Brent Crude Oil: technical analysis

25 May 2018, 13:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 76.90 |

| Take Profit | 76.56, 75.78 |

| Stop Loss | 77.30 |

| Key Levels | 75.78, 76.17, 76.56, 76.95, 77.34, 77.73, 78.12 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 75.78 |

| Take Profit | 76.56, 76.96 |

| Stop Loss | 75.40 |

| Key Levels | 75.78, 76.17, 76.56, 76.95, 77.34, 77.73, 78.12 |

Current trend

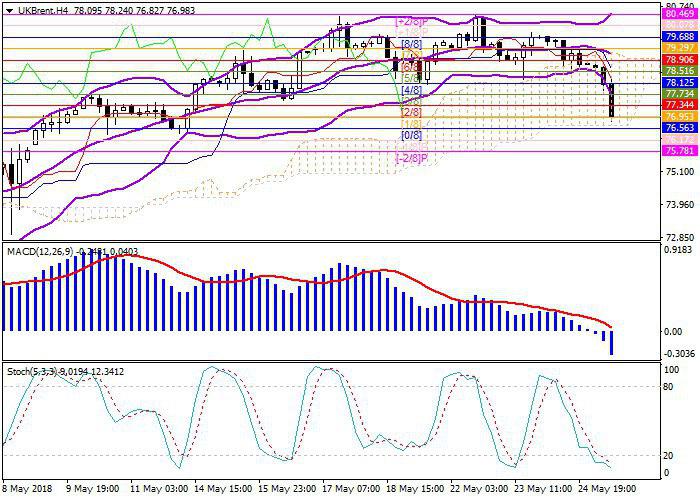

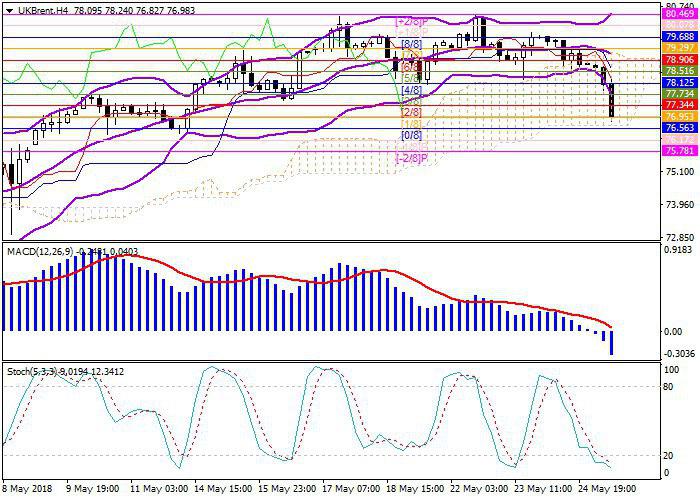

Oil quotes show negative dynamics. The price tested at a minimum at around 77.10 and retains the downward potential to 76.56-75.78 area.

At 75.78 mark there is a strong support level, from which a reversal and the formation of an upward correction is likely. The level of 78.51 (corresponding to the midline of Bollinger Bands) looks like the main target of correction.

Technical indicators mainly preserve a sell signal: Bollinger Bands show a diverge, signaling an active continuation of the current trend. MACD volumes are growing in the positive zone forming the sale signal. Stochatic lines are directed downwards.

Support and resistance

Support levels: 76.95, 76.56, 76.17, 75.78.

Resistance levels: 77.34, 77.73, 78.12.

Trading tips

Sell positions may be opened below 76.95 with targets at 76.56-75.78 area and the stop-loss at 77.30.

Buy positions may be opened if a price rebounds from the support level of 75.78 with targets at 76.56-76.96 area and the stop-loss at 75.40.

Oil quotes show negative dynamics. The price tested at a minimum at around 77.10 and retains the downward potential to 76.56-75.78 area.

At 75.78 mark there is a strong support level, from which a reversal and the formation of an upward correction is likely. The level of 78.51 (corresponding to the midline of Bollinger Bands) looks like the main target of correction.

Technical indicators mainly preserve a sell signal: Bollinger Bands show a diverge, signaling an active continuation of the current trend. MACD volumes are growing in the positive zone forming the sale signal. Stochatic lines are directed downwards.

Support and resistance

Support levels: 76.95, 76.56, 76.17, 75.78.

Resistance levels: 77.34, 77.73, 78.12.

Trading tips

Sell positions may be opened below 76.95 with targets at 76.56-75.78 area and the stop-loss at 77.30.

Buy positions may be opened if a price rebounds from the support level of 75.78 with targets at 76.56-76.96 area and the stop-loss at 75.40.

No comments:

Write comments