EUR/NZD: Ichimoku clouds

03 April 2018, 21:37| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 1.6896 |

| Take Profit | 1.6820 |

| Stop Loss | 1.6986 |

| Key Levels | 1.6820, 1.6982, 1.6986 |

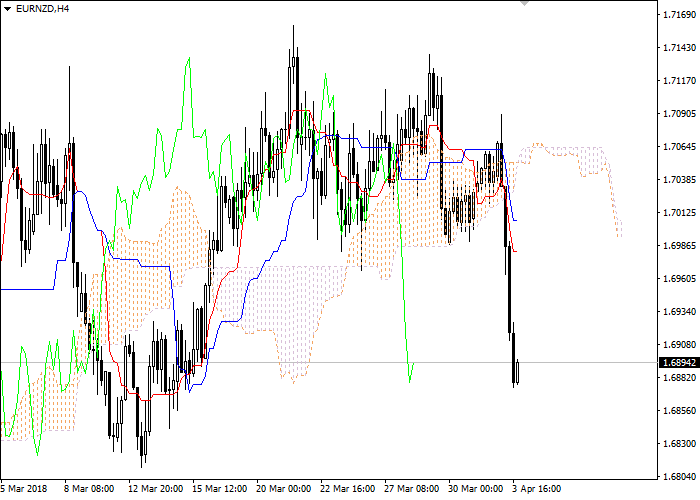

Let's look at the four-hour chart. Tenkan-sen line is below Kijun-sen, both lines are directed downwards. Confirmative line Chikou Span is below the price chart, current cloud has reversed from ascending to descending. The instrument is trading below Tenkan-sen and Kijun-sen lines; the Bearish trend is still strong. One of the previous minimums of Chikou Span line is expected to be a support level (1.6878). The closest resistance level is Tenkan-sen line (1.6982).

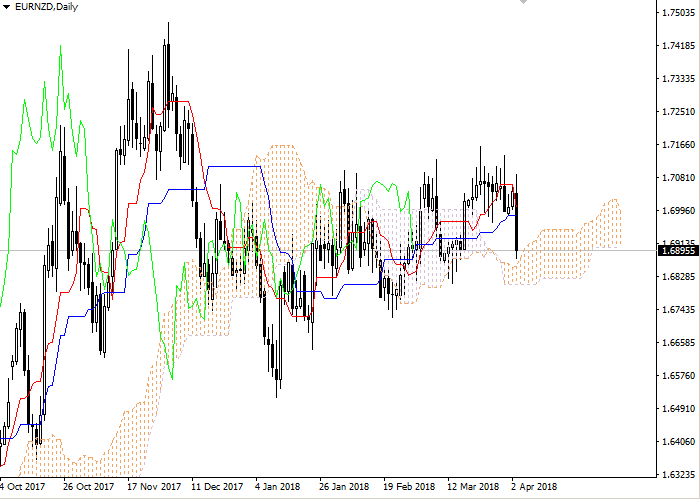

On the daily chart Tenkan-sen line is above Kijun-sen, the red line is directed downwards, while the blue one remains horizontal. Confirmative line Chikou Span is crossing the price chart from above, current cloud is ascending. The instrument is trading around upper border of the cloud. The closest support level is the upper border of the cloud (1.6853). The closest resistance level is Kijun-sen line (1.6985).

On the four-hour chart the instrument has broken down the cloud, forming a strong signal to sell. On the daily chart we can see a correction of the upward movement. It is recommended to open short positions at current price with the target at the level of previous minimum of Chikou Span line (1.6820) and Stop Loss at the lower border of the cloud (1.6986).

No comments:

Write comments