NZD/USD: Murray analysis

02 April 2018, 14:27

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7270 |

| Take Profit | 0.7324, 0.7385 |

| Stop Loss | 0.7235 |

| Key Levels | 0.7019, 0.7080, 0.7200, 0.7263, 0.7324, 0.7385 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7160 |

| Take Profit | 0.7080, 0.7019 |

| Stop Loss | 0.7200 |

| Key Levels | 0.7019, 0.7080, 0.7200, 0.7263, 0.7324, 0.7385 |

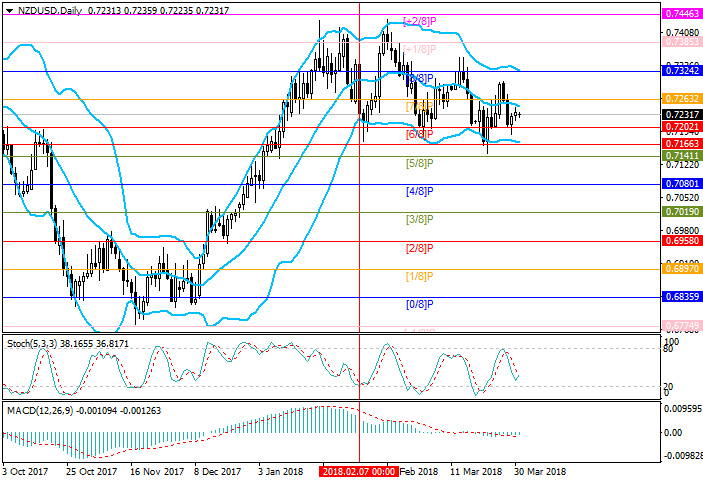

On D1 chart, the price tested the 0.7200 mark ([6/8]). This level is seen as

key for "bears", as unsuccessful attempts to overcome it continue since

February.

Currently, the price is growing again, tending to the level of 0.7263 ([7/8], the midline of Bollinger Bands), and at its breakout quotes may reach the levels of 0.7324 ([8/8], the upper border of Bollinger Bands) and 0.7385 ([+1/8]). The probability of growth is confirmed by Stochastic reversing upwards. Continuation of the decline to the levels of 0.7080 ([4/8]) and 0.7019 ([3/8]) will be possible only if the instrument is consolidated below the 0.7200 mark.

Support and resistance

Support levels: 0.7200 ([6/8]), 0.7080 ([4/8]), 0.7019 ([3/8]).

Resistance levels: 0.7263 ([7/8]), 0.7324 ([8/8]), 0.7385 ([+1/8]).

Trading tips

Long positions may be opened above the level of 0.7263 with targets at 0.7324, 0.7385 and stop-loss at 0.7235 mark.

Short positions may be opened from the level of 0.7160 with targets at 0.7080, 0.7019 and stop-loss at 0.7200 mark.

Currently, the price is growing again, tending to the level of 0.7263 ([7/8], the midline of Bollinger Bands), and at its breakout quotes may reach the levels of 0.7324 ([8/8], the upper border of Bollinger Bands) and 0.7385 ([+1/8]). The probability of growth is confirmed by Stochastic reversing upwards. Continuation of the decline to the levels of 0.7080 ([4/8]) and 0.7019 ([3/8]) will be possible only if the instrument is consolidated below the 0.7200 mark.

Support and resistance

Support levels: 0.7200 ([6/8]), 0.7080 ([4/8]), 0.7019 ([3/8]).

Resistance levels: 0.7263 ([7/8]), 0.7324 ([8/8]), 0.7385 ([+1/8]).

Trading tips

Long positions may be opened above the level of 0.7263 with targets at 0.7324, 0.7385 and stop-loss at 0.7235 mark.

Short positions may be opened from the level of 0.7160 with targets at 0.7080, 0.7019 and stop-loss at 0.7200 mark.

No comments:

Write comments