WTI Crude Oil: the dynamic is mixed

04 April 2018, 09:49

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 64.10 |

| Take Profit | 65.00, 65.50 |

| Stop Loss | 63.50 |

| Key Levels | 60.00, 61.00, 61.73, 62.67, 64.00, 64.89, 65.50, 66.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 62.60 |

| Take Profit | 61.30, 61.00 |

| Stop Loss | 63.00, 63.20 |

| Key Levels | 60.00, 61.00, 61.73, 62.67, 64.00, 64.89, 65.50, 66.00 |

Current trend

Yesterday oil price moderately grew after Monday’s greatest one-day fall since the beginning of the year. Poor positions of USD have supported the instrument slightly but the high volumes of oil production in Saudi Arabia and Russia have restricted the development of the “bullish” moods.

Also API Weekly Crude Oil Stock affected the prices positively. Last week the index surprisingly decreased by 3.280 million barrel after the growth by 5.321 million barrel in the previous period, while the market expected the increase by 1.667 million barrel.

Today the investors are focused on EIA Crude Oil Stocks change release at 16:30 (GMT+2).

Support and resistance

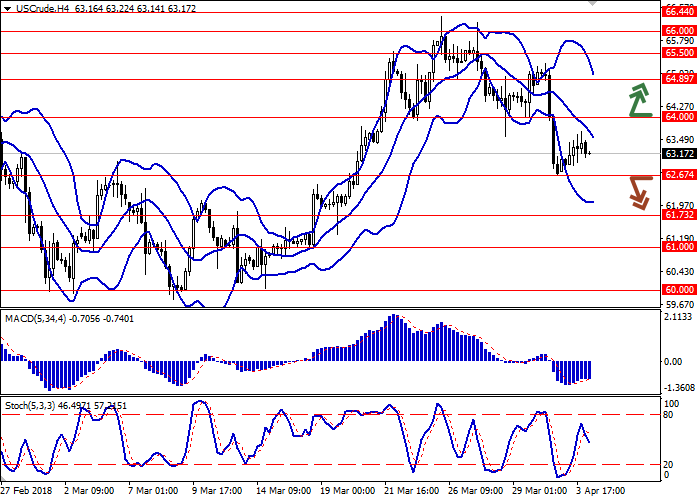

On the 4-hour chart, Bollinger Bands are actively decreasing. The price range is widening, reflecting the rapid change of the trade direction in the short or very short term.

MACD is slightly growing, keeping a weak buy signal (the histogram is above the signal line).

Stochastic has reversed downwards in react to the “bearish” mood of today’s Asian trading session.

The technical indicators’ readings are controversial, so it is better to wait until the situation is clear.

Resistance levels: 64.00, 64.89, 65.50, 66.00.

Support levels: 62.67, 61.73, 61.00, 60.00.

Trading tips

Long positions can be opened after the breakout of the level 64.00 with the targets at 65.00–65.50 and stop loss 63.50.

Short positions can be opened after the breakdown of the level 62.67 with the targets at 61.30–61.00 and stop loss 63.00–63.20.

Implementation period: 2–3 days.

Yesterday oil price moderately grew after Monday’s greatest one-day fall since the beginning of the year. Poor positions of USD have supported the instrument slightly but the high volumes of oil production in Saudi Arabia and Russia have restricted the development of the “bullish” moods.

Also API Weekly Crude Oil Stock affected the prices positively. Last week the index surprisingly decreased by 3.280 million barrel after the growth by 5.321 million barrel in the previous period, while the market expected the increase by 1.667 million barrel.

Today the investors are focused on EIA Crude Oil Stocks change release at 16:30 (GMT+2).

Support and resistance

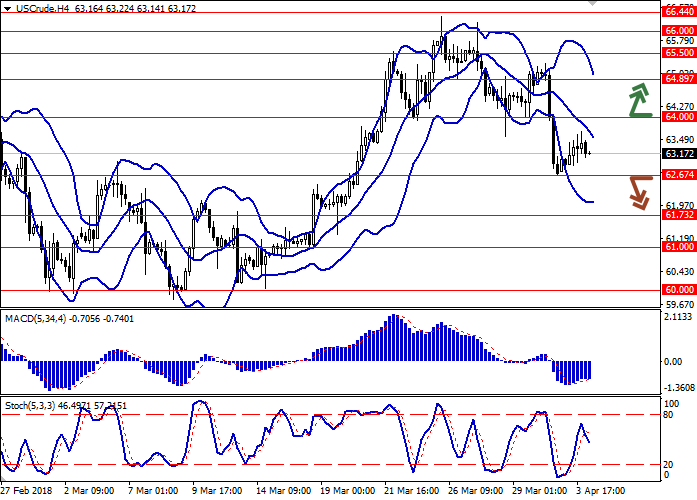

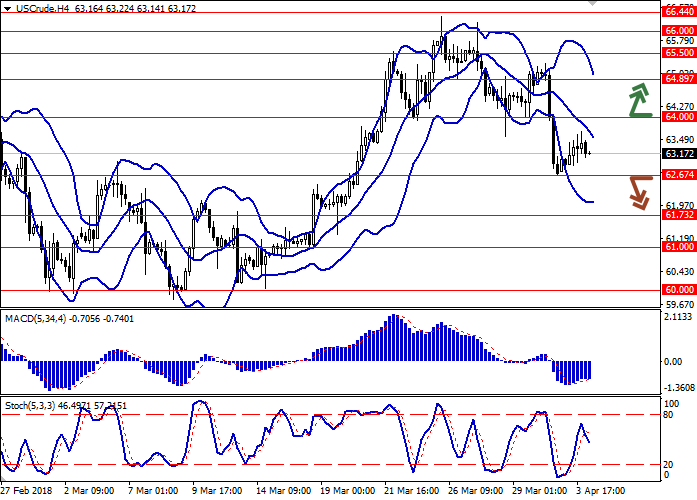

On the 4-hour chart, Bollinger Bands are actively decreasing. The price range is widening, reflecting the rapid change of the trade direction in the short or very short term.

MACD is slightly growing, keeping a weak buy signal (the histogram is above the signal line).

Stochastic has reversed downwards in react to the “bearish” mood of today’s Asian trading session.

The technical indicators’ readings are controversial, so it is better to wait until the situation is clear.

Resistance levels: 64.00, 64.89, 65.50, 66.00.

Support levels: 62.67, 61.73, 61.00, 60.00.

Trading tips

Long positions can be opened after the breakout of the level 64.00 with the targets at 65.00–65.50 and stop loss 63.50.

Short positions can be opened after the breakdown of the level 62.67 with the targets at 61.30–61.00 and stop loss 63.00–63.20.

Implementation period: 2–3 days.

No comments:

Write comments