AUD/USD: Australian dollar is in the correction

10 May 2018, 09:49

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7500 |

| Take Profit | 0.7575, 0.7600, 0.7612 |

| Stop Loss | 0.7460 |

| Key Levels | 0.7384, 0.7409, 0.7439, 0.7468, 0.7500, 0.7534, 0.7559 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7430 |

| Take Profit | 0.7400, 0.7384, 0.7360 |

| Stop Loss | 0.7470 |

| Key Levels | 0.7384, 0.7409, 0.7439, 0.7468, 0.7500, 0.7534, 0.7559 |

Current trend

Yesterday AUD was trading in different directions against USD. During the day, the “bearish” moods prevailed, and the instrument renewed its highs since June 2, 2017, and restored all the loss by the end of the trading session.

The strengthening of AUD is due to the growth of investors’ interest in shelter assets against the increasing concern about the new US sanctions against Iran and the development of a political crisis in Italy. The growth of US bonds’ yield above 3%, which is the maximum of the last two weeks, supports the dollar. Today the investors will focus on Initial Jobless Claims release and Consumer Price Index publication.

Support and resistance

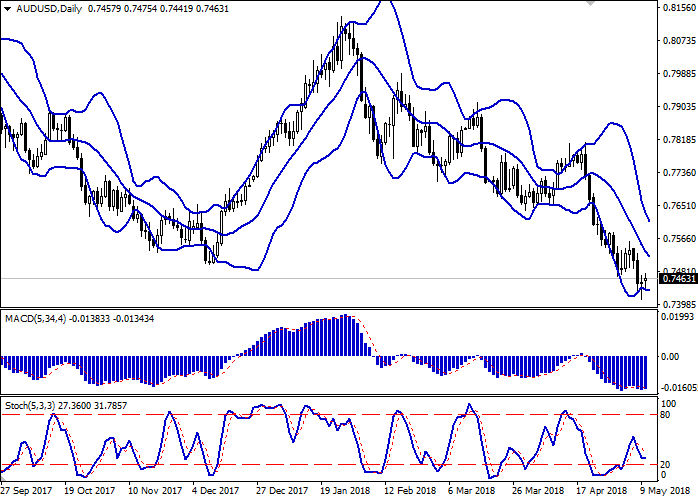

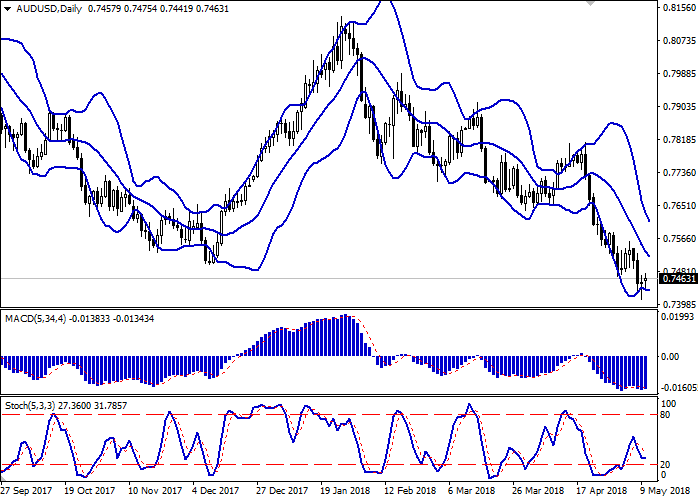

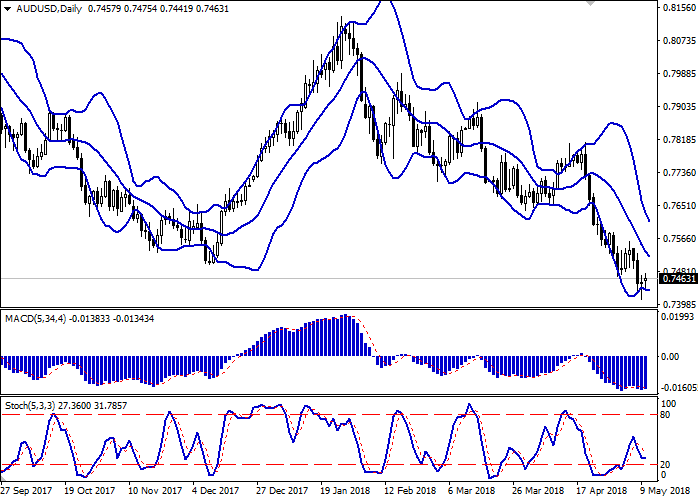

On the daily chart, Bollinger Bands are actively falling. The price range is narrowing, reflecting the mixed trade dynamic appearance in the short term.

MACD is trying to reverse upwards, keeping a sell signal (the histogram is below the signal line).

After a short decrease, Stochastic has reversed horizontally, reflecting the increase of “bullish” moods in the short or very short term.

It is possible to open long positions, as a buy signal can be formed in the short or very short term.

Resistance levels: 0.7468, 0.7500, 0.7534, 0.7559.

Support levels: 0.7439, 0.7409, 0.7384.

Trading tips

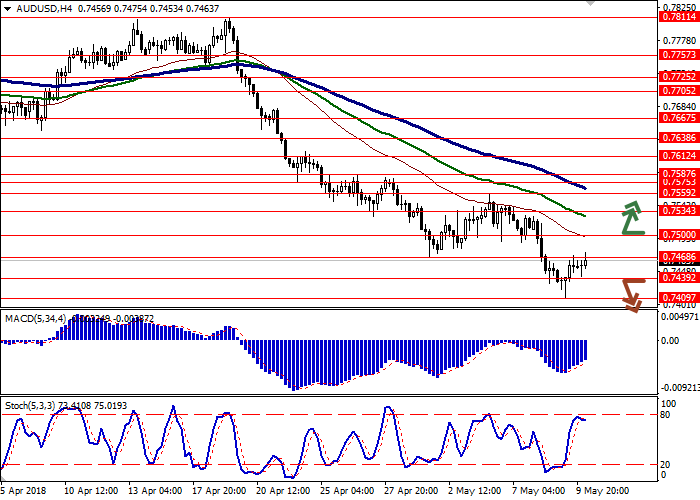

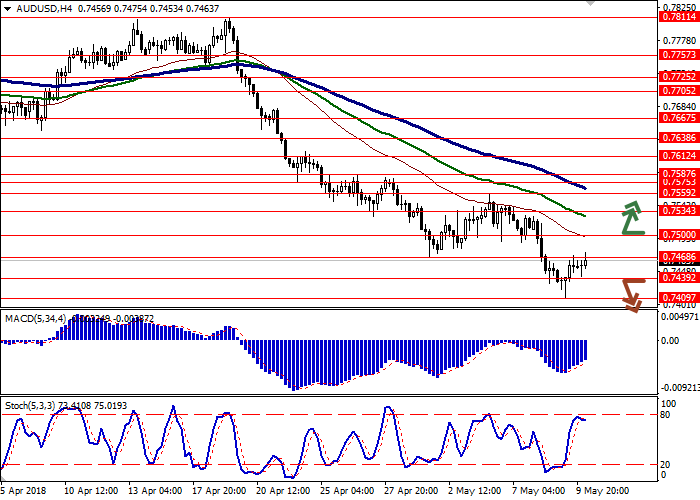

Long positions can be opened at the level of 0.7500 with the targets at 0.7575 or 0.7600–0.7612 and stop loss 0.7460.

Short positions can be opened after the breakdown of the level 0.7439 with the targets at 0.7400 or 0.7384–0.7360 and stop loss 0.7470.

Implementation period: 2–3 days.

Yesterday AUD was trading in different directions against USD. During the day, the “bearish” moods prevailed, and the instrument renewed its highs since June 2, 2017, and restored all the loss by the end of the trading session.

The strengthening of AUD is due to the growth of investors’ interest in shelter assets against the increasing concern about the new US sanctions against Iran and the development of a political crisis in Italy. The growth of US bonds’ yield above 3%, which is the maximum of the last two weeks, supports the dollar. Today the investors will focus on Initial Jobless Claims release and Consumer Price Index publication.

Support and resistance

On the daily chart, Bollinger Bands are actively falling. The price range is narrowing, reflecting the mixed trade dynamic appearance in the short term.

MACD is trying to reverse upwards, keeping a sell signal (the histogram is below the signal line).

After a short decrease, Stochastic has reversed horizontally, reflecting the increase of “bullish” moods in the short or very short term.

It is possible to open long positions, as a buy signal can be formed in the short or very short term.

Resistance levels: 0.7468, 0.7500, 0.7534, 0.7559.

Support levels: 0.7439, 0.7409, 0.7384.

Trading tips

Long positions can be opened at the level of 0.7500 with the targets at 0.7575 or 0.7600–0.7612 and stop loss 0.7460.

Short positions can be opened after the breakdown of the level 0.7439 with the targets at 0.7400 or 0.7384–0.7360 and stop loss 0.7470.

Implementation period: 2–3 days.

No comments:

Write comments