EUR/USD: sideway consolidation maintains

02 April 2018, 14:25

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 1.2450 |

| Take Profit | 1.2350 |

| Stop Loss | 1.2480 |

| Key Levels | 1.2175, 1.2225, 1.2250, 1.2280, 1.2310, 1.2330, 1.2360, 1.2420, 1.2430, 1.2450, 1.2475 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.2280 |

| Take Profit | 1.2380 |

| Stop Loss | 1.2250 |

| Key Levels | 1.2175, 1.2225, 1.2250, 1.2280, 1.2310, 1.2330, 1.2360, 1.2420, 1.2430, 1.2450, 1.2475 |

Current trend

At the end of March, EUR against USD tested the maximum of the last 1.5 months at the level of 1.2475. The pair could not break the level, reversed and began to decrease rapidly.

The main catalyst of the fall is the increased investment attractiveness of the US currency due to the positive American data: Q4 US economic growth rate and employment market report. The euro is under pressure due to the poor key EU indices releases.

At the end of the last week, the trading activity was low due to the Good Friday. The market is expected to stay calm today: USD is slowly weakening against its main competitors, as the investors are waiting for ISM Manufacturing PMI release in the USA. In the middle of the week, the volatility will grow after publications of American data: employment market, manufacturing orders, unemployment level and Nonfarm Payrolls reports. The key indices and unemployment data will be published in Eurozone.

Support and resistance

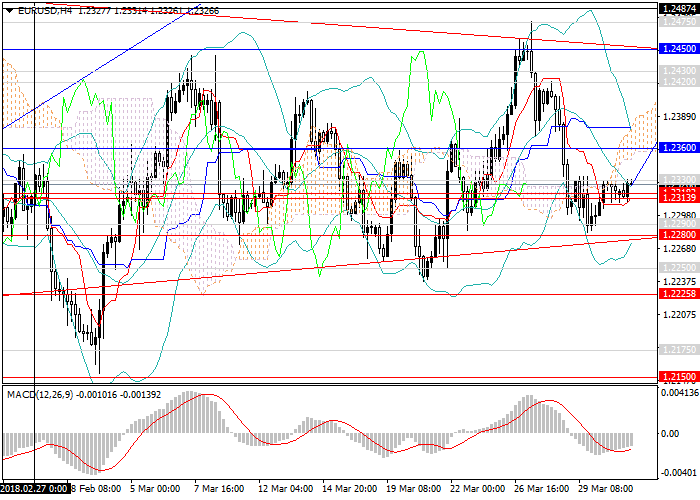

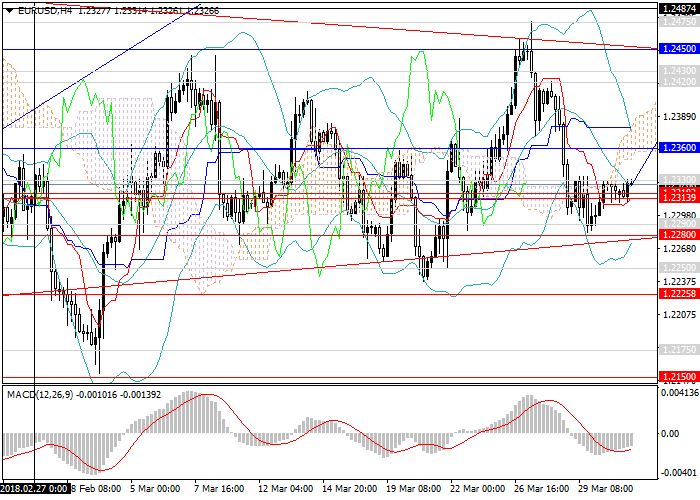

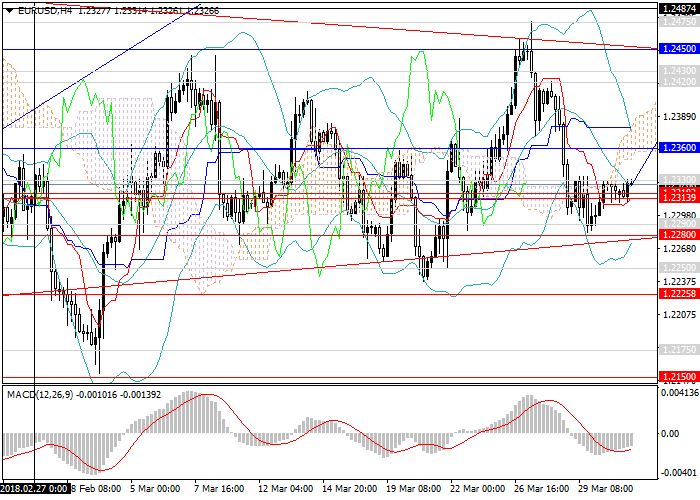

In the short term, the strengthening of the upward momentum with the target at 1.2450 is expected. Then the pair will be trading within a wide sideways channel. The consolidation of the price is due to the lack of key fundamental catalysts.

On the daily chart, technical indicators reflect the maintenance of the consolidation. MACD volumes are minimal, the signal line is around the zero one, and Bollinger Bands are pointed horizontally.

Resistance levels: 1.2330, 1.2360, 1.2420, 1.2430, 1.2450, 1.2475.

Support levels: 1.2310, 1.2280, 1.2250, 1.2225, 1.2175.

Trading tips

Short limited pending orders can be opened at the level of 1.2450 with the target at 1.2350 and short stop loss 1.2480.

Long limited pending orders can be opened of the level 1.2280 with the target at 1.2380 and short stop loss 1.2250.

At the end of March, EUR against USD tested the maximum of the last 1.5 months at the level of 1.2475. The pair could not break the level, reversed and began to decrease rapidly.

The main catalyst of the fall is the increased investment attractiveness of the US currency due to the positive American data: Q4 US economic growth rate and employment market report. The euro is under pressure due to the poor key EU indices releases.

At the end of the last week, the trading activity was low due to the Good Friday. The market is expected to stay calm today: USD is slowly weakening against its main competitors, as the investors are waiting for ISM Manufacturing PMI release in the USA. In the middle of the week, the volatility will grow after publications of American data: employment market, manufacturing orders, unemployment level and Nonfarm Payrolls reports. The key indices and unemployment data will be published in Eurozone.

Support and resistance

In the short term, the strengthening of the upward momentum with the target at 1.2450 is expected. Then the pair will be trading within a wide sideways channel. The consolidation of the price is due to the lack of key fundamental catalysts.

On the daily chart, technical indicators reflect the maintenance of the consolidation. MACD volumes are minimal, the signal line is around the zero one, and Bollinger Bands are pointed horizontally.

Resistance levels: 1.2330, 1.2360, 1.2420, 1.2430, 1.2450, 1.2475.

Support levels: 1.2310, 1.2280, 1.2250, 1.2225, 1.2175.

Trading tips

Short limited pending orders can be opened at the level of 1.2450 with the target at 1.2350 and short stop loss 1.2480.

Long limited pending orders can be opened of the level 1.2280 with the target at 1.2380 and short stop loss 1.2250.

No comments:

Write comments