GBP/USD: general analysis

09 May 2018, 14:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3480 |

| Take Profit | 1.3400, 1.3330 |

| Stop Loss | 1.3580 |

| Key Levels | 1.3312, 1.3396, 1.3486, 1.3540, 1.3590, 1.3660, 1.3743, 1.3817 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3590 |

| Take Profit | 1.3660, 1.3700 |

| Stop Loss | 1.3530 |

| Key Levels | 1.3312, 1.3396, 1.3486, 1.3540, 1.3590, 1.3660, 1.3743, 1.3817 |

Current trend

This week, the pair is trading within the narrow range, waiting for the Bank of England meeting on Thursday.

USD is strengthening against the main currencies after the publication of US strong macroeconomic data and as Fed is ready to tighten its monetary policy. Yesterday, the head of the US regulator Jerome Powell in his speech in Zurich warned the markets to be prepared for further monetary policy tightening. The growth of US bonds’ yield and strong macroeconomic data contribute to two increases of Fed’s interest rates this year. Today the traders are focused on FOMC Member Bostic speech at 19:15 (GMT+2). He is expected, like most of his colleagues earlier, will support the “hawkish” monetary plans of the regulator, which will strengthen USD.

Tomorrow at 13:00 (GMT+2), the Bank of England will publish its interest rate decision, which is expected to stay on the same level, and the further dynamics of the pair depends on the head of the regulator head Mark Carney commentaries.

Support and resistance

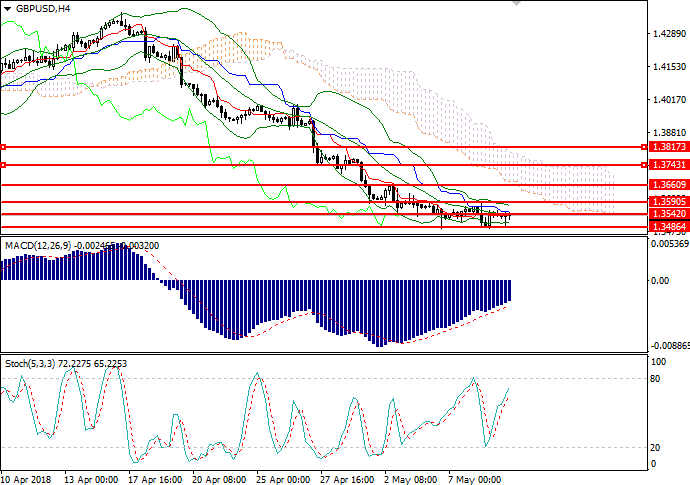

On the 4-hour chart, the instrument is trading near MA of Bollinger Bands. The key support level is 1.3540. The indicator is pointed sideways, and the price range insignificantly narrowed, which reflects the development of the correction. MACD histogram is in the negative zone, its volumes are insignificantly growing, and sell signal is still relevant. Stochastic is ready to enter the overbought area.

Resistance levels: 1.3590, 1.3660, 1.3743, 1.3817.

Support levels: 1.3312, 1.3396, 1.3486, 1.3540.

Trading tips

Short positions can be opened below the level of 1.3485 with the targets at 1.3400, 1.3330 and stop loss 1.3580. Implementation period: 1–2 days.

Long positions can be opened above the level of 1.3580 with the targets at 1.3660, 1.3700 and stop loss 1.3530. Implementation period: 2–3 days.

This week, the pair is trading within the narrow range, waiting for the Bank of England meeting on Thursday.

USD is strengthening against the main currencies after the publication of US strong macroeconomic data and as Fed is ready to tighten its monetary policy. Yesterday, the head of the US regulator Jerome Powell in his speech in Zurich warned the markets to be prepared for further monetary policy tightening. The growth of US bonds’ yield and strong macroeconomic data contribute to two increases of Fed’s interest rates this year. Today the traders are focused on FOMC Member Bostic speech at 19:15 (GMT+2). He is expected, like most of his colleagues earlier, will support the “hawkish” monetary plans of the regulator, which will strengthen USD.

Tomorrow at 13:00 (GMT+2), the Bank of England will publish its interest rate decision, which is expected to stay on the same level, and the further dynamics of the pair depends on the head of the regulator head Mark Carney commentaries.

Support and resistance

On the 4-hour chart, the instrument is trading near MA of Bollinger Bands. The key support level is 1.3540. The indicator is pointed sideways, and the price range insignificantly narrowed, which reflects the development of the correction. MACD histogram is in the negative zone, its volumes are insignificantly growing, and sell signal is still relevant. Stochastic is ready to enter the overbought area.

Resistance levels: 1.3590, 1.3660, 1.3743, 1.3817.

Support levels: 1.3312, 1.3396, 1.3486, 1.3540.

Trading tips

Short positions can be opened below the level of 1.3485 with the targets at 1.3400, 1.3330 and stop loss 1.3580. Implementation period: 1–2 days.

Long positions can be opened above the level of 1.3580 with the targets at 1.3660, 1.3700 and stop loss 1.3530. Implementation period: 2–3 days.

No comments:

Write comments