NZD/USD: general review

09 May 2018, 09:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.6957 |

| Take Profit | 0.6900 |

| Stop Loss | 0.7000 |

| Key Levels | 0.6850, 0.6900, 0.6920, 0.6950, 0.6975, 0.7000, 0.7030, 0.7050, 0.7070, 0.7100 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7030 |

| Take Profit | 0.7100 |

| Stop Loss | 0.7000 |

| Key Levels | 0.6850, 0.6900, 0.6920, 0.6950, 0.6975, 0.7000, 0.7030, 0.7050, 0.7070, 0.7100 |

Current trend

On Tuesday, the US dollar strengthened against the New Zealand one.

The market was focused on US politics’ commentaries. Fed’s head Jerome Powell made a speech at the conference in Switzerland. There was no new information in his commentaries, and he noted that the market had received a signal of Fed’s intention to increase rates long ago, so it should not be surprised with it. However, he mentioned, that the rates would grow if American economy would meet the regulator’s expectations. In the evening, US President Donald Trump announced the withdrawal from the agreement on the Iranian nuclear program, adding that the US will resume sanctions. Trump's decision, however, almost did not affect the strength of USD against NZD.

New Zealand published data on the change in the level of retail sales using electronic payment cards. The indicator showed mixed dynamics, decreasing by 2.2% MoM and increasing by 0.8% YoY, respectively.

Support and resistance

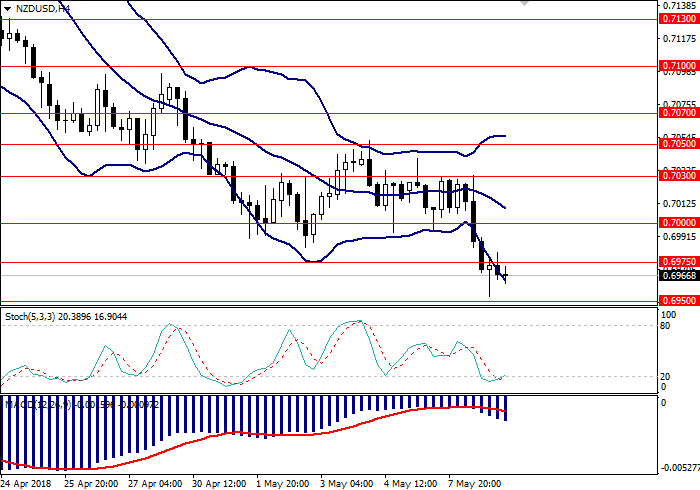

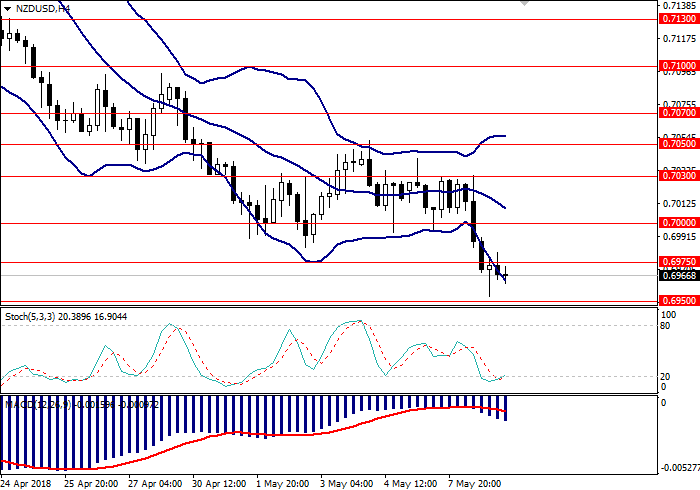

On the H4 chart, the pair declines along the lower border of Bollinger Bands, the price range is widened, which indicates a possible continuation of the uptrend. MACD histogram is in the negative zone keeping a signal for the opening of short positions.

Support levels: 0.6950, 0.6920, 0.6900, 0.6850.

Resistance levels: 0.6975, 0.7000, 0.7030, 0.7050, 0.7070, 0.7100.

Trading tips

Short positions may be opened from the current level with the target at 0.6900 and stop-loss at 0.7000.

Long positions may be opened from the level of 0.7030 with targets at 0.7100 and stop-loss at 0.7000.

Implementation time: 1-3 days.

On Tuesday, the US dollar strengthened against the New Zealand one.

The market was focused on US politics’ commentaries. Fed’s head Jerome Powell made a speech at the conference in Switzerland. There was no new information in his commentaries, and he noted that the market had received a signal of Fed’s intention to increase rates long ago, so it should not be surprised with it. However, he mentioned, that the rates would grow if American economy would meet the regulator’s expectations. In the evening, US President Donald Trump announced the withdrawal from the agreement on the Iranian nuclear program, adding that the US will resume sanctions. Trump's decision, however, almost did not affect the strength of USD against NZD.

New Zealand published data on the change in the level of retail sales using electronic payment cards. The indicator showed mixed dynamics, decreasing by 2.2% MoM and increasing by 0.8% YoY, respectively.

Support and resistance

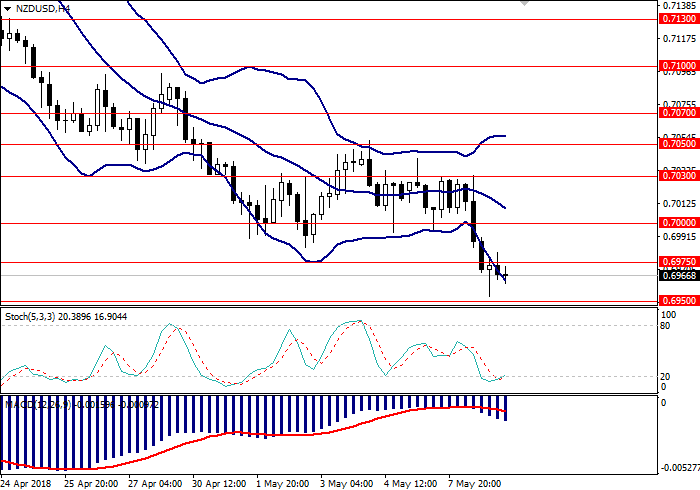

On the H4 chart, the pair declines along the lower border of Bollinger Bands, the price range is widened, which indicates a possible continuation of the uptrend. MACD histogram is in the negative zone keeping a signal for the opening of short positions.

Support levels: 0.6950, 0.6920, 0.6900, 0.6850.

Resistance levels: 0.6975, 0.7000, 0.7030, 0.7050, 0.7070, 0.7100.

Trading tips

Short positions may be opened from the current level with the target at 0.6900 and stop-loss at 0.7000.

Long positions may be opened from the level of 0.7030 with targets at 0.7100 and stop-loss at 0.7000.

Implementation time: 1-3 days.

No comments:

Write comments