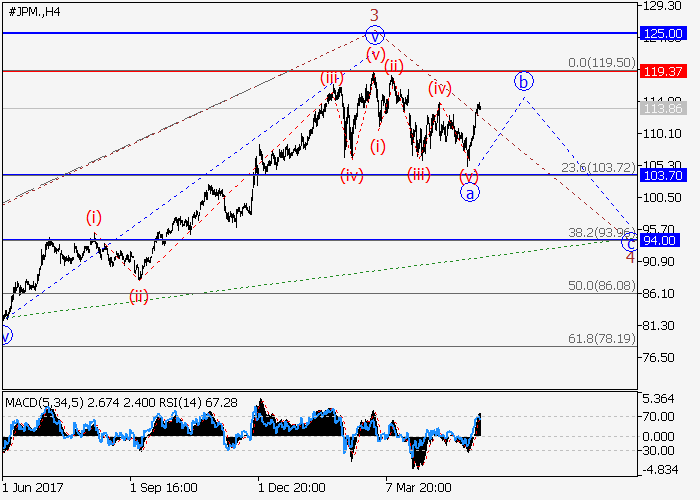

JP Morgan Chase Co.: wave analysis

14 May 2018, 09:53

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 113.85 |

| Take Profit | 103.70, 94.00 |

| Stop Loss | 119.37 |

| Key Levels | 94.00, 103.70, 119.37, 125.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 119.40 |

| Take Profit | 125.00 |

| Stop Loss | 117.55 |

| Key Levels | 94.00, 103.70, 119.37, 125.00 |

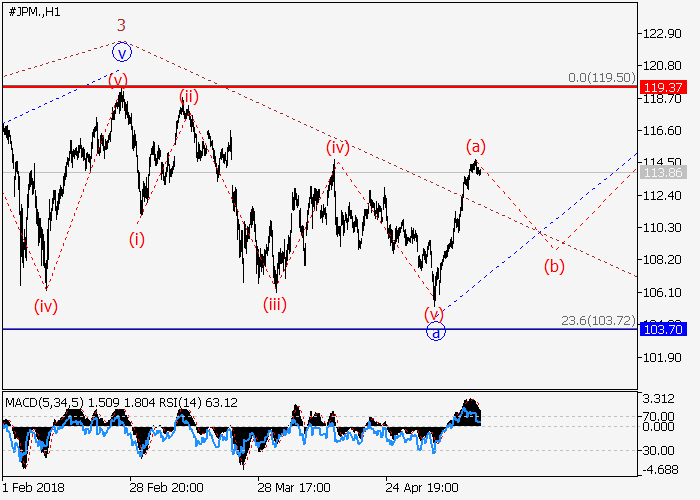

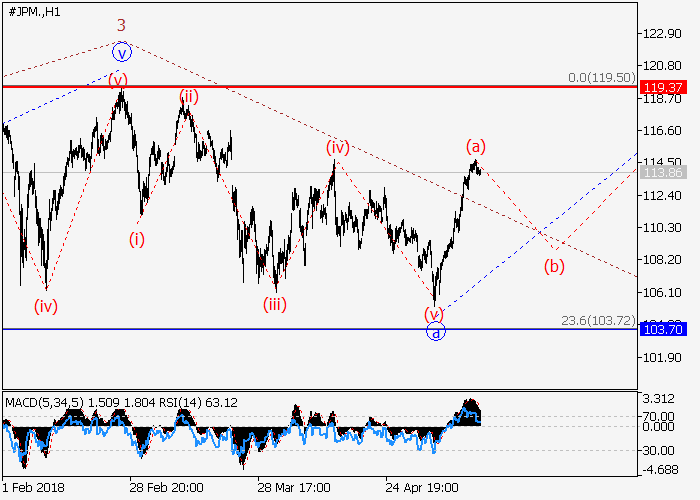

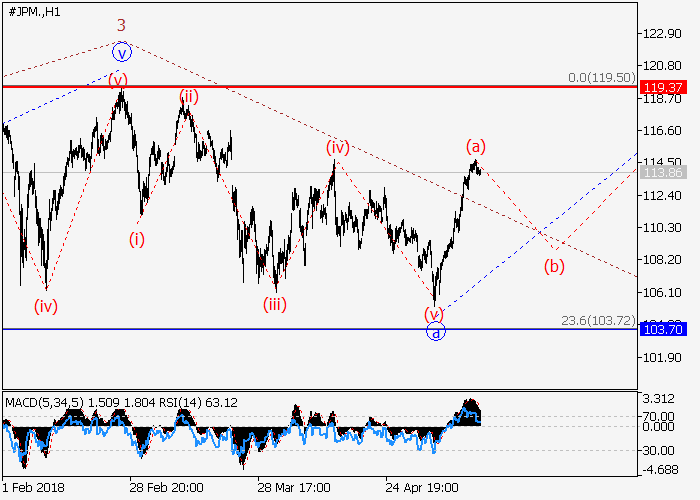

The price is in correction and can fall.

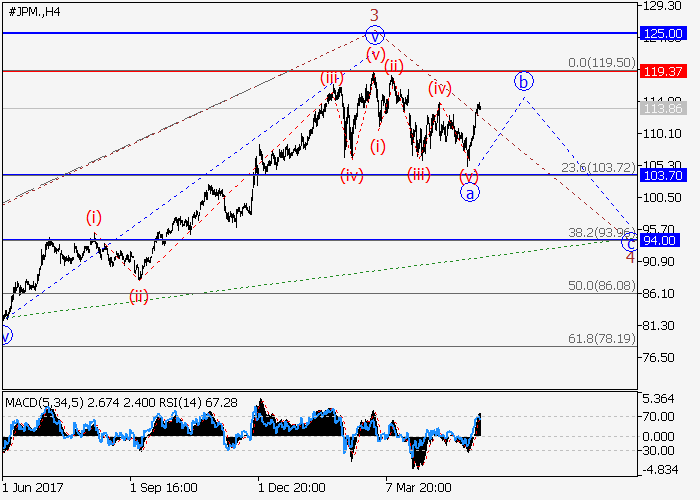

On the 4-hour chart, the downward correction is forming as a fourth wave 4 of the higher level. Locally the wave a of 4 of the lower level has formed, and the wave b of 4 is developing. If the assumption is correct, after the end of the wave the price will fall to the levels of 103.70–94.00. The level of 119.37 is critical and stop-loss for this scenario.

Main scenario

Short positions will become relevant during the correction, below the level of 119.37 with the targets at 103.70–94.00. Implementation period: 5–7 days.

Alternative scenario

The breakout and the consolidation of the price above the level of 119.37 will let the price grow to the level of 125.00.

On the 4-hour chart, the downward correction is forming as a fourth wave 4 of the higher level. Locally the wave a of 4 of the lower level has formed, and the wave b of 4 is developing. If the assumption is correct, after the end of the wave the price will fall to the levels of 103.70–94.00. The level of 119.37 is critical and stop-loss for this scenario.

Main scenario

Short positions will become relevant during the correction, below the level of 119.37 with the targets at 103.70–94.00. Implementation period: 5–7 days.

Alternative scenario

The breakout and the consolidation of the price above the level of 119.37 will let the price grow to the level of 125.00.

No comments:

Write comments