AUD/USD: Australian dollar remains under pressure

18 May 2018, 10:03

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7540 |

| Take Profit | 0.7612, 0.7638 |

| Stop Loss | 0.7500 |

| Key Levels | 0.7409, 0.7439, 0.7468, 0.7500, 0.7534, 0.7565, 0.7587, 0.7612 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7490 |

| Take Profit | 0.7439, 0.7400 |

| Stop Loss | 0.7550 |

| Key Levels | 0.7409, 0.7439, 0.7468, 0.7500, 0.7534, 0.7565, 0.7587, 0.7612 |

Current trend

The Australian dollar was weakening against the US dollar on Thursday, May 17, after strong growth the day before.

AUD/USD is under pressure due to the ambiguous statistics on the Australian labor market, published on Thursday. The unemployment rate rose to 5.6% in April from 5.5% a month earlier. The employment rate turned out to be better than expected and rose to 22.6K in April from -0.7K a month earlier. Expectations for consumer price inflation rose to 3.7% in May from 3.6% a month earlier.

During the Asian session on May 18, the pair traded in different directions, waiting for the new drivers on the market. On Friday market is waiting for the speeches of US Federal Reserve’s Robert Kaplan and Lael Brainard.

Support and resistance

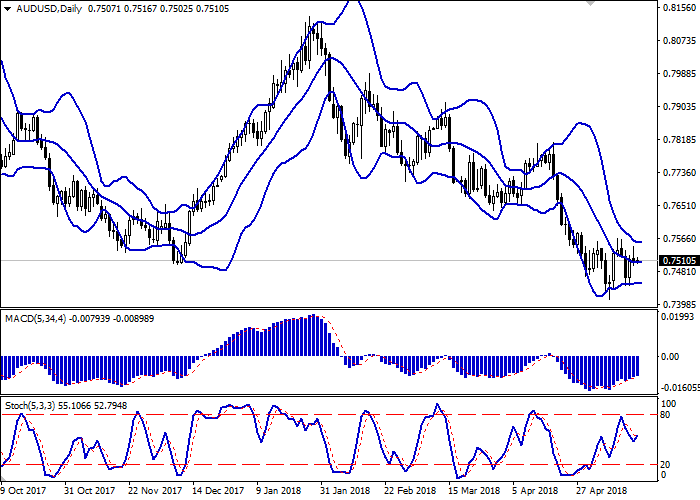

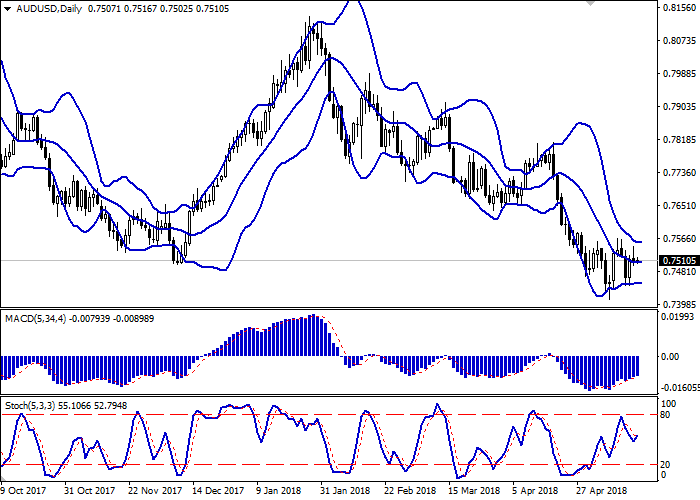

Bollinger bands on the daily chart move sideways. The price range is horizontal, which, however, fully corresponds to the current activity in the market.

MACD is growing, keeping a signal to buy (the histogram is above a signal line).

Stochastic turned up, which is poorly correlated with the real dynamics in the market.

Technical indicators do not give a clear signal, so it is necessary to wait for clarification of the situation.

Resistance levels: 0.7534, 0.7565, 0.7587, 0.7612.

Support levels: 0.7500, 0.7468, 0.7439, 0.7409.

Trading tips

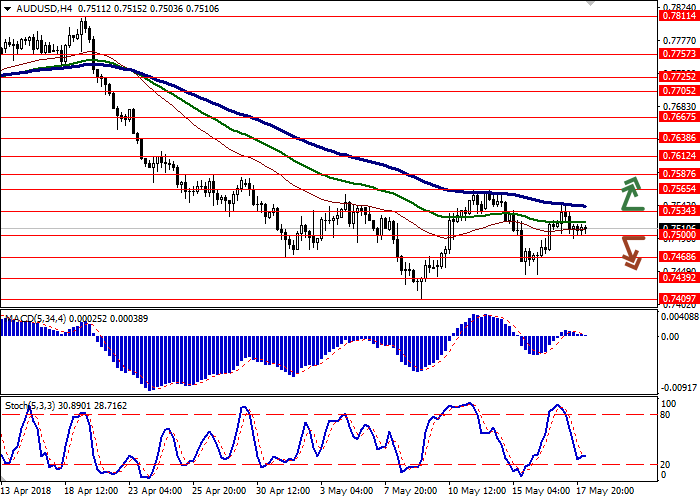

To open long positions, you can rely on the breakout of 0.7534. Take profit – 0.7612, 0.7638. Stop loss – 0.7500. Term of realization: 2-3 days.

A sure breakdown of 0.7500 can be a signal for new corrective sales with the goals of 0.7439 or 0.7400. Stop loss – 0.7550. Term of realization: 2-3 days.

The Australian dollar was weakening against the US dollar on Thursday, May 17, after strong growth the day before.

AUD/USD is under pressure due to the ambiguous statistics on the Australian labor market, published on Thursday. The unemployment rate rose to 5.6% in April from 5.5% a month earlier. The employment rate turned out to be better than expected and rose to 22.6K in April from -0.7K a month earlier. Expectations for consumer price inflation rose to 3.7% in May from 3.6% a month earlier.

During the Asian session on May 18, the pair traded in different directions, waiting for the new drivers on the market. On Friday market is waiting for the speeches of US Federal Reserve’s Robert Kaplan and Lael Brainard.

Support and resistance

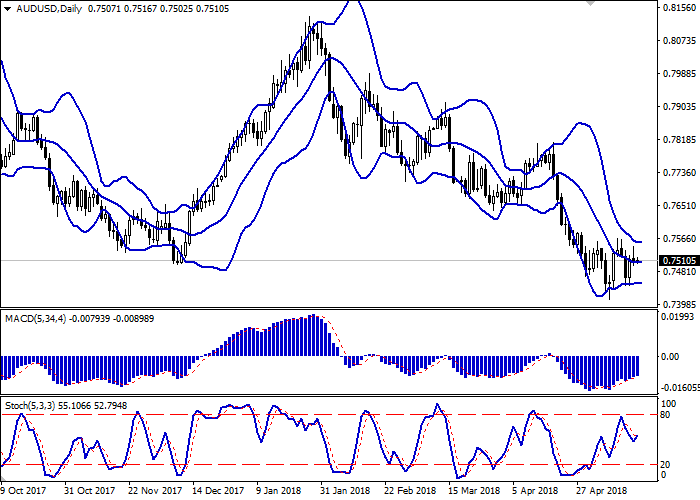

Bollinger bands on the daily chart move sideways. The price range is horizontal, which, however, fully corresponds to the current activity in the market.

MACD is growing, keeping a signal to buy (the histogram is above a signal line).

Stochastic turned up, which is poorly correlated with the real dynamics in the market.

Technical indicators do not give a clear signal, so it is necessary to wait for clarification of the situation.

Resistance levels: 0.7534, 0.7565, 0.7587, 0.7612.

Support levels: 0.7500, 0.7468, 0.7439, 0.7409.

Trading tips

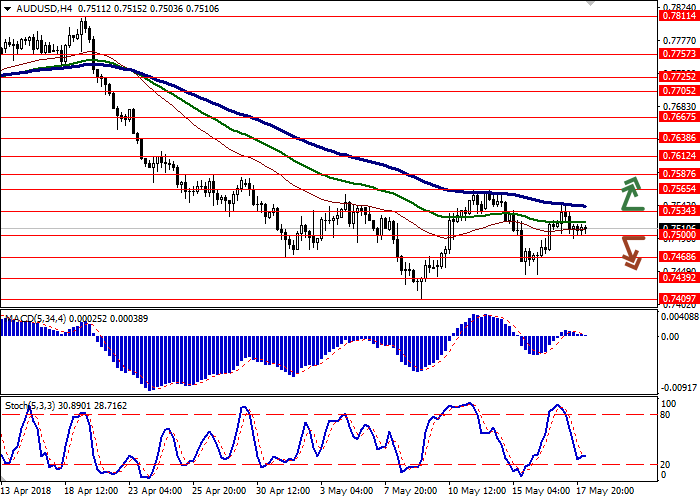

To open long positions, you can rely on the breakout of 0.7534. Take profit – 0.7612, 0.7638. Stop loss – 0.7500. Term of realization: 2-3 days.

A sure breakdown of 0.7500 can be a signal for new corrective sales with the goals of 0.7439 or 0.7400. Stop loss – 0.7550. Term of realization: 2-3 days.

No comments:

Write comments