GBP/USD: general review

14 May 2018, 13:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3610 |

| Take Profit | 1.3660, 1.3700 |

| Stop Loss | 1.3540 |

| Key Levels | 1.3394, 1.3453, 1.3500, 1.3548, 1.3598, 1.3660, 1.3743, 1.3817 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3530 |

| Take Profit | 1.3490, 1.3455 |

| Stop Loss | 1.3570 |

| Key Levels | 1.3394, 1.3453, 1.3500, 1.3548, 1.3598, 1.3660, 1.3743, 1.3817 |

Current trend

Last week, the pair traded in a limited range of 1.3455-1.3610. Today, it grew moderately and trades near a strong resistance level of 1.3600.

On Thursday, the Bank of England announced a cautious decision to leave the interest rate at 0.5% due to a slowdown in Q1. Also, BoE expects the economic growth this year at 1.4% (the previous estimate was 0.4%). GDP growth forecast for 2019-2020 was reduced by 0.1%.

USD is under the pressure of weak inflationary indicators published last week. On Friday, investors were waiting for the speech of the Fed representative James Bullard, which contributed to a moderate weakening of the US currency.

Today at 15:40 (GMT+2), Bullard's speech is scheduled again, which may lead to a strengthening of GBP/USD. Tomorrow, data on the UK labor market (at 10:30 (GMT+2)) and inflation (at 11:00 (GMT+2)) will be published. Market participants expect the positive statistics and the strengthening of GBP. The US will publish release on April retail sales.

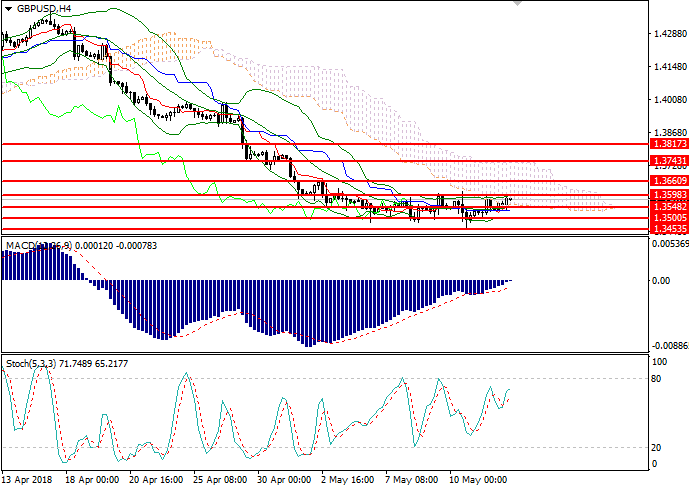

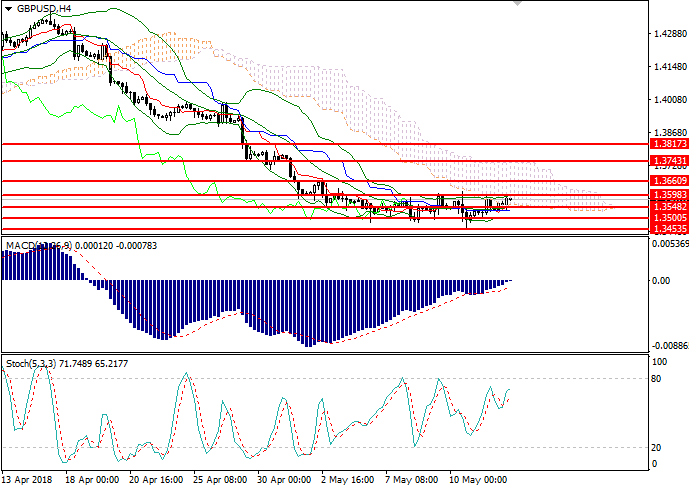

Support and resistance

On H4 chart, the instrument was adjusted to the upper border of Bollinger Bands, which is the key resistance level. 1.3548 mark is a significant support. The indicator is directed sideways, and the price range has slightly expanded, which is the basis for continuing correction. MACD histogram is in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal to open positions.

Support levels: 1.3394, 1.3453, 1.3500, 1.3548.

Resistance levels: 1.3598, 1.3660, 1.3743, 1.3817.

Trading tips

Long positions may be opened above the level of 1.3605 with targets at 1.3660, 1.3700 and stop-loss at 1.3540. Implementation time: 1-2 days.

Short positions may be opened below 1.3535 with targets at 1.3490, 1.3455 and stop-loss at 1.3570. Implementation time: 1-2 days.

Last week, the pair traded in a limited range of 1.3455-1.3610. Today, it grew moderately and trades near a strong resistance level of 1.3600.

On Thursday, the Bank of England announced a cautious decision to leave the interest rate at 0.5% due to a slowdown in Q1. Also, BoE expects the economic growth this year at 1.4% (the previous estimate was 0.4%). GDP growth forecast for 2019-2020 was reduced by 0.1%.

USD is under the pressure of weak inflationary indicators published last week. On Friday, investors were waiting for the speech of the Fed representative James Bullard, which contributed to a moderate weakening of the US currency.

Today at 15:40 (GMT+2), Bullard's speech is scheduled again, which may lead to a strengthening of GBP/USD. Tomorrow, data on the UK labor market (at 10:30 (GMT+2)) and inflation (at 11:00 (GMT+2)) will be published. Market participants expect the positive statistics and the strengthening of GBP. The US will publish release on April retail sales.

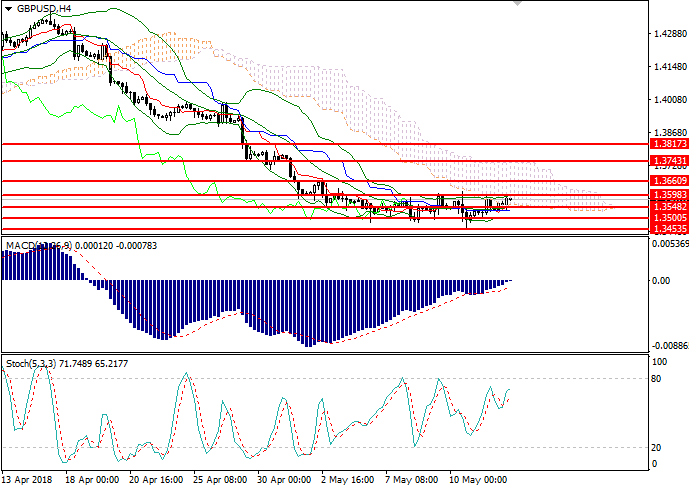

Support and resistance

On H4 chart, the instrument was adjusted to the upper border of Bollinger Bands, which is the key resistance level. 1.3548 mark is a significant support. The indicator is directed sideways, and the price range has slightly expanded, which is the basis for continuing correction. MACD histogram is in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal to open positions.

Support levels: 1.3394, 1.3453, 1.3500, 1.3548.

Resistance levels: 1.3598, 1.3660, 1.3743, 1.3817.

Trading tips

Long positions may be opened above the level of 1.3605 with targets at 1.3660, 1.3700 and stop-loss at 1.3540. Implementation time: 1-2 days.

Short positions may be opened below 1.3535 with targets at 1.3490, 1.3455 and stop-loss at 1.3570. Implementation time: 1-2 days.

No comments:

Write comments