USD/CHF: technical analysis

09 April 2018, 11:08

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.9575 |

| Take Profit | 0.9500, 0.9520 |

| Stop Loss | 0.9618 |

| Key Levels | 0.9521, 0.9550, 0.9570, 0.9589, 0.9606, 0.9625, 0.9640, 0.9679 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9618 |

| Take Profit | 0.9665 |

| Stop Loss | 0.9595 |

| Key Levels | 0.9521, 0.9550, 0.9570, 0.9589, 0.9606, 0.9625, 0.9640, 0.9679 |

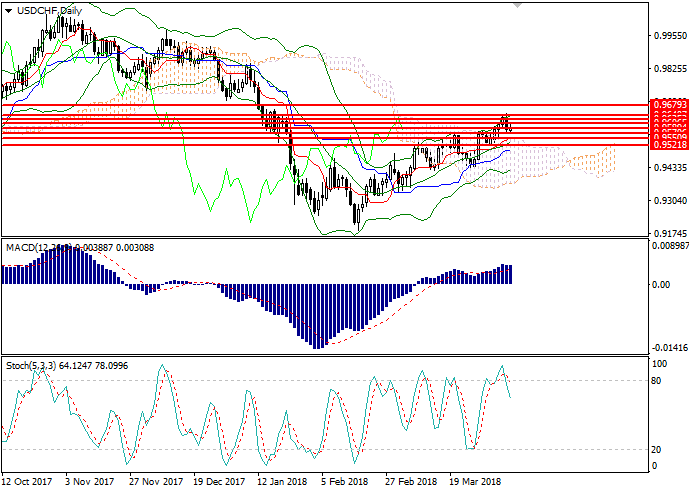

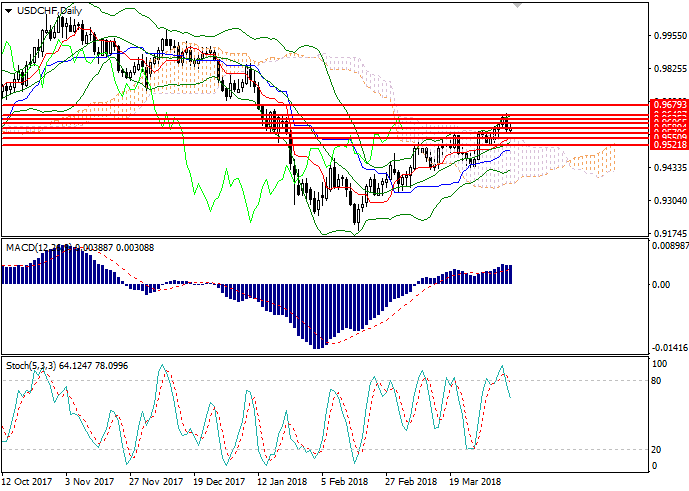

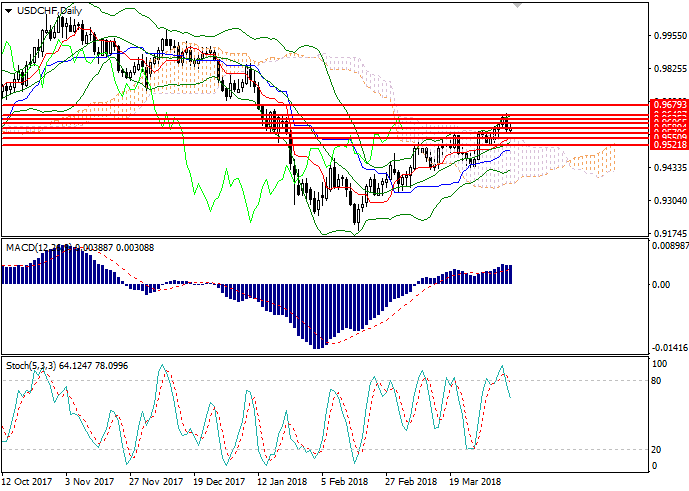

USD/CHF, D1

On D1 chart the pair is trading in the upper part of Bollinger Bands. The indicator is pointing upwards, while the price range has not significantly decreased, which indicates continuation of the pair correction. Significant resistance is the level of 0.9440, the breakdown of which will become a strong buy signal. MACD histogram is in the positive zone maintaining the buy signal. Stochastic has left the overbought area having formed a strong sell signal.

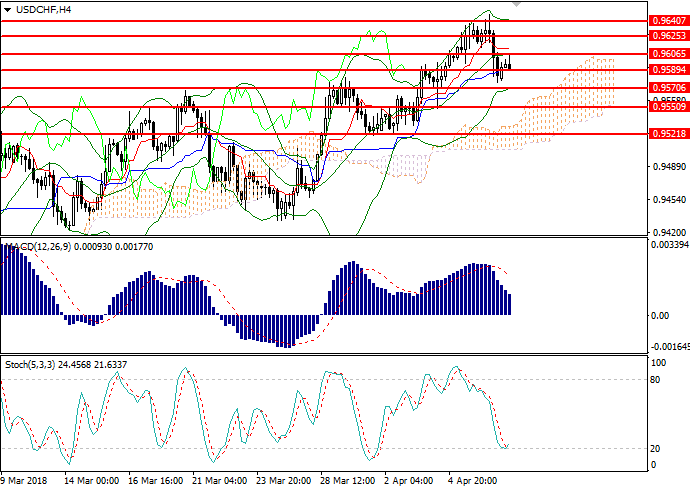

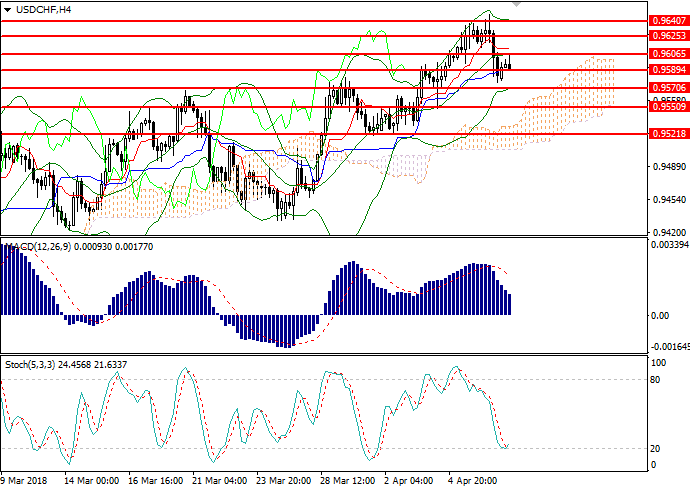

USD/CHF, H4

On the H4 chart the instrument is trading near the moving average of Bollinger Bands. The indicator reverses sideways, and the price range is reduced, correction of the downtrend is still relevant. MACD histogram is in the positive zone with its volumes reducing and the buy signal is relevant. Stochastic turned upwards from the border of the oversold area, forming a buy signal.

Key levels

Support levels: 0.9521, 0.9550, 0.9570, 0.9589.

Resistance levels: 0.9606, 0.9625, 0.9640, 0.9679.

Trading tips

Short positions could be opened from the level of 0.9580 with targets at 0.9500, 0.9520 and stop-loss at 0.9618. Implementation period: 1 day.

Long positions may be opened from the level of 0.9618 with target at 0.9665 and stop-loss at 0.9595. Implementation period: 1 day.

On D1 chart the pair is trading in the upper part of Bollinger Bands. The indicator is pointing upwards, while the price range has not significantly decreased, which indicates continuation of the pair correction. Significant resistance is the level of 0.9440, the breakdown of which will become a strong buy signal. MACD histogram is in the positive zone maintaining the buy signal. Stochastic has left the overbought area having formed a strong sell signal.

USD/CHF, H4

On the H4 chart the instrument is trading near the moving average of Bollinger Bands. The indicator reverses sideways, and the price range is reduced, correction of the downtrend is still relevant. MACD histogram is in the positive zone with its volumes reducing and the buy signal is relevant. Stochastic turned upwards from the border of the oversold area, forming a buy signal.

Key levels

Support levels: 0.9521, 0.9550, 0.9570, 0.9589.

Resistance levels: 0.9606, 0.9625, 0.9640, 0.9679.

Trading tips

Short positions could be opened from the level of 0.9580 with targets at 0.9500, 0.9520 and stop-loss at 0.9618. Implementation period: 1 day.

Long positions may be opened from the level of 0.9618 with target at 0.9665 and stop-loss at 0.9595. Implementation period: 1 day.

No comments:

Write comments