GBP/USD: pound is strengthening

04 April 2018, 09:24

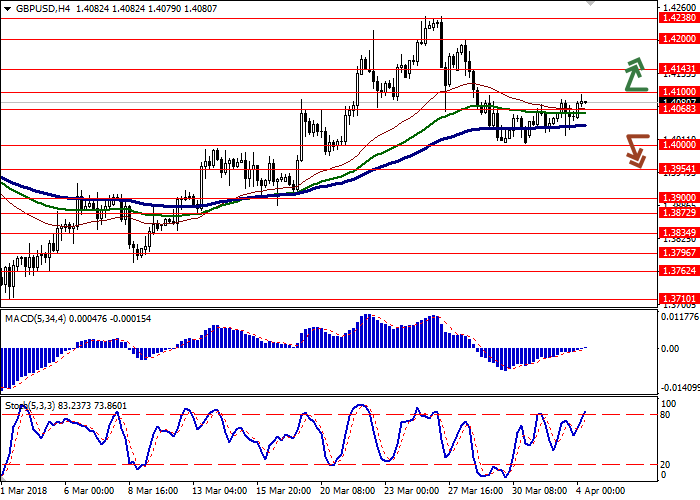

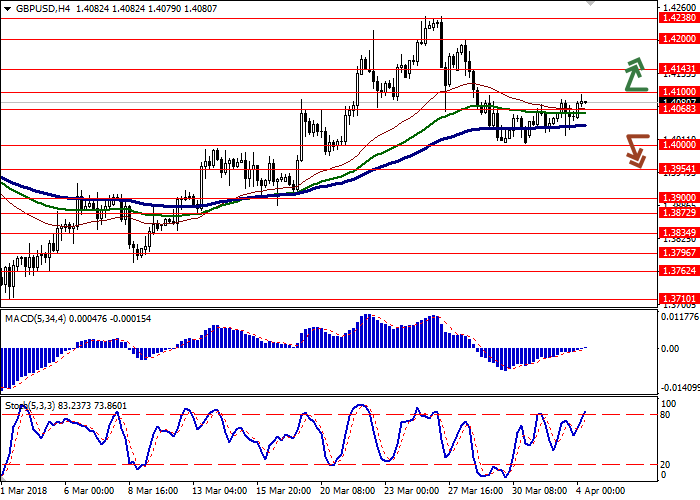

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.4110 |

| Take Profit | 1.4200 |

| Stop Loss | 1.4050 |

| Key Levels | 1.3900, 1.3954, 1.4000, 1.4068, 1.4100, 1.4143, 1.4200, 1.4238 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.4010, 1.3990 |

| Take Profit | 1.3900 |

| Stop Loss | 1.4050, 1.4070 |

| Key Levels | 1.3900, 1.3954, 1.4000, 1.4068, 1.4100, 1.4143, 1.4200, 1.4238 |

Current trend

GBP showed a slight increase against USD on Tuesday, continuing the development of corrective upward dynamics, formed at the beginning of the week. Investors continue to evaluate the information on business activity coming to the market in different countries and expect more significant drivers to appear.

However, as for the British statistics on business activity, it was able to exceed analysts' expectations. Yesterday’s UK March Manufacturing PMI grew to 55.1 points instead of expected fall to 54.7 points. The recent success of negotiations on Brexit could be cause for optimism in the British manufacturing sector.

Today, investors expect the publication of the PMI Construction in the UK. In addition, the market will be influenced by the March inflation data in the eurozone. After 3-months fall CPI can grow from 1.1% to 1.4%. Consumer Price Index – Core can increase from 1.0% to 1.1%.

Support and resistance

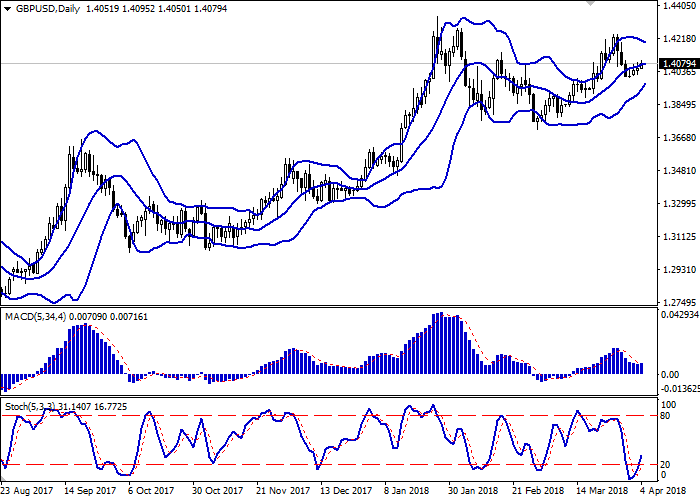

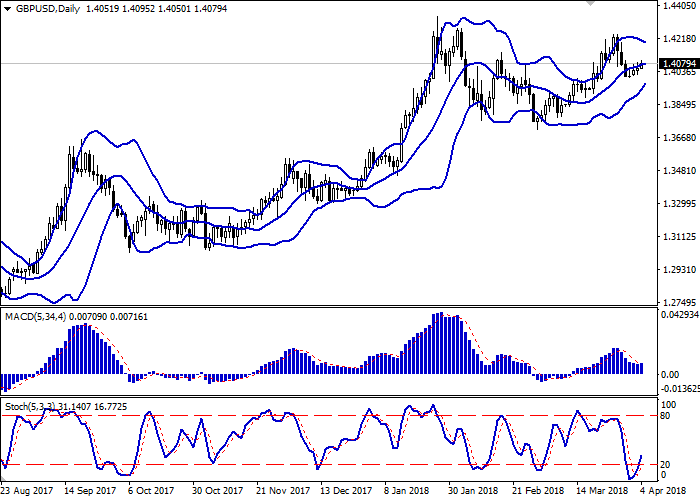

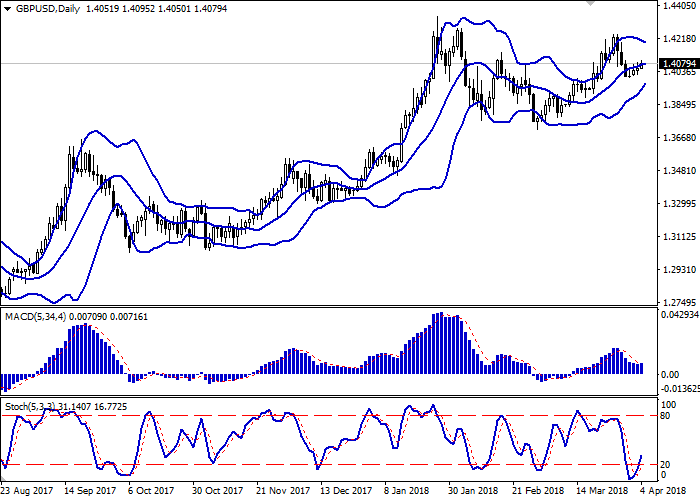

Bollinger Bands in D1 chart show unsteady growth. The price range is narrowing, reflecting the mixed nature of trading in recent days.

MACD indicator is gradually reversing upwards trying to form a buy signal (the histogram has to consolidate above the signal line).

Stochastic recedes confidently from its minimum levels, updated at the end of the last trading week.

According to the indicators, now is a good enough time for planning to open new long positions in the short and/or ultra-short term.

Resistance levels: 1.4100, 1.4143, 1.4200, 1.4238.

Support levels: 1.4068, 1.4000, 1.3954, 1.3900.

Trading tips

To open long positions, one can rely on the breakout of 1.4100 mark. Take-profit – 1.4200. Stop-loss – 1.4050. Implementation period: 2-3 days.

Return of the “bearish” trend to the market with a breakdown of 1.4020–1.4000 mark may be a signal for sales with target at 1.3900. Stop-loss — 1.4050, 1.4070. Implementation period: 2-3 days.

GBP showed a slight increase against USD on Tuesday, continuing the development of corrective upward dynamics, formed at the beginning of the week. Investors continue to evaluate the information on business activity coming to the market in different countries and expect more significant drivers to appear.

However, as for the British statistics on business activity, it was able to exceed analysts' expectations. Yesterday’s UK March Manufacturing PMI grew to 55.1 points instead of expected fall to 54.7 points. The recent success of negotiations on Brexit could be cause for optimism in the British manufacturing sector.

Today, investors expect the publication of the PMI Construction in the UK. In addition, the market will be influenced by the March inflation data in the eurozone. After 3-months fall CPI can grow from 1.1% to 1.4%. Consumer Price Index – Core can increase from 1.0% to 1.1%.

Support and resistance

Bollinger Bands in D1 chart show unsteady growth. The price range is narrowing, reflecting the mixed nature of trading in recent days.

MACD indicator is gradually reversing upwards trying to form a buy signal (the histogram has to consolidate above the signal line).

Stochastic recedes confidently from its minimum levels, updated at the end of the last trading week.

According to the indicators, now is a good enough time for planning to open new long positions in the short and/or ultra-short term.

Resistance levels: 1.4100, 1.4143, 1.4200, 1.4238.

Support levels: 1.4068, 1.4000, 1.3954, 1.3900.

Trading tips

To open long positions, one can rely on the breakout of 1.4100 mark. Take-profit – 1.4200. Stop-loss – 1.4050. Implementation period: 2-3 days.

Return of the “bearish” trend to the market with a breakdown of 1.4020–1.4000 mark may be a signal for sales with target at 1.3900. Stop-loss — 1.4050, 1.4070. Implementation period: 2-3 days.

No comments:

Write comments