AUD/USD: Australian dollar is trading mixed

07 May 2018, 09:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7565 |

| Take Profit | 0.7612, 0.7638 |

| Stop Loss | 0.7520 |

| Key Levels | 0.7400, 0.7439, 0.7468, 0.7500, 0.7534, 0.7559, 0.7575, 0.7587 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7490 |

| Take Profit | 0.7430, 0.7400 |

| Stop Loss | 0.7540 |

| Key Levels | 0.7400, 0.7439, 0.7468, 0.7500, 0.7534, 0.7559, 0.7575, 0.7587 |

Current trend

On Friday, AUD grew against USD, but by the end of the daily session, it has lost part of its gain due to US employment market data release.

Published on Friday, the Reserve Bank of Australia's comment on monetary policy has provided short-term support for the Australian currency, but after a slight increase, it once again began to decline. RBA predicts an acceleration of economic growth this year to 3.25%. But the regulator doubts that inflation will reach the target range of 2–3%. It was also noted that despite the acceptable growth rates of the economy, the RBA does not intend to raise the interest rate in the foreseeable future.

Сегодня the pair слабеет after публикации слабого индекс активности в строительном секторе, который in April decreased from 57.2 to 55.4 points.

Support and resistance

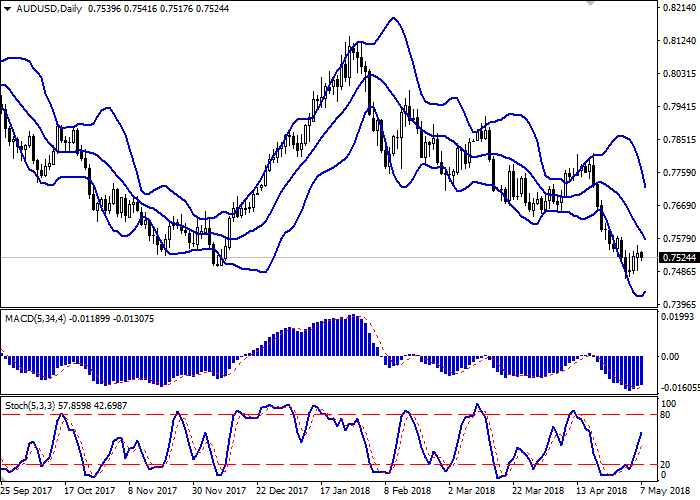

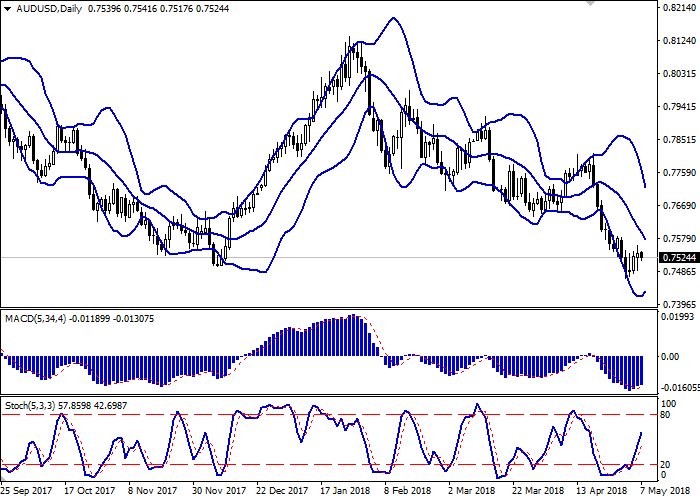

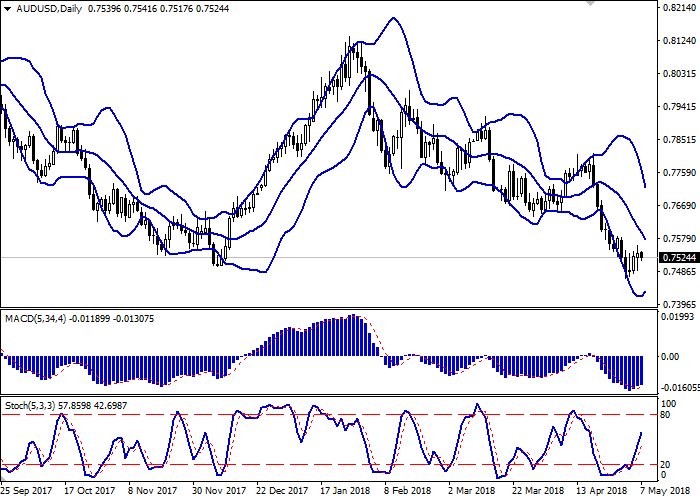

On the daily chart, Bollinger Bands are decreasing. The price range is actively narrowing, reflecting the appearance of the mixed dynamic.

MACD is growing, keeping a weak buy signal (the histogram is above the signal line). Stochastic is growing and is not reacting to the “bearish” dynamic appearance at the beginning of the week.

It is better to open long positions in the short term.

Resistance levels: 0.7534, 0.7559, 0.7575, 0.7587.

Support levels: 0.7500, 0.7468, 0.7439, 0.7400.

Trading tips

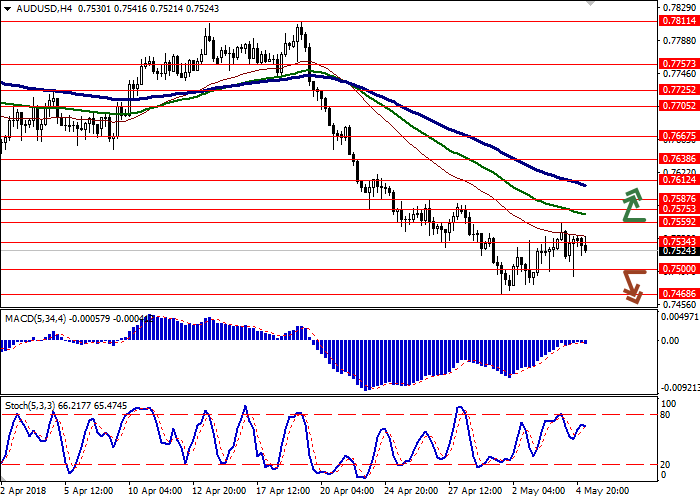

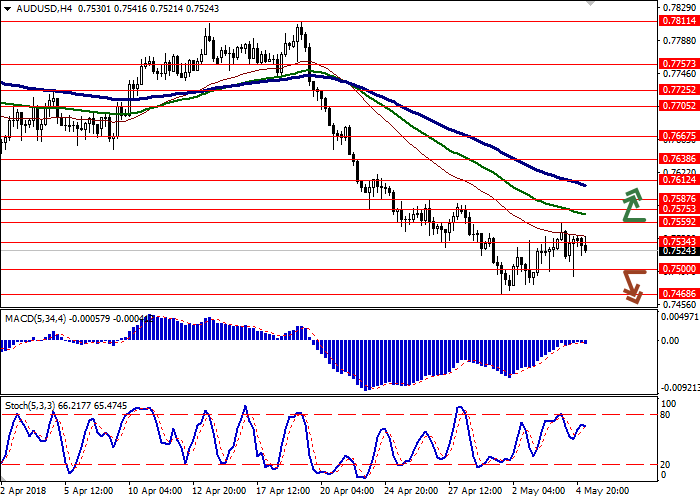

Long positions can be opened after the breakout of the level 0.7559 with the targets at 0.7612–0.7638 and stop loss 0.7520. Implementation period: 2 days.

Short positions can be opened after the breakdown of the level 0.7500 with the targets at 0.7430–0.7400 and stop loss 0.7540. Implementation period: 2–3 days.

On Friday, AUD grew against USD, but by the end of the daily session, it has lost part of its gain due to US employment market data release.

Published on Friday, the Reserve Bank of Australia's comment on monetary policy has provided short-term support for the Australian currency, but after a slight increase, it once again began to decline. RBA predicts an acceleration of economic growth this year to 3.25%. But the regulator doubts that inflation will reach the target range of 2–3%. It was also noted that despite the acceptable growth rates of the economy, the RBA does not intend to raise the interest rate in the foreseeable future.

Сегодня the pair слабеет after публикации слабого индекс активности в строительном секторе, который in April decreased from 57.2 to 55.4 points.

Support and resistance

On the daily chart, Bollinger Bands are decreasing. The price range is actively narrowing, reflecting the appearance of the mixed dynamic.

MACD is growing, keeping a weak buy signal (the histogram is above the signal line). Stochastic is growing and is not reacting to the “bearish” dynamic appearance at the beginning of the week.

It is better to open long positions in the short term.

Resistance levels: 0.7534, 0.7559, 0.7575, 0.7587.

Support levels: 0.7500, 0.7468, 0.7439, 0.7400.

Trading tips

Long positions can be opened after the breakout of the level 0.7559 with the targets at 0.7612–0.7638 and stop loss 0.7520. Implementation period: 2 days.

Short positions can be opened after the breakdown of the level 0.7500 with the targets at 0.7430–0.7400 and stop loss 0.7540. Implementation period: 2–3 days.

No comments:

Write comments