XAU/USD: technical analysis

04 April 2018, 09:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1339.10 |

| Take Profit | 1350.00 |

| Stop Loss | 1331.50 |

| Key Levels | 1306.64, 1314.06, 1319.94, 1325.61, 1332.02, 1336.60, 1339.78, 1343.74, 1349.40, 1355.59, 1363.02 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1330.60 |

| Take Profit | 1320.80 |

| Stop Loss | 1335.00 |

| Key Levels | 1306.64, 1314.06, 1319.94, 1325.61, 1332.02, 1336.60, 1339.78, 1343.74, 1349.40, 1355.59, 1363.02 |

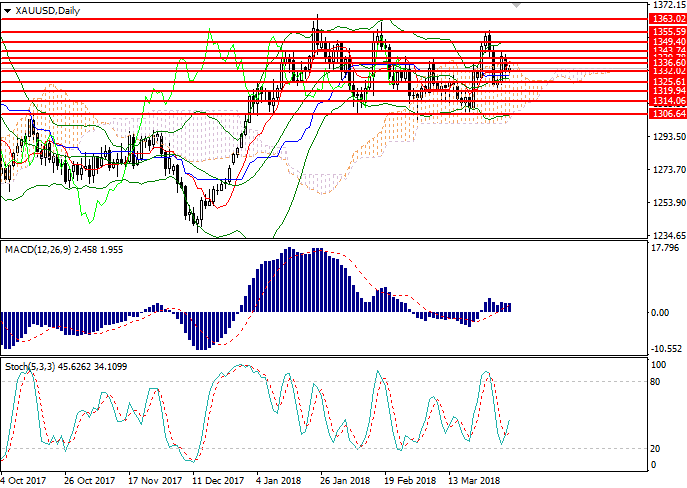

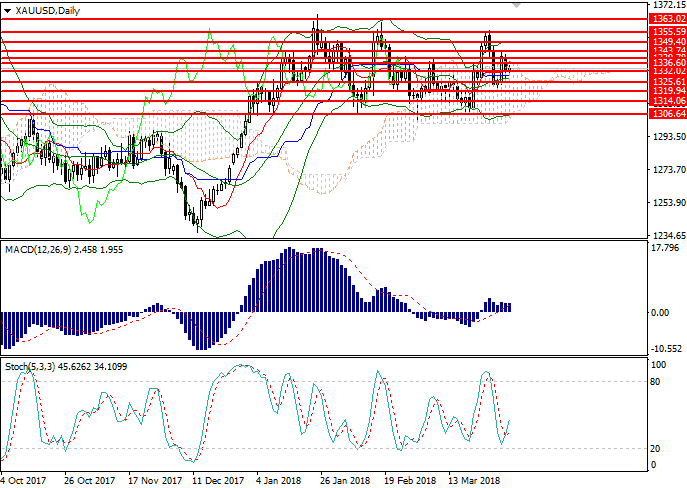

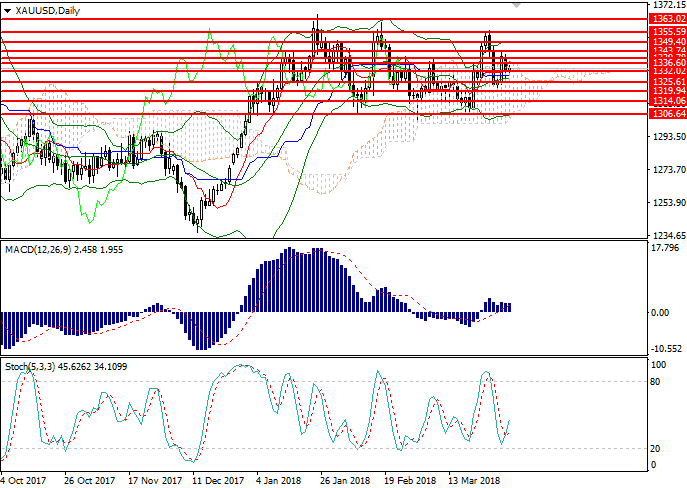

XAU/USD, D1

On D1 chart the pair is trading in the upper part of Bollinger Bands. The indicator is reversing upwards while the price range has widened which is a ground for the further strenghtening of the instrument. MACD histogram is in thee positive zone maintaining a weak buy signal. Stochastic has turned upwards at the border of the oversold area forming a relevant buy signal.

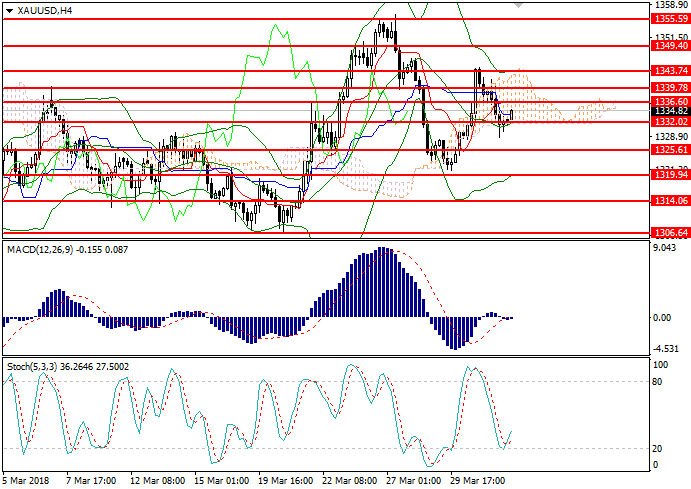

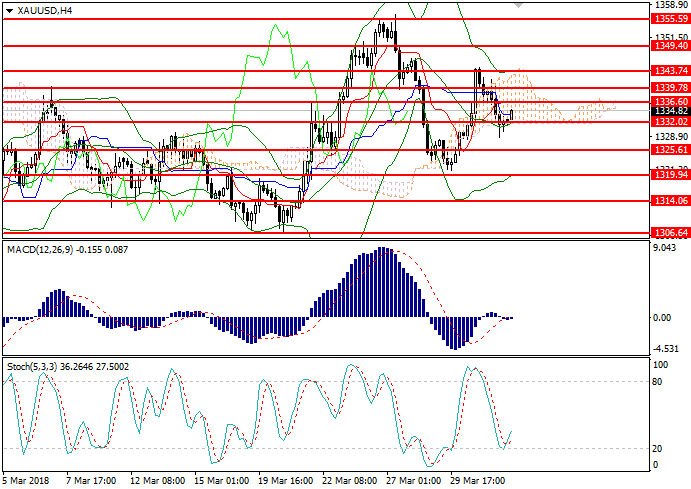

XAU/USD, H4

On the H4 chart the instrument is trading near the moving average of Bollinger Bands. The indicator is reversing upwards, and the price range remains unchanged, which indicates the preservation of the uptrend. MACD histogram is corrected at the zero mark, the signal for entering the market is not formed. Stochastic has turned upwards at the border of the oversold area forming a relevant buy signal.

Key levels

Support levels: 1306.64, 1314.06, 1319.94, 1325.61, 1332.02.

Resistance levels: 1336.60, 1339.78, 1343.74, 1349.40, 1355.59, 1363.02.

Trading tips

Long positions may be opened above the level of 1339.00 with target at 1350.00 and stop-loss at 1331.50. Implementation period: 1-2 days.

Short positions may be opened from the level of 1330.60 with target at 1320.80 and stop-loss at 1335.00. Implementation period: 1-2 days.

On D1 chart the pair is trading in the upper part of Bollinger Bands. The indicator is reversing upwards while the price range has widened which is a ground for the further strenghtening of the instrument. MACD histogram is in thee positive zone maintaining a weak buy signal. Stochastic has turned upwards at the border of the oversold area forming a relevant buy signal.

XAU/USD, H4

On the H4 chart the instrument is trading near the moving average of Bollinger Bands. The indicator is reversing upwards, and the price range remains unchanged, which indicates the preservation of the uptrend. MACD histogram is corrected at the zero mark, the signal for entering the market is not formed. Stochastic has turned upwards at the border of the oversold area forming a relevant buy signal.

Key levels

Support levels: 1306.64, 1314.06, 1319.94, 1325.61, 1332.02.

Resistance levels: 1336.60, 1339.78, 1343.74, 1349.40, 1355.59, 1363.02.

Trading tips

Long positions may be opened above the level of 1339.00 with target at 1350.00 and stop-loss at 1331.50. Implementation period: 1-2 days.

Short positions may be opened from the level of 1330.60 with target at 1320.80 and stop-loss at 1335.00. Implementation period: 1-2 days.

No comments:

Write comments