EUR/USD: general analysis

25 May 2018, 13:16

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.1657 |

| Take Profit | 1.1596, 1.1540 |

| Stop Loss | 1.1690 |

| Key Levels | 1.1540, 1.1596, 1.1657, 1.1780, 1.1840, 1.1900 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1780 |

| Take Profit | 1.1840, 1.1900 |

| Stop Loss | 1.1740 |

| Key Levels | 1.1540, 1.1596, 1.1657, 1.1780, 1.1840, 1.1900 |

Current trend

Yesterday, the pair correctionally grew and is now trying to consolidate above the level of 1.1718. USD is under pressure of canceling the US-DPRK summit, moreover, next week new sanctions may be imposed on DPRK. However, EUR is unstable due to the Italian and Spanish government crisis. The Socialist Party of Spain is ready to vote of no confidence in Prime Minister Mariano Rajoy, whose advisers are accused of corruption.

Investors continue to follow the development of US-China trade disputes. The recent agreements on the mutual suspension of duties and of the US trade deficit with the US 200 billion aroused serious criticism in the US Congress. The Donald Trump to declare that the trade agreement with the PRC could be changed since it is difficult to verify its results. Market participants saw in this the possibility of a breakdown of the transaction. In addition, the US currency is weakened due to the data. There are fears that the following duties on metals, the president's administration and the trade war (this time with Germany, Japan, and South Korea) will get a new round.

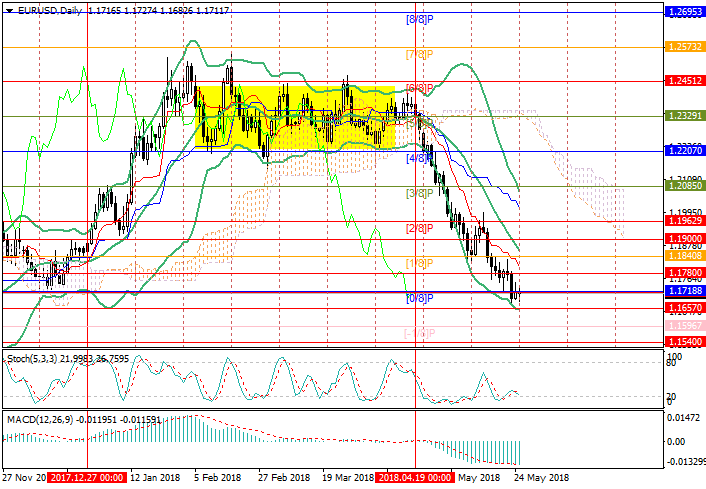

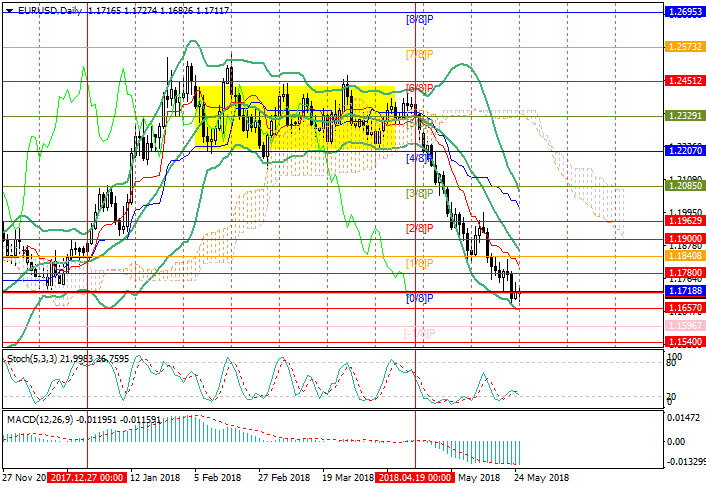

Support and resistance

The consolidation above 1.1718 (Murray [2/8]) will let the price grow to the levels of 1.1840 (Bollinger bands’ middle line), 1.1900. However, the indicators reflect the strength of sellers, so the decline to 1.1596 (Murray [–1/8]) and 1.1540 is possible. Bollinger bands are pointed down, MACD is growing in the negative zone, Stochastic is reversing downwards.

Resistance levels: 1.1780, 1.1840, 1.1900.

Support levels: 1.1657, 1.1596, 1.1540.

Trading tips

Short positions can be opened at the level 1.1657 with the targets at 1.1596, 1.1540 and stop loss 1.1690.

Long positions can be opened at the level 1.1780 with the targets at 1.1840, 1.1900 and stop loss 1.1740.

Yesterday, the pair correctionally grew and is now trying to consolidate above the level of 1.1718. USD is under pressure of canceling the US-DPRK summit, moreover, next week new sanctions may be imposed on DPRK. However, EUR is unstable due to the Italian and Spanish government crisis. The Socialist Party of Spain is ready to vote of no confidence in Prime Minister Mariano Rajoy, whose advisers are accused of corruption.

Investors continue to follow the development of US-China trade disputes. The recent agreements on the mutual suspension of duties and of the US trade deficit with the US 200 billion aroused serious criticism in the US Congress. The Donald Trump to declare that the trade agreement with the PRC could be changed since it is difficult to verify its results. Market participants saw in this the possibility of a breakdown of the transaction. In addition, the US currency is weakened due to the data. There are fears that the following duties on metals, the president's administration and the trade war (this time with Germany, Japan, and South Korea) will get a new round.

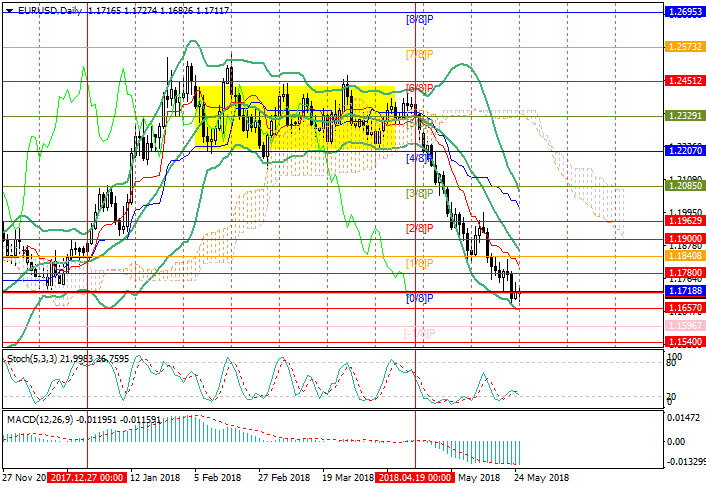

Support and resistance

The consolidation above 1.1718 (Murray [2/8]) will let the price grow to the levels of 1.1840 (Bollinger bands’ middle line), 1.1900. However, the indicators reflect the strength of sellers, so the decline to 1.1596 (Murray [–1/8]) and 1.1540 is possible. Bollinger bands are pointed down, MACD is growing in the negative zone, Stochastic is reversing downwards.

Resistance levels: 1.1780, 1.1840, 1.1900.

Support levels: 1.1657, 1.1596, 1.1540.

Trading tips

Short positions can be opened at the level 1.1657 with the targets at 1.1596, 1.1540 and stop loss 1.1690.

Long positions can be opened at the level 1.1780 with the targets at 1.1840, 1.1900 and stop loss 1.1740.

No comments:

Write comments