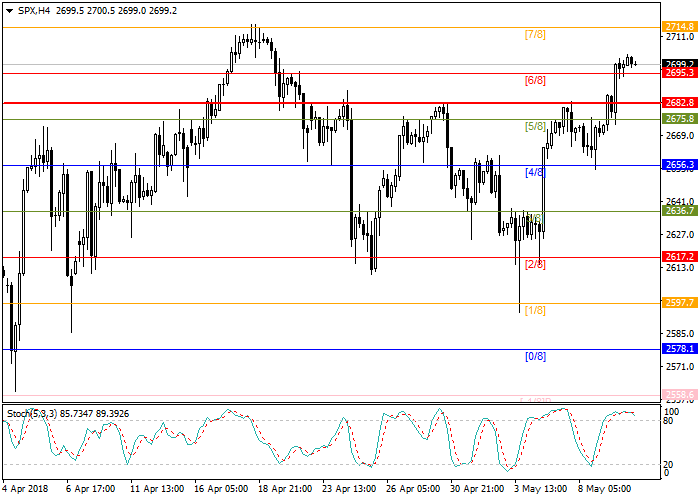

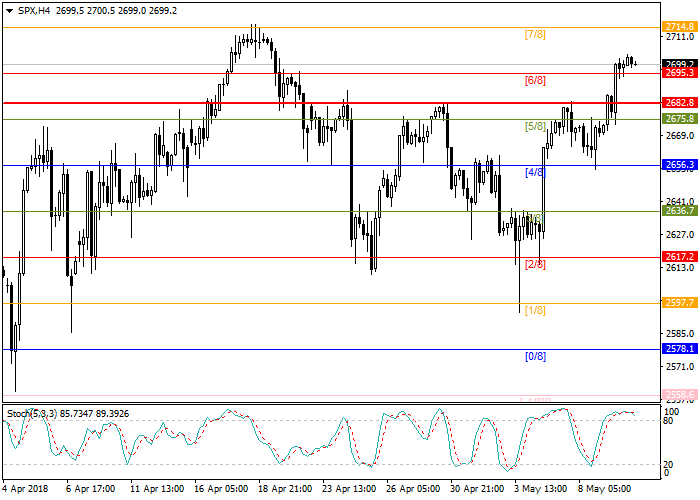

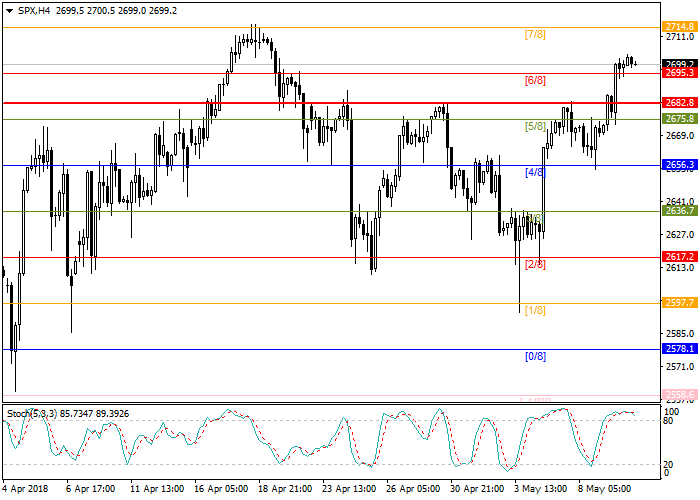

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 2714.8 |

| Take Profit | 2682.8 |

| Stop Loss | 2725.6 |

| Key Levels | 2656.3, 2682.8, 2714.8, 2725.6 |

Current trend

S&P500 index continues to trade with an increase: the nearest important resistance level passes at the 7/8 Murray or 2714.8, here began sales and correction.

Earlier it became known that US President Donald Trump decided to break all agreements with Iran on the nuclear deal and increase pressure on the country through sanctions so that geopolitical risks will adversely affect the market. Bonds have also added yield: the risk premium for 10-year bonds is above 3% amid fears of an increase in inflationary pressures, which is also a negative factor for the stock market. However, the energy sector remains in positive territory thanks to the growth of oil quotes due to the reduction of future supplies from Iran.

Important news today include data on the consumer price index, reflecting inflationary dynamics and secondary jobless claims.

Support and resistance

Stochastic is at the level of 98 points and indicates the possible correction.

Resistance levels: 2714.8, 2725.6.

Support levels: 2682.8, 2656.3.

Trading tips

Short positions may be opened from the resistance level of 2714.8 with take-profit at 2682.8 and stop-loss at 2725.6.

S&P500 index continues to trade with an increase: the nearest important resistance level passes at the 7/8 Murray or 2714.8, here began sales and correction.

Earlier it became known that US President Donald Trump decided to break all agreements with Iran on the nuclear deal and increase pressure on the country through sanctions so that geopolitical risks will adversely affect the market. Bonds have also added yield: the risk premium for 10-year bonds is above 3% amid fears of an increase in inflationary pressures, which is also a negative factor for the stock market. However, the energy sector remains in positive territory thanks to the growth of oil quotes due to the reduction of future supplies from Iran.

Important news today include data on the consumer price index, reflecting inflationary dynamics and secondary jobless claims.

Support and resistance

Stochastic is at the level of 98 points and indicates the possible correction.

Resistance levels: 2714.8, 2725.6.

Support levels: 2682.8, 2656.3.

Trading tips

Short positions may be opened from the resistance level of 2714.8 with take-profit at 2682.8 and stop-loss at 2725.6.

No comments:

Write comments