EUR/USD: general review

04 May 2018, 14:50

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.1950 |

| Take Profit | 1.1900, 1.1840 |

| Stop Loss | 1.2000 |

| Key Levels | 1.1840, 1.1900, 1.1962, 1.2023, 1.2085, 1.2146 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2023 |

| Take Profit | 1.2085, 1.2146 |

| Stop Loss | 1.1980 |

| Key Levels | 1.1840, 1.1900, 1.1962, 1.2023, 1.2085, 1.2146 |

Current trend

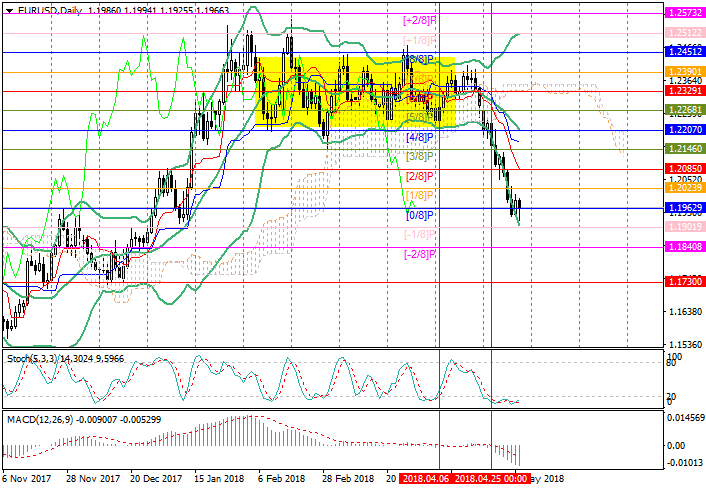

This week, the pair dropped to the area of the lower border of the main trading range to the level of 1.1962 ([0/8]), where it is still traded.

The American currency is affected by the number of contradicting factors. On the one hand, it is pressured by the results of the Fed meeting. The interest rate remained unchanged at the previous level of 1.75% while in the statement investors didn’t see any hints on an acceleration of the pace of its increases. At the same time, it was noted that inflation is close to its target level of 2.0%, economic risks are balanced, and the current state of the economy assumes further rate hikes. On the other hand, the Dollar is supported by a start of negotiations between the US Treasury Secretary Steven Mnuchin and Vice Premier of China Liu He in Beijing. Direct negotiations between officials of their status give investors room for optimism, though experts warn not to expect immediate results.

Today the market is waiting for the publication of April data on the American labor market. Unemployment rate is expected to decrease from 4.1% to 4.0%, and the number of non-farm jobs to increase from 103K to 192K.

Support and resistance

The technical picture is uncertain. Bollinger Bands diverge, confirming the downtrend, and MACD histogram grows in the negative zone, indicating that the decline may continue to 1.1900 and 1.1840 marks. However, one cannot exclude an upward correction to 1.2085 and 1.2146 marks.

Support levels: 1.1962, 1.1900, 1.1840.

Resistance levels: 1.2023, 1.2085, 1.2146.

Trading tips

Short positions may be opened from 1.1950 mark with targets at 1.1900, 1.1840 and stop-loss at 1.2000.

Long positions may be opened from the level of 1.2023 with targets of 1.2085, 1.2146 and the stop-loss at 1.1980.

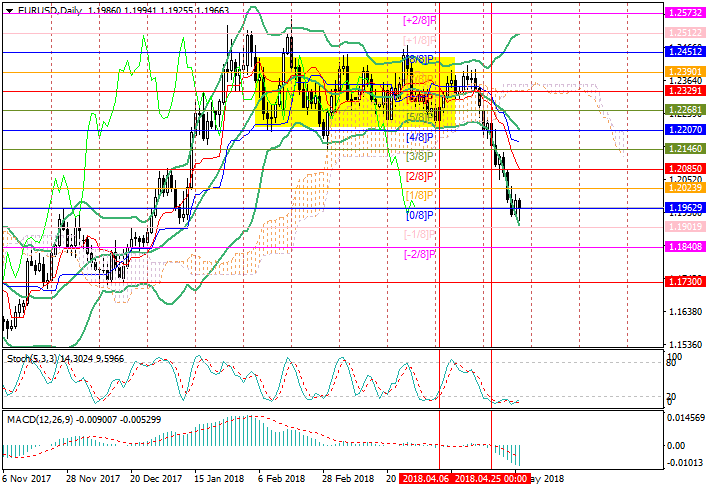

This week, the pair dropped to the area of the lower border of the main trading range to the level of 1.1962 ([0/8]), where it is still traded.

The American currency is affected by the number of contradicting factors. On the one hand, it is pressured by the results of the Fed meeting. The interest rate remained unchanged at the previous level of 1.75% while in the statement investors didn’t see any hints on an acceleration of the pace of its increases. At the same time, it was noted that inflation is close to its target level of 2.0%, economic risks are balanced, and the current state of the economy assumes further rate hikes. On the other hand, the Dollar is supported by a start of negotiations between the US Treasury Secretary Steven Mnuchin and Vice Premier of China Liu He in Beijing. Direct negotiations between officials of their status give investors room for optimism, though experts warn not to expect immediate results.

Today the market is waiting for the publication of April data on the American labor market. Unemployment rate is expected to decrease from 4.1% to 4.0%, and the number of non-farm jobs to increase from 103K to 192K.

Support and resistance

The technical picture is uncertain. Bollinger Bands diverge, confirming the downtrend, and MACD histogram grows in the negative zone, indicating that the decline may continue to 1.1900 and 1.1840 marks. However, one cannot exclude an upward correction to 1.2085 and 1.2146 marks.

Support levels: 1.1962, 1.1900, 1.1840.

Resistance levels: 1.2023, 1.2085, 1.2146.

Trading tips

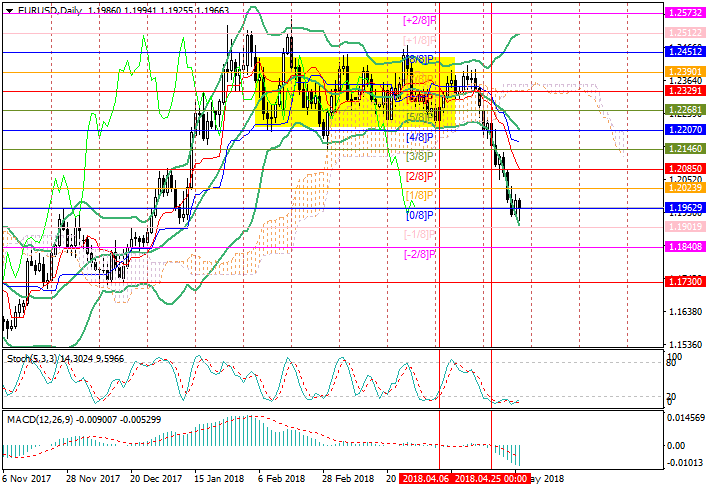

Short positions may be opened from 1.1950 mark with targets at 1.1900, 1.1840 and stop-loss at 1.2000.

Long positions may be opened from the level of 1.2023 with targets of 1.2085, 1.2146 and the stop-loss at 1.1980.

No comments:

Write comments