SPX: general analysis

22 May 2018, 10:45

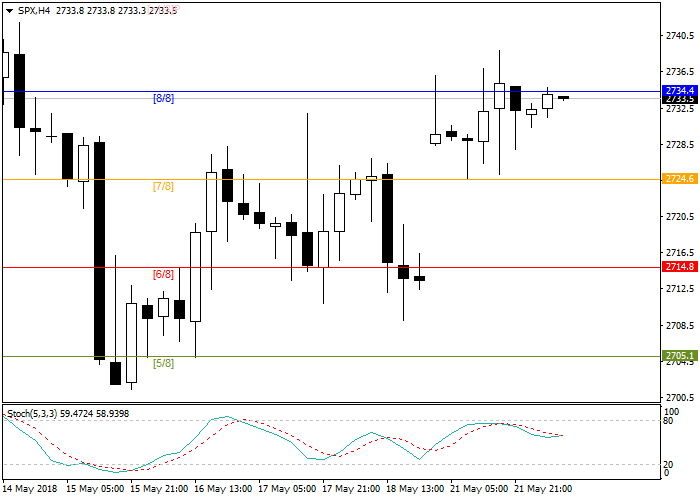

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 2744.1 |

| Take Profit | 2724.8 |

| Stop Loss | 2746.4 |

| Key Levels | 2714.8, 2724.8, 2744.1, 2766.5 |

Current trend

The S&P 500 index is trading near the key resistance level of 2744.1 or 1/8 Murray, the next target is the level of 2782.8.

The demand for stock assets is due to the news from the White House. Yesterday, Finance Minister Mnuchin said that trade wars between the US and China are over, and the countries are working on a new agreement. Beijing is going to increase the purchase of American goods to reduce the trade deficit. On the other hand, the US trade representative Lighthizer said that this issue between the countries has not been finally solved, and the taxed can still be used as a measure of obstruction policy.

The US dollar, which grew by about 5% against the major currencies amid the aggressive monetary policy and rising inflation in the US, affects the stock indices negatively: it undermines the competition of American goods, and about 40% of the income from companies of the S&P 500 list is from foreign markets.

Support and resistance

Stochastic is around 69 points and does not give signals for opening positions.

Resistance levels: 2744.1, 2766.5.

Support levels: 2724.8, 2714.8.

Trading tips

Short positions can be opened at the level 2744.1 with the target at 2724.8 and stop loss 2746.4.

The S&P 500 index is trading near the key resistance level of 2744.1 or 1/8 Murray, the next target is the level of 2782.8.

The demand for stock assets is due to the news from the White House. Yesterday, Finance Minister Mnuchin said that trade wars between the US and China are over, and the countries are working on a new agreement. Beijing is going to increase the purchase of American goods to reduce the trade deficit. On the other hand, the US trade representative Lighthizer said that this issue between the countries has not been finally solved, and the taxed can still be used as a measure of obstruction policy.

The US dollar, which grew by about 5% against the major currencies amid the aggressive monetary policy and rising inflation in the US, affects the stock indices negatively: it undermines the competition of American goods, and about 40% of the income from companies of the S&P 500 list is from foreign markets.

Support and resistance

Stochastic is around 69 points and does not give signals for opening positions.

Resistance levels: 2744.1, 2766.5.

Support levels: 2724.8, 2714.8.

Trading tips

Short positions can be opened at the level 2744.1 with the target at 2724.8 and stop loss 2746.4.

No comments:

Write comments