USD/CHF: dollar is moderately growing

03 April 2018, 10:11

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9570, 0.9585 |

| Take Profit | 0.9600, 0.9630 |

| Stop Loss | 0.9545, 0.9555 |

| Key Levels | 0.9454, 0.9488, 0.9510, 0.9532, 0.9562, 0.9580, 0.9600 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9530, 0.9500 |

| Take Profit | 0.9470, 0.9454 |

| Stop Loss | 0.9550, 0.9560 |

| Key Levels | 0.9454, 0.9488, 0.9510, 0.9532, 0.9562, 0.9580, 0.9600 |

Current trend

USD yesterday showed moderate growth against CHF, taking advantage of low trading activity in the market due to Easter holidays. At the same time, USD practically did not react to the publication of mixed statistics on business activity for March.

Markit Manufacturing PMI fell from 55.7 to 55.6 points, and a similar index from ISM fell from 60.8 to 59.3 points.

USD is under pressure due to Chinese decision to imply retaliatory 25% import fees on the list of goods made in the USA, which came into force on April 2. The measure is a part of retaliatory pressure from Beijing to improve China’s positions during the trade negotiations with the USA.

The investors focus today on the Swiss statistics on real retail sales for February (09:15 GMT+2) and PMI for March from SVME (09:30 GMT+2). The US will attract attention by the representatives of the Fed, Kashkari and Brainard's reports.

Support and resistance

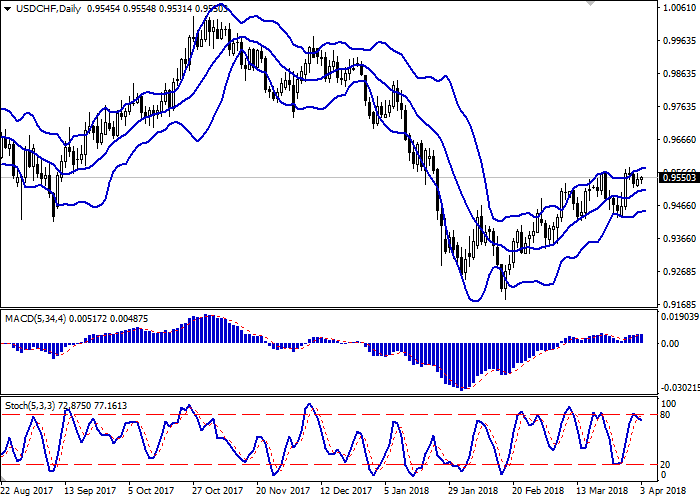

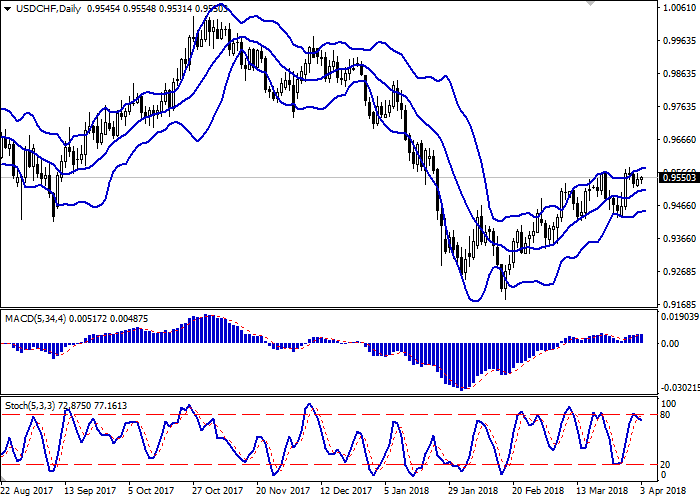

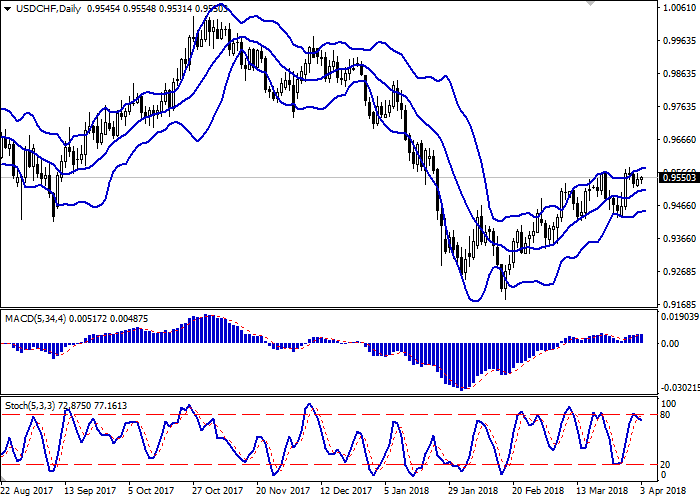

Bollinger Bands in D1 chart demonstrate mixed dynamics. The price range does not change much, outlining the approximate boundaries of the short-term/mid-term flat channel.

MACD indicator is growing preserving a weak buy signal (histogram is above the signal line).

Stochastic, in turn, reaching the mark of "80", reversed downwards, indicating "bearish" risks.

The technical indicators remain uninformative, so it is reasonable to wait for clarification of the situation.

Resistance levels: 0.9562, 0.9580, 0.9600.

Support levels: 0.9532, 0.9510, 0.9488, 0.9454.

Trading tips

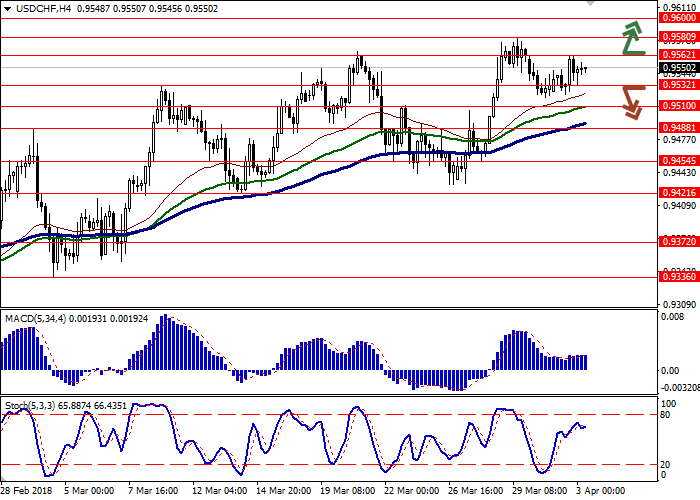

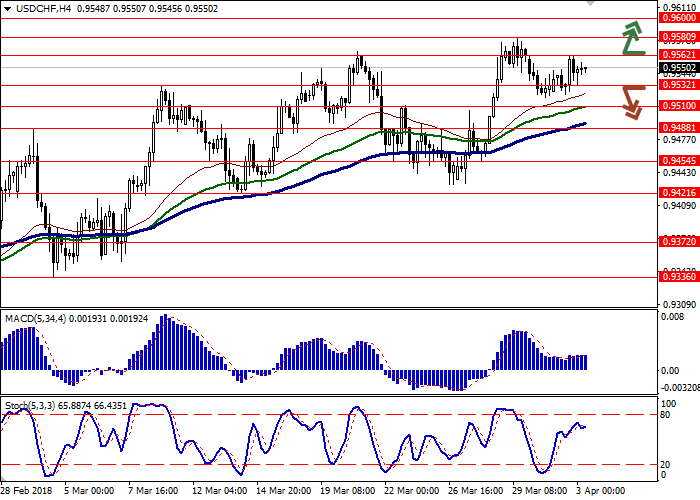

To open long positions, one can rely on the breakout of 0.9562 or 0.9580 marks. Take-profit – 0.9600 or 0.9630. Implementation period: 2 days.

The return of "bearish" trend with the breakdown of the level of 0.9532–0.9510 may become a signal for new sales with the targets at 0.9470 or 0.9454. Stop-loss — 0.9550, 0.9560. Implementation period: 2-3 days.

USD yesterday showed moderate growth against CHF, taking advantage of low trading activity in the market due to Easter holidays. At the same time, USD practically did not react to the publication of mixed statistics on business activity for March.

Markit Manufacturing PMI fell from 55.7 to 55.6 points, and a similar index from ISM fell from 60.8 to 59.3 points.

USD is under pressure due to Chinese decision to imply retaliatory 25% import fees on the list of goods made in the USA, which came into force on April 2. The measure is a part of retaliatory pressure from Beijing to improve China’s positions during the trade negotiations with the USA.

The investors focus today on the Swiss statistics on real retail sales for February (09:15 GMT+2) and PMI for March from SVME (09:30 GMT+2). The US will attract attention by the representatives of the Fed, Kashkari and Brainard's reports.

Support and resistance

Bollinger Bands in D1 chart demonstrate mixed dynamics. The price range does not change much, outlining the approximate boundaries of the short-term/mid-term flat channel.

MACD indicator is growing preserving a weak buy signal (histogram is above the signal line).

Stochastic, in turn, reaching the mark of "80", reversed downwards, indicating "bearish" risks.

The technical indicators remain uninformative, so it is reasonable to wait for clarification of the situation.

Resistance levels: 0.9562, 0.9580, 0.9600.

Support levels: 0.9532, 0.9510, 0.9488, 0.9454.

Trading tips

To open long positions, one can rely on the breakout of 0.9562 or 0.9580 marks. Take-profit – 0.9600 or 0.9630. Implementation period: 2 days.

The return of "bearish" trend with the breakdown of the level of 0.9532–0.9510 may become a signal for new sales with the targets at 0.9470 or 0.9454. Stop-loss — 0.9550, 0.9560. Implementation period: 2-3 days.

No comments:

Write comments