NZD/USD: New Zealand dollar is growing

09 April 2018, 09:56

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7310 |

| Take Profit | 0.7340, 0.7350 |

| Stop Loss | 0.7280, 0.7275 |

| Key Levels | 0.7222, 0.7241, 0.7261, 0.7278, 0.7300, 0.7321, 0.7353 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7270 |

| Take Profit | 0.7241, 0.7222 |

| Stop Loss | 0.7300 |

| Key Levels | 0.7222, 0.7241, 0.7261, 0.7278, 0.7300, 0.7321, 0.7353 |

Current trend

Today NZD is strongly growing against USD, as the US currency stays under pressure of disappointing March US employment market release on Friday.

Investors are also focused on the US-China trade conflict, which continues to worsen. On Thursday, Donald Trump instructed the Office of the United States Trade Representative to compile a new list of Chinese goods that can be taxed, this time amounting 100 billion, in response to the Celestial Empire's intention to impose a 25% duty on American goods totaling USD 50 billion.

Support and resistance

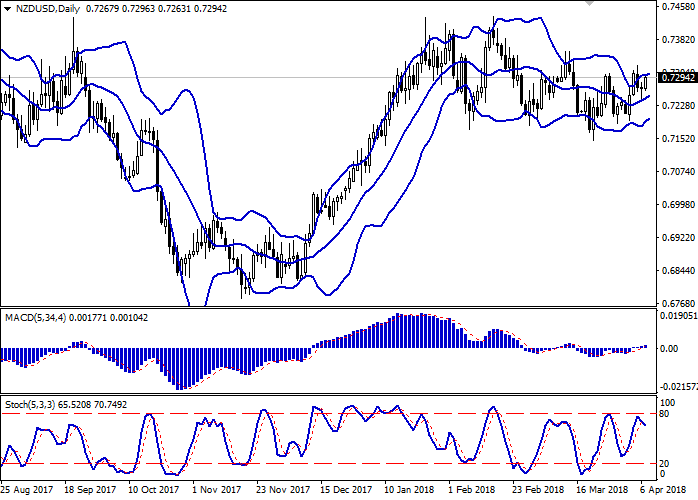

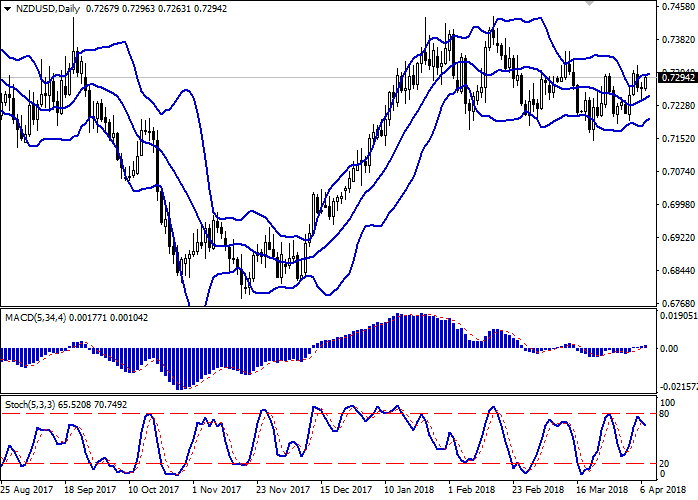

On the daily chart, Bollinger Bands are quite strongly growing. The price range stays almost the same, restricting the development of the “bullish” trend in the short term. MACD is growing, keeping a weak buy signal (the histogram is above the signal line). The indicator is in the positive zone and has recently consolidated above the zero line. Stochastic has reversed downwards, reacting to the “bearish” trading mood at the end of the last week.

The indicators do not give a clear signal. It is better to wait until the situation is unequivocal but it is better to keep a part of current long positions in the short or very short term for some time.

Resistance levels: 0.7300, 0.7321, 0.7353.

Support levels: 0.7278, 0.7261, 0.7241, 0.7222.

Trading tips

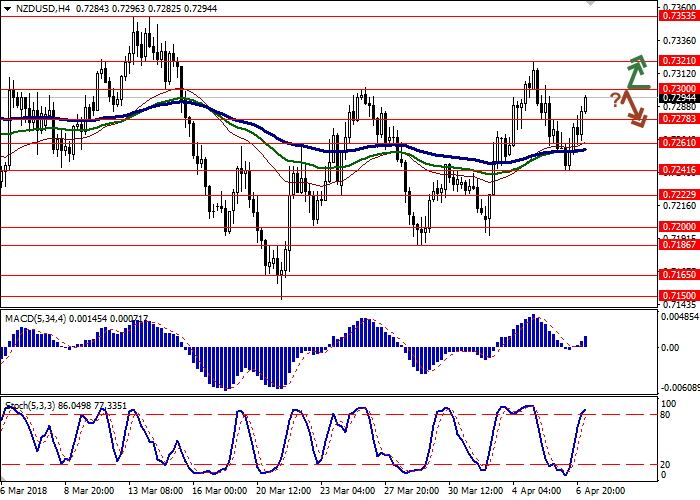

Long positions can be opened after the breakout of the level 0.7300 with the targets at 0.7340–0.7350 and stop loss 0.7280–0.7275. Implementation period: 2–3 days.

Short positions can be opened after the rebound at the level of 0.7300 and the breakdown of the level 0.7278 with the targets at 0.7241–0.7222 and stop loss not far as 0.7300. Implementation period: 2–4 days.

Today NZD is strongly growing against USD, as the US currency stays under pressure of disappointing March US employment market release on Friday.

Investors are also focused on the US-China trade conflict, which continues to worsen. On Thursday, Donald Trump instructed the Office of the United States Trade Representative to compile a new list of Chinese goods that can be taxed, this time amounting 100 billion, in response to the Celestial Empire's intention to impose a 25% duty on American goods totaling USD 50 billion.

Support and resistance

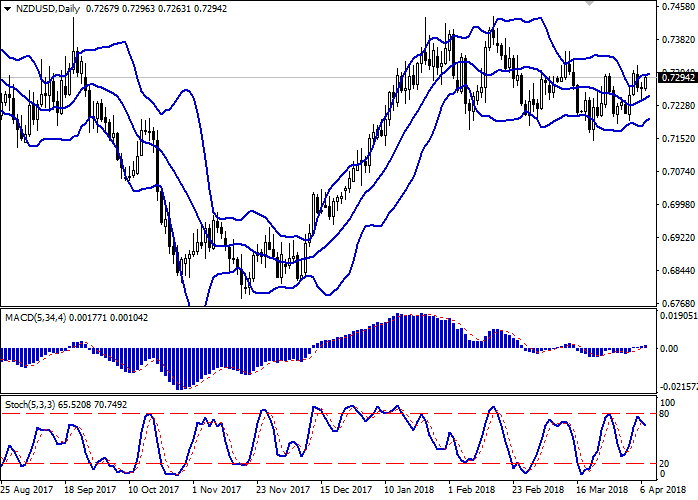

On the daily chart, Bollinger Bands are quite strongly growing. The price range stays almost the same, restricting the development of the “bullish” trend in the short term. MACD is growing, keeping a weak buy signal (the histogram is above the signal line). The indicator is in the positive zone and has recently consolidated above the zero line. Stochastic has reversed downwards, reacting to the “bearish” trading mood at the end of the last week.

The indicators do not give a clear signal. It is better to wait until the situation is unequivocal but it is better to keep a part of current long positions in the short or very short term for some time.

Resistance levels: 0.7300, 0.7321, 0.7353.

Support levels: 0.7278, 0.7261, 0.7241, 0.7222.

Trading tips

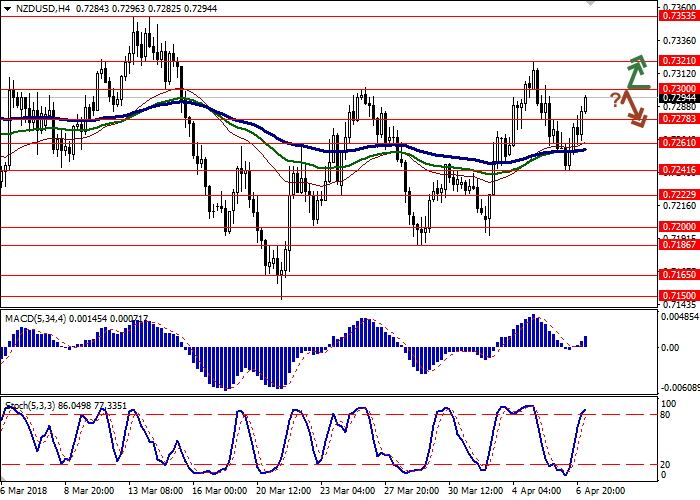

Long positions can be opened after the breakout of the level 0.7300 with the targets at 0.7340–0.7350 and stop loss 0.7280–0.7275. Implementation period: 2–3 days.

Short positions can be opened after the rebound at the level of 0.7300 and the breakdown of the level 0.7278 with the targets at 0.7241–0.7222 and stop loss not far as 0.7300. Implementation period: 2–4 days.

No comments:

Write comments