GBP/USD: general analysis

16 May 2018, 13:50

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.3420 |

| Take Profit | 1.3310, 1.3200 |

| Stop Loss | 1.3470 |

| Key Levels | 1.3671, 1.3550, 1.3427, 1.3310, 1.3200 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3560 |

| Take Profit | 1.3671 |

| Stop Loss | 1.3510 |

| Key Levels | 1.3671, 1.3550, 1.3427, 1.3310, 1.3200 |

Current trend

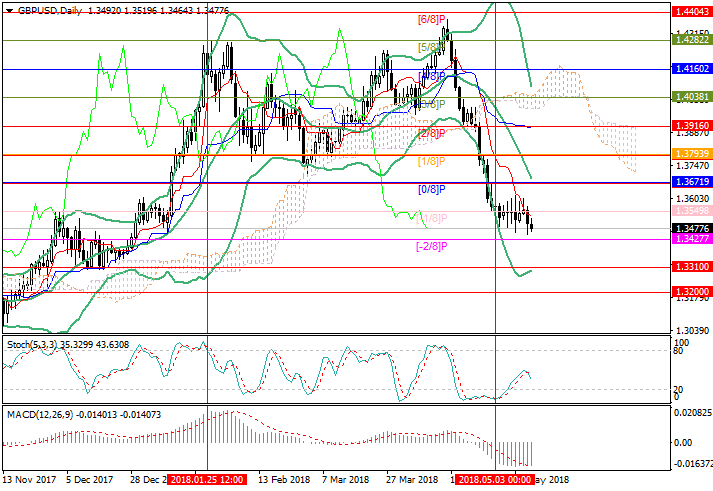

Since the beginning of the month, the pair trades within the sideways channel 1.3610–1.3458 (Murray [6/8]–[1/8], Н4).

UK employment statistic was mixed. The unemployment level stays record low –4.2%. Average Earning Including Bonus has grown by 2.9% during the last 2 months, which has exceeded the inflation growth of the period (2.7%). On the other hand, the growth rate of Average Earnings Excluding Bonus decreased from 2.8% to 2.6%.

British economy is slowing after significant growth, which the Deputy Governor of the BoE Ben Broadbent confirmed in his interview for Daily Telegraph and due to the unclear situation about Brexit. Until the Summer EU Summit, UK must publish its plan of the relations with EU development during the transitional period. However, the British governing parties are not able to agree. On Tuesday, the Scottish Parliament rejected London Brexit low, as it restricts the rights of local parliamentarians.

Support and resistance

The price is tending to the lower border of the channel, but the fall is possible after consolidation below the level of 1.3427 (Murray [–2/8]), and the “bearish” targets will be at 1.3310 (the lower border of Bollinger Bands) and 1.3200. After the breakout of 1.3550 (Murray [–1/8]) the correction to the level of 1.3671 (Murray [0/8], the middle line of Bollinger Bands) is possible. The indicators reflect the fall. Bollinger Bands and Stochastic are pointed downwards. MACD histogram is stable in the negative zone.

Resistance levels: 1.3550, 1.3671.

Support levels: 1.3427, 1.3310, 1.3200.

Trading tips

Short positions can be opened below the level of 1.3427 with the targets at 1.3310, 1.3200 and stop loss 1.3470.

Long positions can be opened above the level of 1.3550 with the target at 1.3671 and stop loss around 1.3510.

Implementation period: 5–7 days.

Since the beginning of the month, the pair trades within the sideways channel 1.3610–1.3458 (Murray [6/8]–[1/8], Н4).

UK employment statistic was mixed. The unemployment level stays record low –4.2%. Average Earning Including Bonus has grown by 2.9% during the last 2 months, which has exceeded the inflation growth of the period (2.7%). On the other hand, the growth rate of Average Earnings Excluding Bonus decreased from 2.8% to 2.6%.

British economy is slowing after significant growth, which the Deputy Governor of the BoE Ben Broadbent confirmed in his interview for Daily Telegraph and due to the unclear situation about Brexit. Until the Summer EU Summit, UK must publish its plan of the relations with EU development during the transitional period. However, the British governing parties are not able to agree. On Tuesday, the Scottish Parliament rejected London Brexit low, as it restricts the rights of local parliamentarians.

Support and resistance

The price is tending to the lower border of the channel, but the fall is possible after consolidation below the level of 1.3427 (Murray [–2/8]), and the “bearish” targets will be at 1.3310 (the lower border of Bollinger Bands) and 1.3200. After the breakout of 1.3550 (Murray [–1/8]) the correction to the level of 1.3671 (Murray [0/8], the middle line of Bollinger Bands) is possible. The indicators reflect the fall. Bollinger Bands and Stochastic are pointed downwards. MACD histogram is stable in the negative zone.

Resistance levels: 1.3550, 1.3671.

Support levels: 1.3427, 1.3310, 1.3200.

Trading tips

Short positions can be opened below the level of 1.3427 with the targets at 1.3310, 1.3200 and stop loss 1.3470.

Long positions can be opened above the level of 1.3550 with the target at 1.3671 and stop loss around 1.3510.

Implementation period: 5–7 days.

No comments:

Write comments