GBP/USD: the pound is corrected

08 May 2018, 09:40

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3610, 1.3655 |

| Take Profit | 1.3800 |

| Stop Loss | 1.3535, 1.3500 |

| Key Levels | 1.3400, 1.3420, 1.3484, 1.3535, 1.3600, 1.3650, 1.3710, 1.3796 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3490, 1.3480 |

| Take Profit | 1.3420, 1.3400 |

| Stop Loss | 1.3535, 1.3550 |

| Key Levels | 1.3400, 1.3420, 1.3484, 1.3535, 1.3600, 1.3650, 1.3710, 1.3796 |

Current trend

GBP showed growth against USD on Monday, departing from local lows, updated at the end of last week.

As there is lack of macroeconomic data, the currency is moving according to the technical factors. The investors are waiting for Thursday when The Bank of England will make an interest rate decision. Earlier, it was expected to grow from 0.50% to 0.75%. However, a number of recently published negative statistics, mainly, inflation, earnings growth and GDP releases, can make the bank’s officials refuse from the decision.

Today, traders focus on the Fed's head, Jerome Powell's speech with the comment on the Friday’s US labor market report as well as on the prospects of possible acceleration of interest rate hike. As for the UK, investors expect publication of Halifax House Prices in April.

Support and resistance

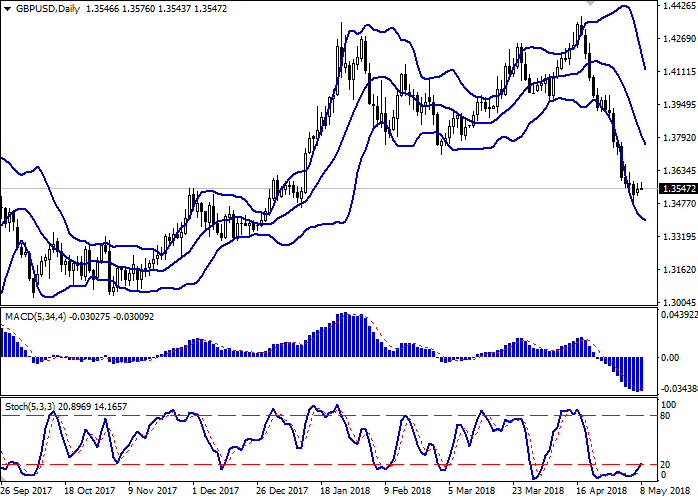

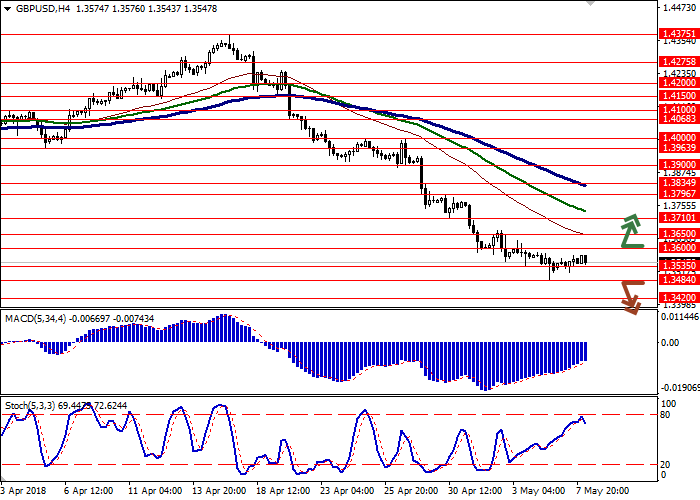

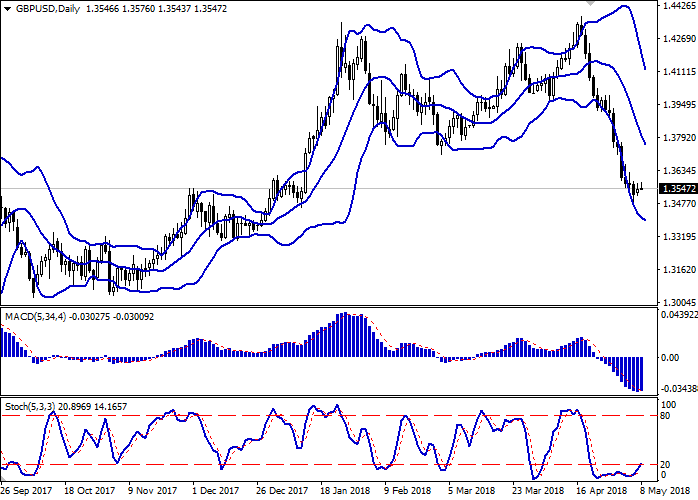

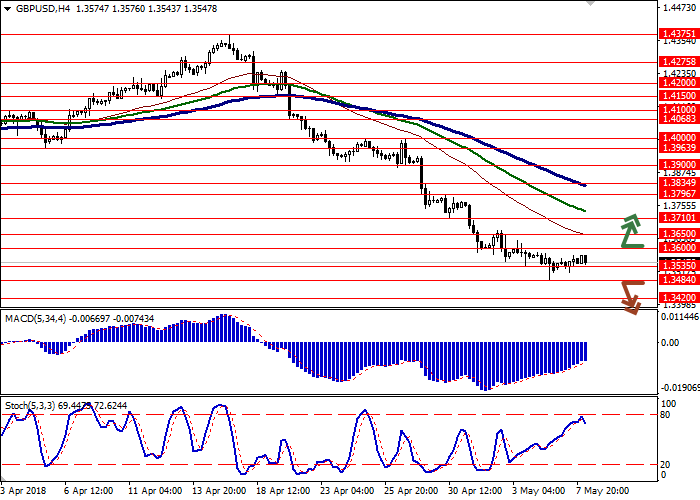

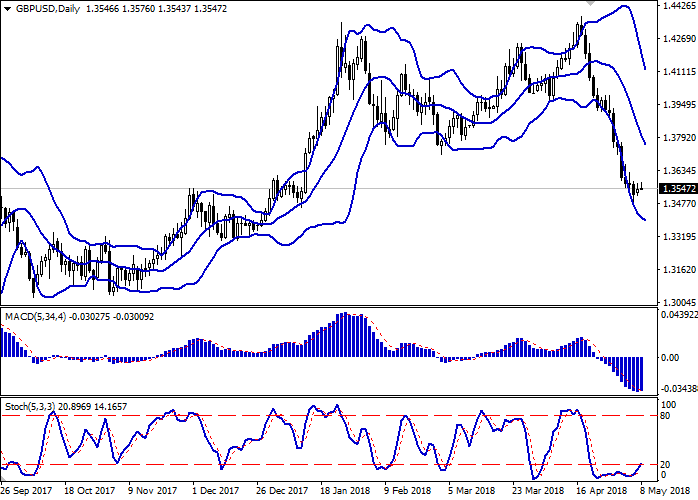

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reacting to the emergence of mixed dynamics in the ultra-short term.

MACD indicator reverses to growth and is about to form a buy signal (it has to consolidate above the signal line).

Stochastic maintains a "bullish" sentiment, testing the breakout of "20" mark. The indicator still points to the oversold pound in the short term.

The indicators signal in favor of a corrective decline in the short term. One should wait for the final formation of "bullish" signals.

Resistance levels: 1.3600, 1.3650, 1.3710, 1.3796.

Support levels: 1.3535, 1.3484, 1.3420, 1.3400.

Trading tips

To open long positions, one can rely on the breakout of 1.3600, 1.3650 marks. Take-profit – 1.3800. Stop-loss — 1.3535 or 1.3500. Implementation period: 2-3 days.

The return of "bearish" trend with the breakdown of the level of 1.3500, 1.3484 may become a signal for new sales with the targets at 1.3420, 1.3400. Stop-loss — 1.3535 or 1.3550. Implementation period: 2 days.

GBP showed growth against USD on Monday, departing from local lows, updated at the end of last week.

As there is lack of macroeconomic data, the currency is moving according to the technical factors. The investors are waiting for Thursday when The Bank of England will make an interest rate decision. Earlier, it was expected to grow from 0.50% to 0.75%. However, a number of recently published negative statistics, mainly, inflation, earnings growth and GDP releases, can make the bank’s officials refuse from the decision.

Today, traders focus on the Fed's head, Jerome Powell's speech with the comment on the Friday’s US labor market report as well as on the prospects of possible acceleration of interest rate hike. As for the UK, investors expect publication of Halifax House Prices in April.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reacting to the emergence of mixed dynamics in the ultra-short term.

MACD indicator reverses to growth and is about to form a buy signal (it has to consolidate above the signal line).

Stochastic maintains a "bullish" sentiment, testing the breakout of "20" mark. The indicator still points to the oversold pound in the short term.

The indicators signal in favor of a corrective decline in the short term. One should wait for the final formation of "bullish" signals.

Resistance levels: 1.3600, 1.3650, 1.3710, 1.3796.

Support levels: 1.3535, 1.3484, 1.3420, 1.3400.

Trading tips

To open long positions, one can rely on the breakout of 1.3600, 1.3650 marks. Take-profit – 1.3800. Stop-loss — 1.3535 or 1.3500. Implementation period: 2-3 days.

The return of "bearish" trend with the breakdown of the level of 1.3500, 1.3484 may become a signal for new sales with the targets at 1.3420, 1.3400. Stop-loss — 1.3535 or 1.3550. Implementation period: 2 days.

No comments:

Write comments